Top 20 Small Business Challenges That Owners Face

Small business challenges encompass various hurdles entrepreneurs encounter while navigating the competitive landscape.

The complexities are multifaceted, from financial constraints and market fluctuations to operational inefficiencies and workforce management.

Understanding these challenges is paramount for business owners as it gives them the foresight needed to develop effective strategies for sustainability and growth.

By identifying the hurdles early on, businesses can proactively implement solutions, allocate resources judiciously, and make informed decisions to ensure longevity in a volatile market.

The top three challenges small businesses usually face can be resolved by utilizing various software solutions like,

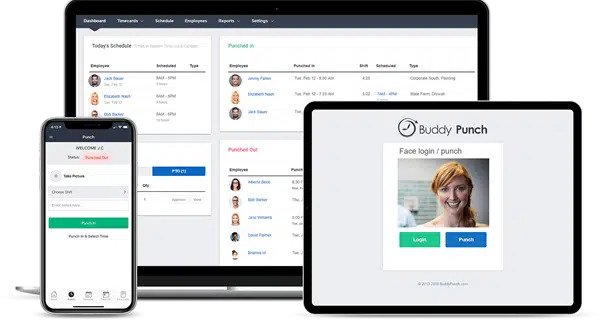

Operational Efficiency: Time tracking software streamlines day-to-day operations by automating time-consuming tasks.

This enhances productivity and allows businesses to allocate resources more effectively, ensuring that each task is completed with maximum efficiency.

Financial Management: Keeping a tight rein on finances is a perpetual challenge for small businesses.

Time tracking software aids in accurate project costing and invoicing by providing real-time insights into labor expenses.

Workforce Productivity and Accountability: Monitoring employee performance and ensuring accountability can be challenging for small business owners.

Time clock software tracks working hours and provides visibility into project timelines, facilitating effective workforce management.

Try Buddy Punch For Free

Why Do So Many Small Businesses Fail?

Small businesses face many challenges, leading to a notable failure rate.

A prominent factor contributing to this trend is inadequate strategic planning, as entrepreneurs often need a well-defined roadmap to plunge into ventures.

Managing small businesses requires careful consideration of market dynamics and the ability to navigate uncertainties effectively.

Entrepreneurs must be adept at anticipating and addressing small business struggles, ensuring that their strategic planning is not only comprehensive but also adaptable to the ever-changing business landscape.

Financial mismanagement is another critical aspect, with insufficient capitalization and poor budgeting spelling doom for many enterprises.

Small business problems often arise due to a lack of financial foresight and planning.

Entrepreneurs need to proactively address small business marketing challenges and business challenges today by prioritizing sound financial management practices.

Proper budgeting and capital allocation are key elements in overcoming the financial struggles that plague small businesses.

Customer centricity is imperative, and businesses must address customer needs and deliver value to succeed.

Small businesses must recognize the importance of customer-centric approaches to overcome business challenges today.

Understanding and meeting customer expectations is integral to managing small businesses successfully.

By focusing on customer satisfaction, businesses can alleviate small business marketing challenges and build a loyal customer base.

The lack of essential business management and entrepreneurial skills also exacerbates the situation, hindering adaptability to market dynamics.

Entrepreneurs facing small business problems should invest in acquiring and honing their business management and entrepreneurial skills.

Overcoming small business struggles necessitates continuous learning and development to effectively tackle business challenges today.

Developing a comprehensive skill set is crucial for managing small businesses in an ever-evolving business environment.

What Are The Biggest Challenges For Small Business Owners?

Managing small businesses requires a delicate balance of skills and a keen awareness of the challenges that arise in the entrepreneurial scope.

One significant hurdle owners face is the constant juggling of limited resources, demanding strategic budgeting and precise cash flow management to ensure sustained success.

In the world of small business problems, marketing poses a unique challenge.

Many small businesses grapple with establishing a robust online presence and competing effectively with larger counterparts in today’s digital age.

Addressing these business challenges today is crucial for long-term viability.

Balancing time and priorities is an ongoing concern for small business owners.

Wearing multiple hats and handling various responsibilities can be overwhelming, making it essential to prioritize tasks effectively.

Small business marketing challenges compound this, as owners strive to promote their ventures amidst a sea of competitors.

To overcome these obstacles, adopting efficient time management strategies and modern time management systems becomes paramount.

