10 Best Direct Deposit Payroll Software for Small Businesses

Discover the 10 best direct deposit payroll software and compare features and pricing to find the option that’s best for your small business.

If you’re tired of cutting paper checks and are ready to migrate to a payroll system that lets you pay employees via direct deposit, one of these 10 payroll software with direct deposit — each designed specifically for small businesses — will help you make the shift.

Features to look for in direct deposit payroll software

In terms of payroll processing, there are four key features you’ll want to make sure your software has:

- The ability to calculate, file, and pay federal, state, and local taxes.

- The ability to handle your specific pay schedule (weekly, bi-weekly, monthly, etc.).

- The ability to calculate overtime and include overtime/bonus pay in paychecks.

- The ability to remove garnishments and voluntary deductions from paychecks.

In addition to these basic features, you’ll also want to look for features that make paying your employees via direct deposit easier:

- Same-day or next-day deposits: This helps avoid delays in employees receiving their pay if you struggle to get your time data to payroll in a timely manner.

- Employee self-service options: This lets employees enter/update their bank information, view their paystubs, and change their withholdings on their own.

- Integrations with the other systems you use: Connecting your payroll software to your accounting and time tracking software makes running payroll quicker, easier, and more accurate.

However, instead of relying on integrations, you may want to look for all-in-one software that offers time tracking and payroll processing.

Finally, you’ll want to find an option that’s easy to use with a simple, intuitive interface and great customer support. Payroll is critical for proper accounting and employee satisfaction, so you’ll want to be confident that the provider you choose will be there to support you when you run into issues.

The 10 best payroll software with direct deposit

Below, you’ll find our reviews of the best payroll software with direct deposit. For each option, we dig deep into features, pricing, and customer reviews to help you find the perfect option for your small business.

1. Buddy Punch – Best for combined time tracking and payroll

Buddy Punch is an easy to use and affordable time tracking, employee scheduling, and payroll application that lets you manage all of your payroll tasks in a single tool.

As a time tracking tool, employees clock in and out using the Buddy Punch app (available for the web, iOS, Android, and ChromeOS). Everyone’s hours are compiled into time cards, and hours and overtime are automatically calculated for you. And since you already have all of your time-tracking data in Buddy Punch, paying your employees is quick and easy through Buddy Punch payroll.

How Buddy Punch Payroll works

Buddy Punch payroll’s features include tax filing, direct deposits, and compliance support, making payroll processing smoother and more efficient.

To set up Buddy Punch payroll, you start by setting up your company in Buddy Punch. You can create workspaces for different locations or for remote employees, and you can set up benefits deductions for things like insurance, HSAs, child support, and retirement contributions.

An address must be entered for each new employee you create. This lets the system know what federal, state, and local taxes need to be withheld from the employee’s paycheck.

Contractors can also be paid using Buddy Punch. When you create a new employee profile, simply select whether they’re a W-2 employee or a 1099 contractor. This lets Buddy Punch know not to remove taxes or other benefits from contractors’ payments.

Once the company is set up and employee profiles are created, employees can set up their accounts. They can enter their bank details to set up direct deposit of their paychecks, and they can also review their pay stubs in Buddy Punch anytime.

Finally, you can choose two-day or four-day payroll processing. If you choose two-day processing and want your employees paid on a Friday, then you will submit your payroll no later than two days prior (i.e. the end of the day on Tuesday).