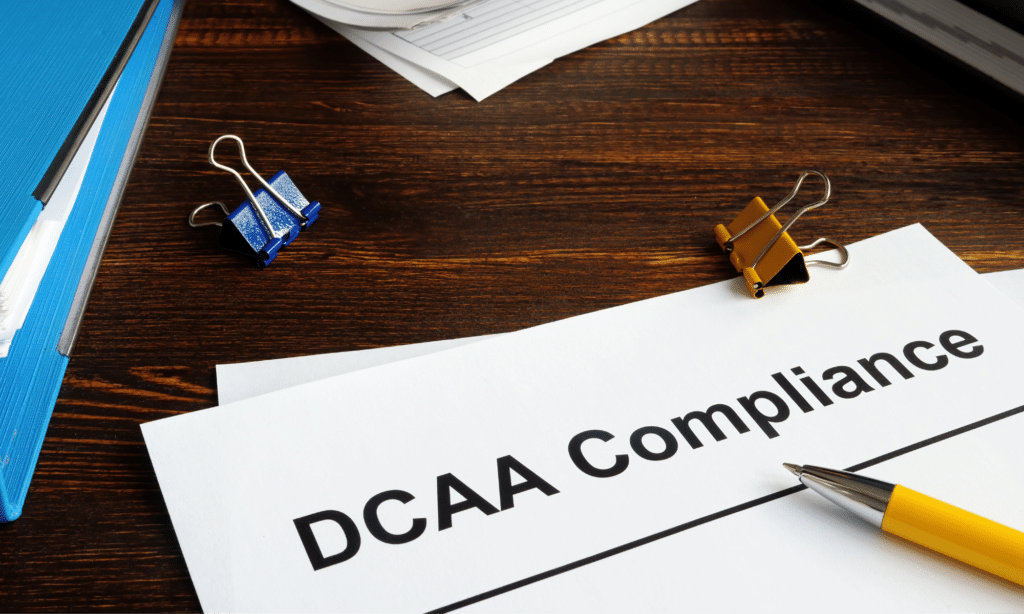

When it comes to managing small businesses, regulatory compliance is a persistent and crucial aspect.

Ever-changing laws and regulations demand vigilant attention to ensure that the business operates within legal boundaries.

Failing to address regulatory concerns can lead to serious consequences, making it imperative for small business owners to stay informed and adapt to evolving legal landscapes.

Hiring and retaining skilled employees in a competitive market is a perennial challenge that impacts both productivity and growth.

Small businesses must navigate this aspect carefully, implementing attractive compensation packages and fostering a positive work environment to attract and retain top talent.

1. Lack Of Funds

One of the foremost challenges small business owners face is the constant battle against financial constraints.

Limited capital often hampers crucial aspects of business development, hindering growth and innovation.

In fact, according to the Small Business Administration (SBA) in 2023, nearly 44% of small businesses reported startup costs ranging from $250k to $1 million.

Whether it’s funding for marketing initiatives, technology upgrades, or expansion plans, the struggle to secure adequate funds can be a significant roadblock.

This challenge amplifies during economic downturns or unexpected crises, putting small businesses at a higher risk.

To mitigate this issue, owners must explore alternative financing options, establish robust budgeting strategies, and seek grants or partnerships.

How to overcome this issue?

To overcome the challenge of financial constraints in small businesses, explore alternative financing options, establish robust budgeting strategies, and actively seek grants or partnerships.

Diversifying funding sources can ease the burden, ensuring essential aspects like marketing, technology upgrades, and expansion plans receive adequate support.

Additionally, proactive financial planning can enhance resilience, especially during economic downturns or crises, reducing the risk associated with limited capital.

2. Difficulty To Access Credit

For numerous small business owners, obtaining credit proves to be an ongoing struggle with significant consequences.

Constricted credit avenues frequently impede crucial investments in expansion, inventory, or technological advancements.

Stringent criteria set by traditional lenders pose challenges for securing loans, especially for smaller enterprises.

The absence of a robust credit history or collateral further complicates the process.

This challenge intensifies during economic downturns when financial institutions, grappling with tightened lending policies, exacerbate the difficulty in accessing essential credit resources.

How to overcome this issue?

Small business owners facing credit challenges can explore alternative financing options such as online lenders, crowdfunding, or microfinance institutions.

Building a strong business credit profile through responsible financial management and timely payments can enhance eligibility.

Collaborating with local business development agencies for guidance on accessing grants or subsidized loans can also be beneficial.

During economic downturns, diversifying revenue streams and maintaining open communication with lenders can help navigate the tightened credit landscape.

3. Hiring and Employee Retention

Limited budgets often restrict competitive salary offerings, making competing with more giant corporations challenging.

Additionally, maintaining a positive workplace culture and providing opportunities for professional growth become essential components in the battle for employee retention.

Small businesses must create an environment that fosters employee satisfaction and loyalty.

Effective communication, recognition programs, and flexible work arrangements can be crucial in overcoming the hurdles of hiring and retaining skilled professionals.

4. Finding Customers

Small business owners pave the way for sustained growth and success in competitive markets by addressing the challenge of finding customers head-on.

Understanding the target audience and crafting a compelling value proposition becomes paramount in this pursuit.

Leveraging online platforms, optimizing websites for search engines, and engaging in community outreach are essential strategies to enhance visibility.

Word-of-mouth referrals and positive customer experiences are crucial in building a loyal customer base.

5. Increasing Brand Awareness

Strategic and creative marketing approaches are crucial to stand out in the crowded marketplace.

Leveraging digital platforms, social media, and content marketing can provide cost-effective avenues to enhance visibility.

Collaborations with influencers or local partnerships can also amplify brand exposure.

Consistency in branding across various channels, coupled with compelling storytelling, helps create a memorable brand identity.

6. Managing Workflow

With limited resources and a minor team, finding the right balance between task delegation and project oversight becomes crucial in overcoming supply chain issues and ensuring optimization.

Adopting streamlined processes and integrating project time management tools can enhance workflow efficiency, addressing business trends and adapting to the evolving marketplace.

Clear communication channels, regular team meetings, and setting realistic goals contribute to a cohesive work environment, tackling challenges such as marketing campaigns and attracting new clients.

Successfully navigating the complexities of workflow management not only boosts productivity but also fosters a positive workplace culture, supporting the development of successful small businesses.

To further enhance operational effectiveness, small business owners must actively engage in professional development to stay updated on the latest business models and industry trends.

Incorporating these insights into their business model allows for the creation of innovative strategies and the execution of successful marketing campaigns.

Additionally, maintaining a comprehensive to-do list can help prioritize tasks and ensure that the business leaders remain focused on key priorities.

By staying proactive in addressing supply chain issues and adapting to new client needs, small businesses can continue to thrive in an ever-changing business landscape.

7. Keeping Up With Advance Technologies

The fast paced nature of technological advancements demands constant adaptation, and limited resources can make acquiring and implementing new tools challenging.

To overcome this hurdle, owners must prioritize tech investments that align with their business goals.

Leveraging cloud based solutions, automation, and digital platforms can streamline operations, even for businesses with modest budgets.

Small businesses that successfully integrate advanced technologies enhance operational efficiency and position themselves competitively in the market.

Ready to give Buddy Punch a try?

For free trial, no credit card required.

8. Lack Of Time

Owners often find themselves stretched thin by juggling multiple responsibilities, from managing operations to handling finances.

The quest for efficiency becomes paramount, necessitating a strategic time management plan.

It identifies tasks that demand personal attention and those that can be outsourced or automated to streamline daily operations.

Embracing productivity tools and time tracking applications helps owners gain insights into workflow bottlenecks and areas for improvement.

9. Effective Time Saving Tools

Time saving tools help monitor work hours, aiding in payroll accuracy and project management.

Scheduling apps streamline appointment bookings and team coordination, reducing time spent on administrative tasks.

For seamless personnel management, small businesses can turn to HR management tools that automate processes like employee onboarding, performance tracking, and leave management.

Additionally, integrating payroll software minimizes manual errors, ensuring timely and accurate compensation.

Buddy Punch | Best Time Saving Tool For Small Business Owners

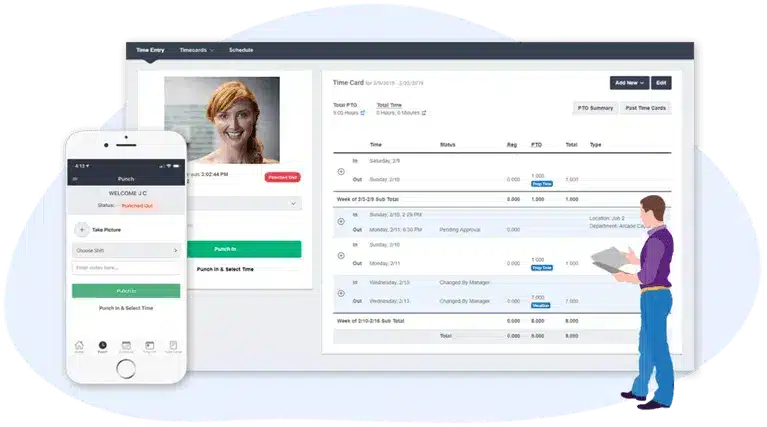

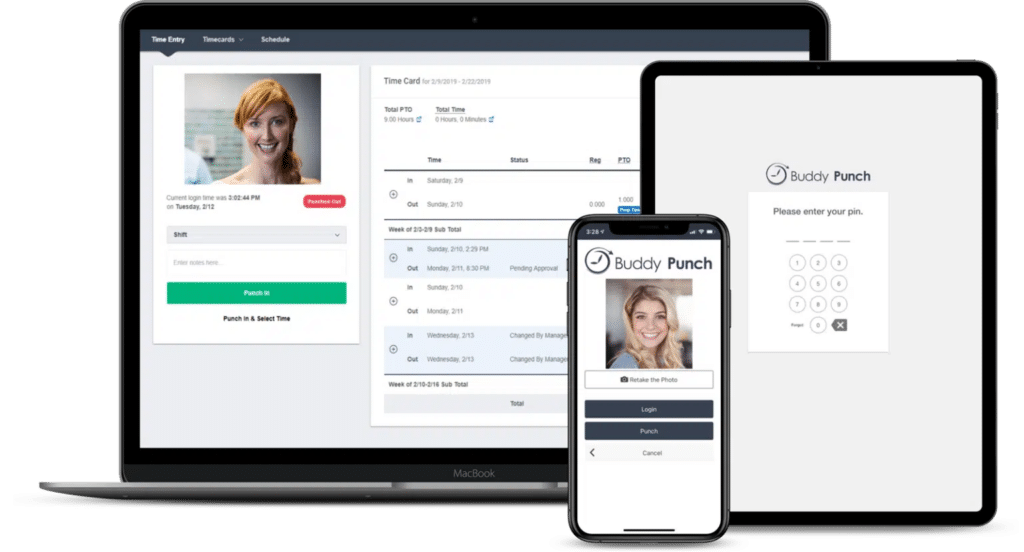

Buddy Punch is an innovative and versatile time saving tool that small businesses across diverse industries embrace.