Running payroll with Buddy Punch

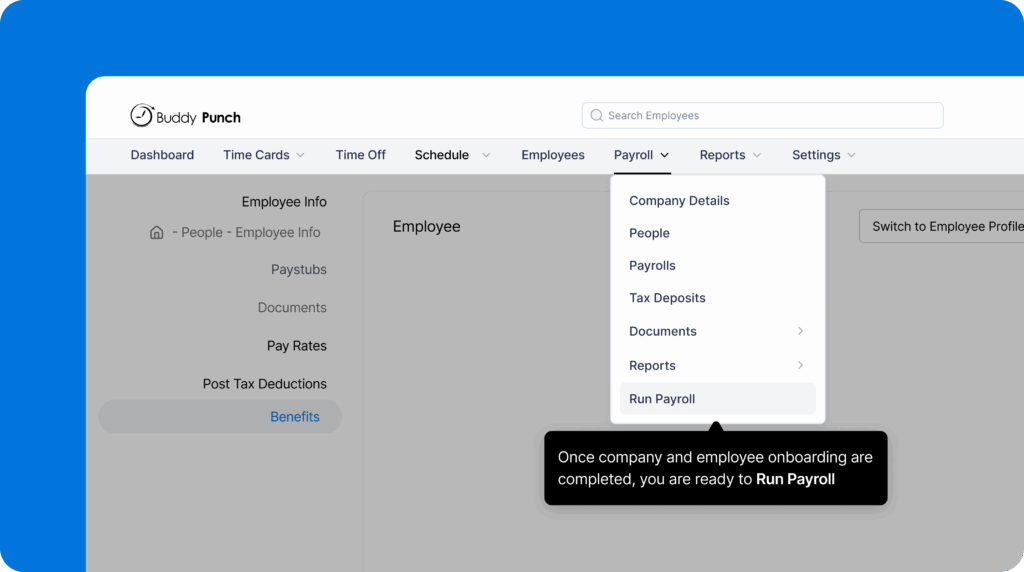

Once you’ve reviewed all employee hours — or a supervisor has approved all of their team members’ timesheets — it’s time to run payroll. Simply click the “Run Payroll” link in the payroll dropdown.

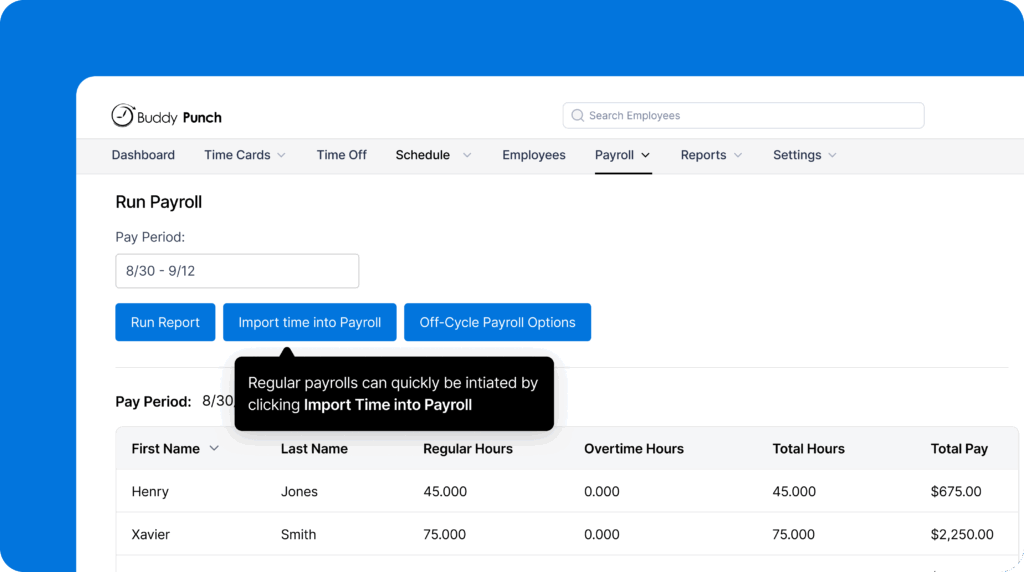

Next, click “Import time into payroll.” This grabs all time clock data from the pay period and adds it to your payroll report.

You’ll be taken to the “Run Payroll” page where you can do a final review of all time data and add custom earning rates or make adjustments if necessary. You can also choose how you want to pay employees — either via direct deposit or manually by mailing them a paper check.

When all edits are complete, you can preview your payroll to see a quick breakdown of all of your employees’ and contractors’ pay along with your cash requirement — the amount needed to fund payroll.