This user friendly software streamlines time and attendance management, offering features tailored to the specific needs of smaller enterprises.

Its intuitive interface allows easy employee clock ins, reducing the risk of time theft and inaccuracies.

Small businesses appreciate the automated payroll integration, ensuring accuracy and efficiency in compensation processes.

Buddy Punch is a superior solution for small businesses because of its affordability, scalability, and adaptability.

As a cloud based time clock software, it eliminates the need for extensive hardware investments, making it cost effective for businesses with limited budgets.

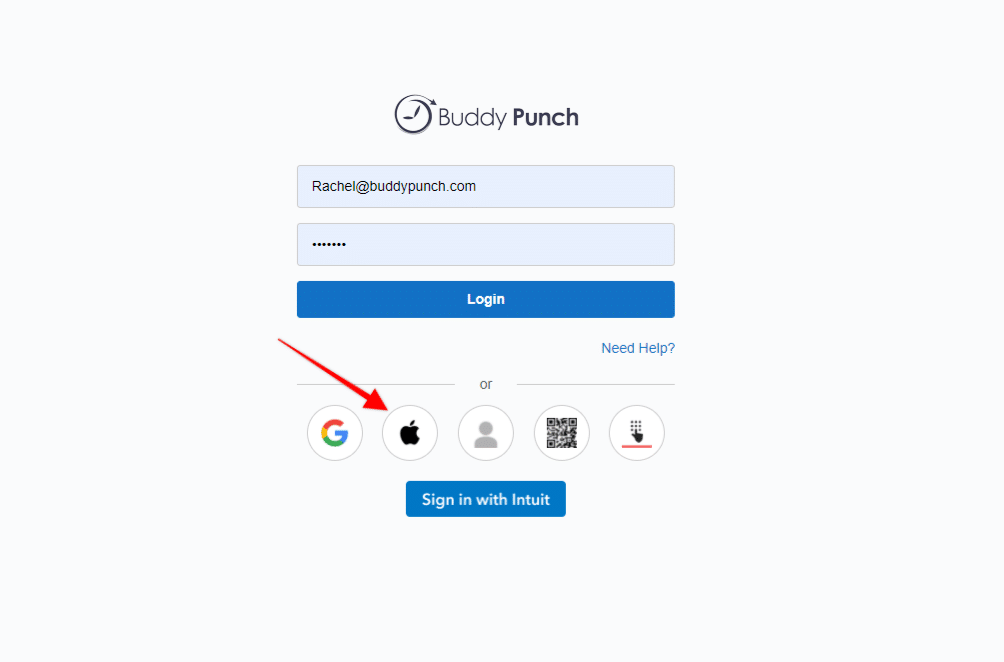

1. Different SSO Options

Buddy Punch, hailed as the best time saving tool for small businesses, offers an array of Single Sign-On (SSO) options, enhancing accessibility and efficiency.

Users can seamlessly integrate with Google, Okta, and OneLogin for effortless sign-ins and sign outs.

This variety in SSO choices caters to small businesses’ preferences and existing systems.

Whether leveraging the familiarity of Google credentials or the security features of Okta and OneLogin, Buddy Punch ensures a smooth and secure user experience.

By offering different SSO avenues, Buddy Punch exemplifies its commitment to adaptability, making time tracking and employee management a streamlined and personalized experience for small business owners.

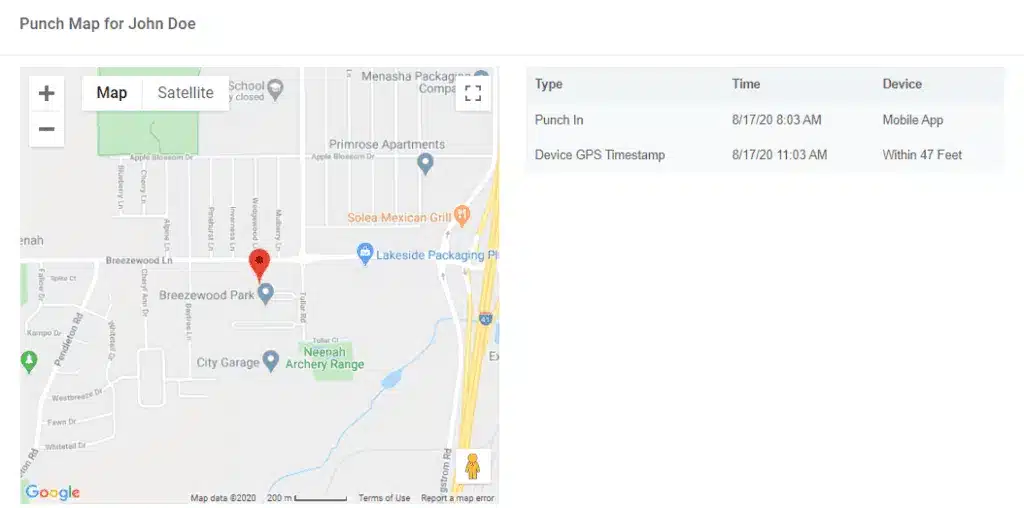

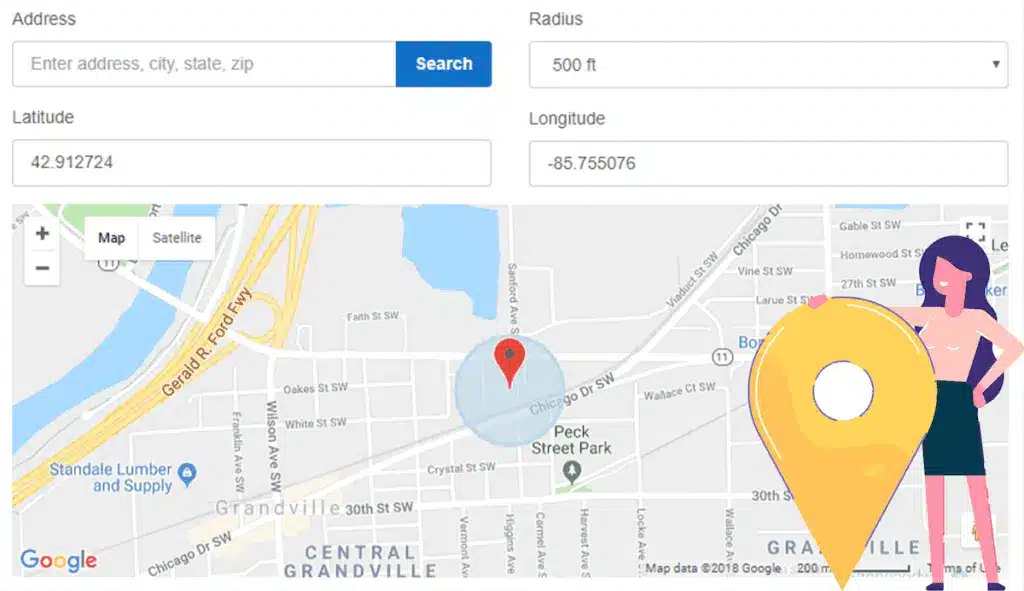

2. GPS Tracking

The GPS functionality offered by Buddy Punch is a game changer for businesses with remote workers or multiple job sites.

With the ability to collect GPS data optionally or as a requirement, Buddy Punch ensures accurate time tracking for specific locations.

This enhances accountability and aids in job costing, allowing businesses to discern where their workforce invests their time.

3. Geofences

Geofences feature is beneficial for companies with mobile or field-based teams.

By assigning unique job codes to different locations within Geofences, businesses gain precise insights into employee whereabouts and allocate time accurately.

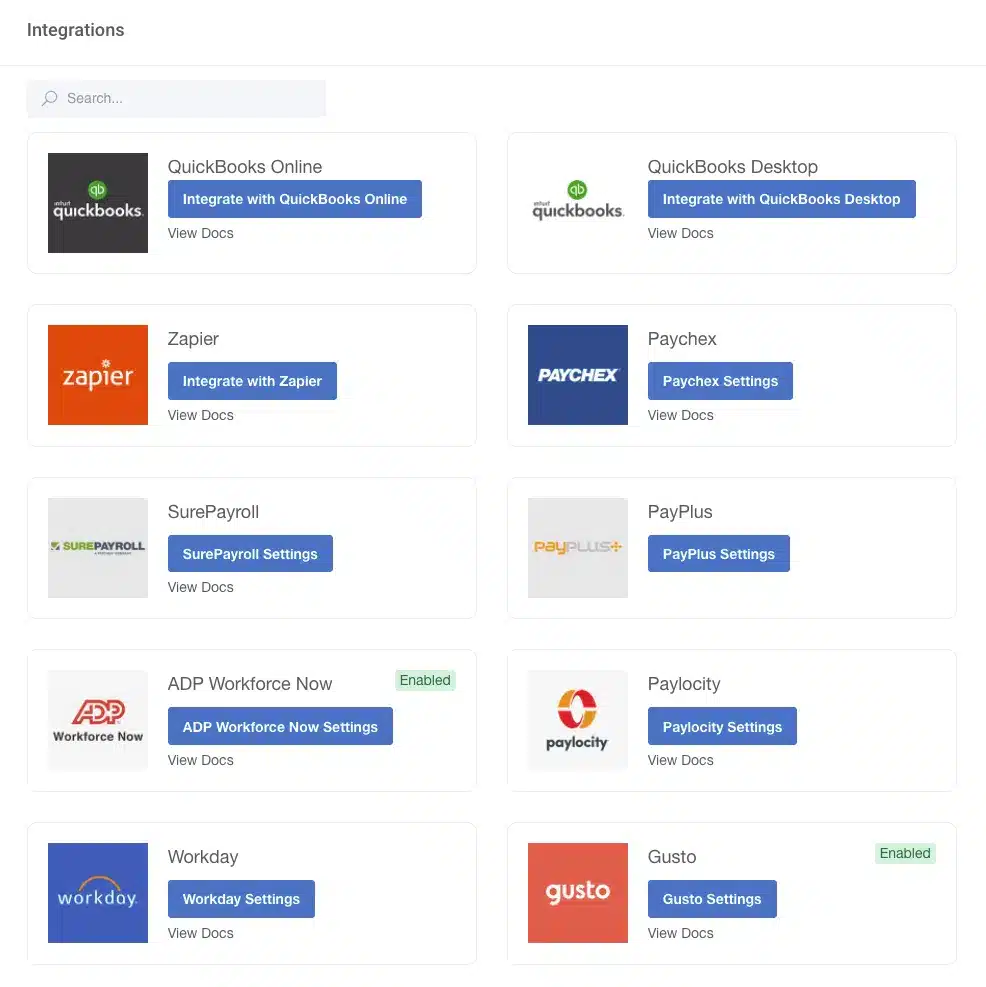

4. Integration Options

Buddy Punch stands out by seamlessly integrating with popular platforms such as QuickBooks, Paychex, and ADP, streamlining the overall experience for small business owners.