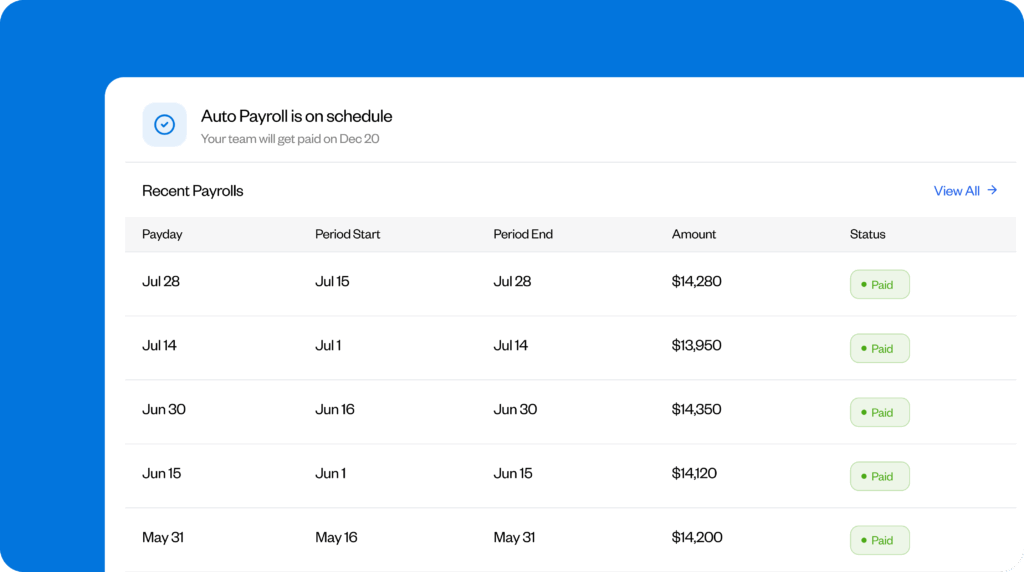

Finally, you submit your payroll to start its processing. You’ll be able to see the status of the payroll at any time — whether it’s pending, drafted, or paid — from the dashboard.

You can also download a payroll journal if needed from completed pay periods, track tax deposits on the “Tax Deposits” page, and access/download important filing authorizations (like Form 941) under “Documents.”

Features to keep your payroll accurate

Beyond tracking time and running payroll, Buddy Punch comes with lots of optional features that help you keep your employees honest and your payroll accurate:

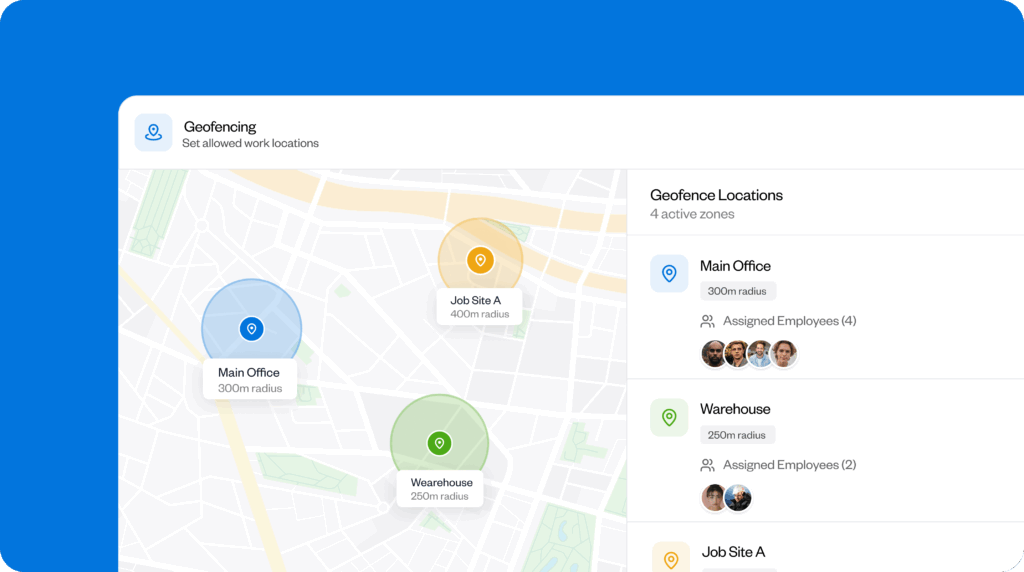

- Geofencing: Use Buddy Punch’s geofencing feature to designate a particular radius (geofence), around a particular office location or job site. If an employee attempts to punch in outside of the geofence, they will be asked to try again in the right location.

- IP address locks: If all of your employees work in an office, you can set up IP address locks that prevent your employees from clocking in and out unless they’re connected to your office’s Wi-Fi. This is a great alternative to geofencing for office workers.

- Photos on punch: Use Photos on Punch to require employees to take a selfie when they clock in and out. The review these photos on their time cards to make sure no one was buddy punching.

- GPS tracking: For field workers or remote employees, you can capture their locations when they clock in and out to make sure they were on site when they punched. Or you can set up real-time GPS to track workers’ locations throughout the day.

- Overtime alerts: Get a notification when an employee is nearing overtime so you can adjust their schedule and avoid unplanned overtime costs.