The flexibility to sync employee information and time effortlessly enhances payroll and workforce management efficiency.

These integration options save time and contribute to a more seamless and tailored approach, making Buddy Punch a vital ally for small businesses aiming to conquer the multifaceted challenges of efficient time tracking and management.

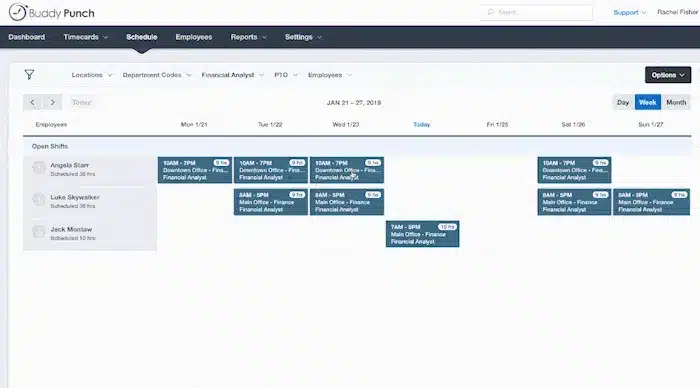

5. Employee Work Schedule

The system offers a user friendly dashboard, drag-and-drop scheduling functionality, and automated timesheets, making the scheduling process swift and hassle free.

Business owners can create, update, and distribute schedules effortlessly, ensuring optimal coverage and keeping staff well-informed.

The ability to view and notify employees of scheduled shifts, coupled with features like geofencing and availability tracking, adds a layer of control and efficiency.

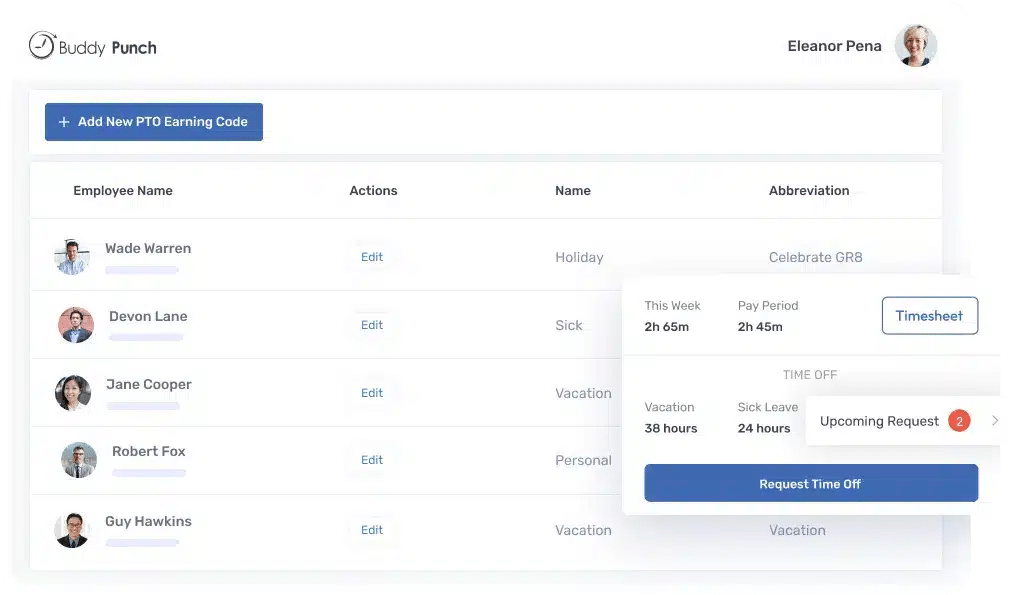

6. PTO Tracking

With its comprehensive PTO tracking feature, business owners can create custom PTO types, including vacation, sick leave, and personal reasons, fostering a flexible approach to employee time-off requests.

Buddy Punch offers an employee self-service approach, allowing them to enter and manage their PTO on the user-friendly platform directly.

Furthermore, the system provides options for accruals, enabling tracking of available and used time.

Employers can grant employees the ability to view PTO requests of their peers, enhancing transparency and collaboration within the team.

7. Payroll Tracking

Buddy Punch’s payroll tracking feature offers a user friendly platform for recording work hours, managing timesheets, and automating overtime calculations.

It seamlessly integrates with payroll systems, eliminating manual data entry errors and saving valuable time for business owners.

This tool empowers businesses to maintain a meticulous record of employee work hours, ensuring accurate and efficient payroll processing.

The tool’s adaptability caters to various payroll needs, allowing customized configurations based on the business’s unique requirements.

8. Additional Expense Tracking

Additional expense tracking feature empowers owners to categorize, record, and analyze various expenses beyond regular payroll, providing a comprehensive overview of the company’s financial landscape.

With customizable options and seamless integration, Buddy Punch simplifies the often intricate task of tracking additional expenses.

9. Smartphone Apps

The Buddy Punch smartphone apps bring convenience to employees’ fingertips, providing push notifications and SMS functionalities that keep management in control, even when workers are remote.

This feature ensures that time tracking is not confined to the office, enhancing employers’ and employees’ flexibility and adaptability.

Today, where mobility is critical, these apps, available for Android and iOS devices, empower hourly workers on the move or in the field to seamlessly track work hours and log their time.

Buddy Punch’s Online Reviews

As of writing this blog post, Buddy Punch has a total of 925 total reviews with an average rating of 4.8 out of 5 on capterra.

“Great app, check in and out with accuracy, keep in contact with supervisors and can submit photos for proof of visit if not using GPS.”

Click here to read the full review.

“Delighted! As a trucking company and having resources starting their shifts at different times and in different locations it was “effort” in tying this all together to ensure everyone was being paid for correct times – doing payroll was a chore in calling and requesting and then finally imposing deadlines or you don’t get paid which pushes other things back in processing payroll… Week one of deployment -> all those issues disappeared!!! Well done Buddy Punch!!!!”

Click here to read the full review.

“We will always use Buddy Punch, It works for Us.”

Click here to read the full review.

Try Buddy Punch for Free

Ready to give Buddy Punch a try?

For free trial, no credit card required.

If you feel that Buddy Punch might be the right fit for your business, sign up for a 14 day free trial (no credit card needed). You can also book a one-on-one demo, or view a pre-recorded demo video.

10. Financial Planning

To overcome financial planning challenges in small businesses, prioritize a detailed budget that outlines income, expenses, and savings goals.

Regularly review and adjust the budget based on performance.

Implement cost-cutting measures where feasible and explore financing options for strategic investments.

Leverage accounting software for accurate financial tracking and consider consulting with financial experts for guidance.

Building an emergency fund provides a safety net for unexpected expenses.

Additionally, fostering transparent communication with stakeholders and clients about financial constraints can create understanding.

Regular financial education for the team enhances overall fiscal responsibility and aids in navigating uncertainties.

11. Scaling

Scaling is a challenge for small business owners due to resource constraints and operational complexities.

Limited finances and manpower make expanding difficult.

To overcome this, owners should focus on strategic planning and gradual growth.

Prioritize market research, optimize processes, and leverage technology for efficiency.

Seek external funding, form partnerships, and consider franchising for controlled expansion.

Cultivate a talented team and delegate responsibilities to streamline operations.

By taking measured steps, small businesses can overcome scaling challenges and ensure sustainable growth.

12. Ineffective Web Presence

Small business owners face the challenge of ineffective web presence, hindering their online visibility and customer reach.

The issue arises due to limited resources, time constraints, or insufficient digital marketing knowledge.

To overcome this challenge, small business owners can prioritize a user-friendly website, leverage social media platforms, and invest in basic search engine optimization (SEO) strategies.

Collaborating with affordable digital marketing services or using website builders can also streamline the process, enhancing their online presence and effectively engaging potential customers.

Regularly updating content and optimizing for mobile devices are essential steps to establish a robust and impactful web presence.

13. Managing Customer Reviews

Managing customer reviews is a challenge for small business owners due to limited resources and the potential impact on reputation.

Small businesses may lack dedicated personnel or advanced tools to monitor and respond promptly.

To overcome this, prioritize customer service training for staff and implement streamlined processes for review monitoring and response.

Encourage satisfied customers to leave positive reviews, helping balance feedback.

Utilize online reputation management tools within the budget and promptly address negative reviews with professional and constructive responses. Proactive engagement with customers can mitigate the impact of negative reviews and foster a positive online reputation.

Ready to start a free trial?

No credit card required, all features included.

14. Customer Acquisition

Limited resources make customer acquisition challenging for small businesses, hindering their ability to compete with larger counterparts in marketing and outreach.

Small businesses can leverage cost-effective digital marketing strategies such as social media campaigns, targeted online advertising, and search engine optimization.

Building strong relationships with existing customers through personalized experiences and word-of-mouth referrals can also amplify acquisition efforts.

Collaborations with local communities and networking events can enhance visibility.

Prioritizing customer satisfaction and offering unique value propositions helps retain acquired customers, contributing to sustainable growth despite resource constraints.

15. Company Culture

Developing a strong company culture poses a difficulty for small business owners due to limited resources and personnel.

Unlike larger corporations, small businesses may struggle to invest in elaborate culture-building initiatives.

Small business owners can cultivate a positive company culture by prioritizing clear communication, promoting shared values, and involving employees in decision-making.

Regular team-building activities and recognition programs create a sense of belonging.

Leveraging technology for virtual interactions and feedback channels can bridge the gap in resources, fostering a vibrant culture even with limited means.

16. Customer Satisfaction

Limited resources in terms of manpower and budget often hinder small businesses from maintaining optimal customer satisfaction levels.

They may struggle to offer personalized experiences and swift problem resolution.