Buddy Punch has many more features in addition to the ones discussed above. You can explore all of them here.

Customer reviews

At the time of writing, Buddy Punch has an overall rating of 4.8 out of 5 stars across 1,000+ reviews on Capterra. Here’s what one customer has to say about its payroll features:

“Buddy Punch helped our business reduce a lot of costs related to human resources management, payroll, and time tracking. We implemented this software as our employees exceeded eight because we were finding it difficult to keep track of time, work, payroll, etc. This software has really helped us in this regard, and we also saved a lot of time.”

Pricing

Buddy Punch’s payroll features are only available as an add-on to its time tracking software. Its time tracking packages start at $4.49 per user per month plus a $19 per month base fee that covers all admin users. The payroll add-on costs an additional $6 per user per month plus a $39 per month base fee.

All together, you’ll pay a base $58/month fee plus an additional $10.49 per month for each employee you add to the system. For the cost, you’ll get access to time tracking, PTO tracking, GPS tracking, payroll processing, direct deposit, and tax filings.

Learn more about Buddy Punch

- Start a free trial — no credit card required

- View pricing

- Watch a video demo

- Take an interactive product tour

- Request a personalized demo

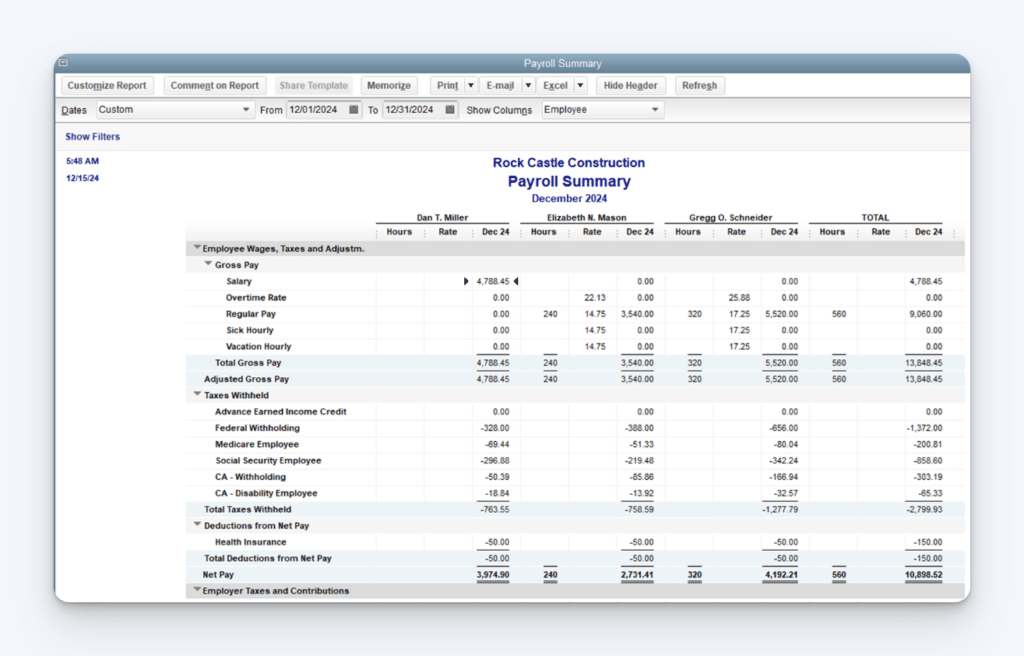

2. QuickBooks Payroll – Best for teams that already use other Intuit products

If your organization uses QuickBooks Online heavily for accounting, QuickBooks Payroll can be a good option. Since both tools are made by Intuit, the process of integrating the data between the two systems is seamless. This eliminates the need for double data entry and ensures your payroll data is accurate.

Key features

- Same-day and next-day direct deposit options

- Automatic tax calculations, filing, and payments

- Tax penalty protection guarantee covering up to $25,000

- Employees can access their pay stubs, tax forms, and benefits information

Customer reviews

QuickBooks Payroll has an overall rating of 4.4 out of 5 stars on Capterra across more than 900 reviews. Here’s what customers like about the platform:

“I found QuickBooks Payroll particularly impressive for its seamless integration with QuickBooks Online for accounting, comprehensive tax compliance features, and user-friendly interface for managing payroll and tax processes efficiently.”

Pricing

QuickBooks Payroll’s pricing starts at $6.50/employee per month plus a $88/month base fee.