Small businesses can prioritize customer satisfaction by investing in training for staff, implementing efficient customer service processes, and utilizing technology for streamlined interactions.

Actively seeking and responding to customer feedback helps in identifying areas for improvement.

Establishing strong relationships and consistently delivering quality products/services can compensate for resource constraints, fostering customer loyalty despite the challenges.

17. Market Competition

Market competition poses a significant challenge for small business owners due to limited resources and brand recognition.

Competing with established players can result in reduced visibility and customer base.

Small businesses can navigate market competition by differentiating their offerings, emphasizing unique value propositions, and leveraging digital marketing for cost-effective exposure.

Building strong customer relationships and implementing targeted advertising strategies can help create a niche presence.

Collaboration, networking, and staying agile in adapting to market trends contribute to standing out and gaining a competitive edge despite resource constraints.

18. Inefficient Marketing

The lack of a dedicated marketing team or budget constraints can hinder effective promotion.

To overcome this, small business owners can leverage cost-effective digital marketing tools, focus on targeted strategies, and utilize social media platforms.

Collaborating with influencers or engaging in community partnerships can also amplify brand visibility.

Additionally, investing in basic marketing training for the team or outsourcing specific tasks to marketing professionals can enhance efficiency and drive results without excessive financial burden.

19. Changing Labor Regulations and Policies

Small business owners face challenges with changing labor regulations and policies due to limited resources for legal compliance.

Navigating complex and evolving rules can lead to compliance issues, legal risks, and potential financial strain.

To overcome this, small business owners should stay informed about regulatory updates through reliable sources, consider hiring legal counsel or consultants for guidance, and invest in training programs to educate staff on compliance.

Building a proactive approach and fostering a culture of compliance within the organization can mitigate the impact of changing labor regulations on small businesses.

20. Declining Profits Amid Rising Operational Costs

Small business owners face declining profits amid rising operational costs due to various economic factors, limiting financial resources.

Implement cost-cutting measures, such as optimizing operational efficiency and negotiating with suppliers for better rates.

Diversify revenue streams or explore partnerships to increase income.

Leverage technology for streamlined processes and consider adjusting pricing strategies.

Regularly review financial plans and adapt to market changes.

Seeking professional financial advice can provide insights into sustainable solutions, helping small businesses navigate challenges and maintain profitability in a competitive landscape.

What’s The Best Way To Overcome Small Business Challenges?

The best way to overcome these challenges involves embracing technological solutions and adopting efficient time management tools.

Starting a new business is an exciting venture, but it comes with its fair share of common challenges.

For any entrepreneur embarking on the journey of a startup, addressing these challenges head-on is crucial for long-term success.

1. Business Plan

A solid business plan is the foundation for navigating the complexities of a new business.

It serves as a roadmap, helping entrepreneurs outline their goals and strategies.

Unfortunately, many new businesses struggle with the formulation of an effective business plan, often leading to setbacks.

2. Work on Acquiring New Customers

One of the most common challenges faced by startups is the acquisition of new customers.

With the market saturated and larger companies dominating, breaking through and establishing a customer base can be a daunting task.

Digital marketing, including strategies like SEO and email marketing, proves essential in reaching potential customers and expanding the business’s online presence.

3. Secure your Finances

Lack of capital is another hurdle that many startups encounter.

Securing business financing is a persistent challenge, especially in the face of economic uncertainties such as a pandemic.

The Small Business Administration (SBA) can be a valuable resource for entrepreneurs seeking financial support and guidance.

4. Outsource what you can!

Outsourcing is a strategic move that can help alleviate some of the burdens on a new business.

Whether it’s bookkeeping, business administration, or supply chain management, outsourcing allows entrepreneurs to focus on core aspects of their business while delegating specialized tasks to experts.

5. Master Supply Chain Management

Navigating supply chain disruptions and issues is a contemporary challenge, particularly in the wake of a pandemic.

As businesses worldwide experienced disruptions, optimizing supply chain processes became imperative.

Companies must adapt to evolving trends and implement efficient supply chain strategies to ensure a steady flow of products and services.

6. Hire Smartly

Recruiting and onboarding new employees add another layer of complexity.

Finding the right talent and integrating them seamlessly into the team is essential for business success.

Platforms like LinkedIn prove invaluable in connecting with potential employees and expanding professional networks.

7. Retain Clients

Existing customers are the lifeblood of any business, but maintaining their loyalty requires continuous effort.

Understanding and addressing their needs is crucial for building lasting relationships.

8. Practice Work-Life Balance

The US Chamber of Commerce identifies work-life balance as a top challenge for entrepreneurs, emphasizing the importance of balancing dedication to the business with personal well-being.

Ready to start a free trial?

No credit card required, all features included.

Final Thoughts,

In these final thoughts, it’s essential to recognize that challenges are inherent in entrepreneurship but also present growth opportunities.

The complex landscape of small business challenges require resilience and strategic thinking as it is the backbone for success for any business.

The journey entails overcoming financial constraints, technological evolution, and shifting market dynamics.

By fostering a culture of adaptability, investing in technology, and prioritizing customer satisfaction, owners can transform challenges into stepping stones toward long term success.

The small business landscape is ever evolving, and owners who approach these challenges with resilience and foresight are poised to thrive in adversity.