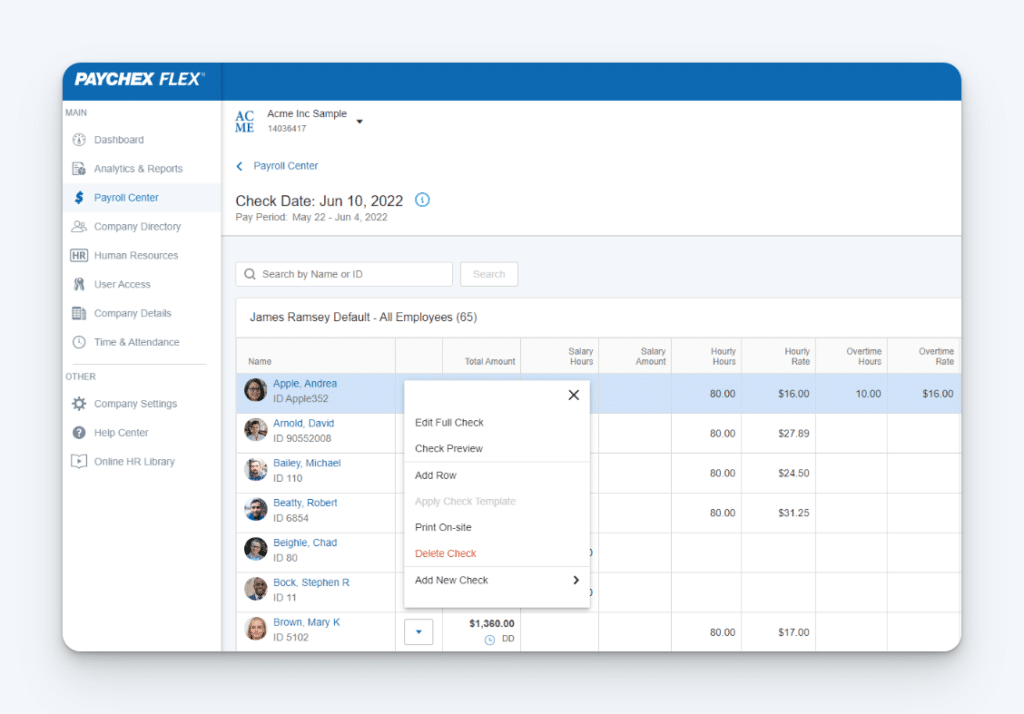

3. Paychex Flex – Best for growing businesses with diverse payroll needs

If your business is growing and you’re struggling to navigate new compliance issues, Paychex Flex is a good option to consider. They assign a dedicated payroll specialist to every one of their customers, so in addition to their payroll software, you’ll get access to an expert who can provide guidance and support.

Key features

- Pay employees via direct deposit (same day), paper checks, or pay cards

- Benefits management, time tracking, and recruiting

- Tools for handling employee classifications

- Affordable Care Act (ACA) reporting

Customer reviews

Paychex Flex has an overall rating of 4.2 out of 5 stars on Capterra across more than 1,600 reviews. Here’s what customers like about the platform:

“The dashboard is intuitive, making it easy to navigate through different features, whether you’re handling payroll, benefits administration, or employee time tracking. The mobile app is also a significant advantage, allowing users to manage tasks on the go.”

Pricing

Pricing for Paychex Flex is not publicly available. You can contact their sales team to get a quote.

4. ADP RUN – Best for international payroll support

ADP RUN is a great option for small businesses that currently have international employees and plan to grow in the future. It offers international payroll through its integration with ADP Global Payroll, and its features can scale as your workforce expands through ADP’s other extensive HR and benefits solutions.

Key features

- Pay employees via direct deposit, paper checks, or pay cards

- Pay international team members in compliance with local labor laws and tax regulations

- Multi-jurisdictional and multi-company management

- Employee background checks and unemployment management

- Reports for monitoring payroll, expenses, and tax data across regions

Customer reviews

ADP RUN has an overall rating of 4.5 out of 5 stars on Capterra across 780+ reviews. Here’s what customers like about the platform:

“Run ADP was intuitive and easy to navigate and use, even for a non-HR person. I was able to take care of payroll quickly and efficiently without any of the bugs or quirks that some of the other payroll software programs seem to have. If I had a question or needed help with anything, their customer service was available and incredibly helpful.”

Pricing

Pricing for ADP RUN is not publicly available. You can request a quote through their website.

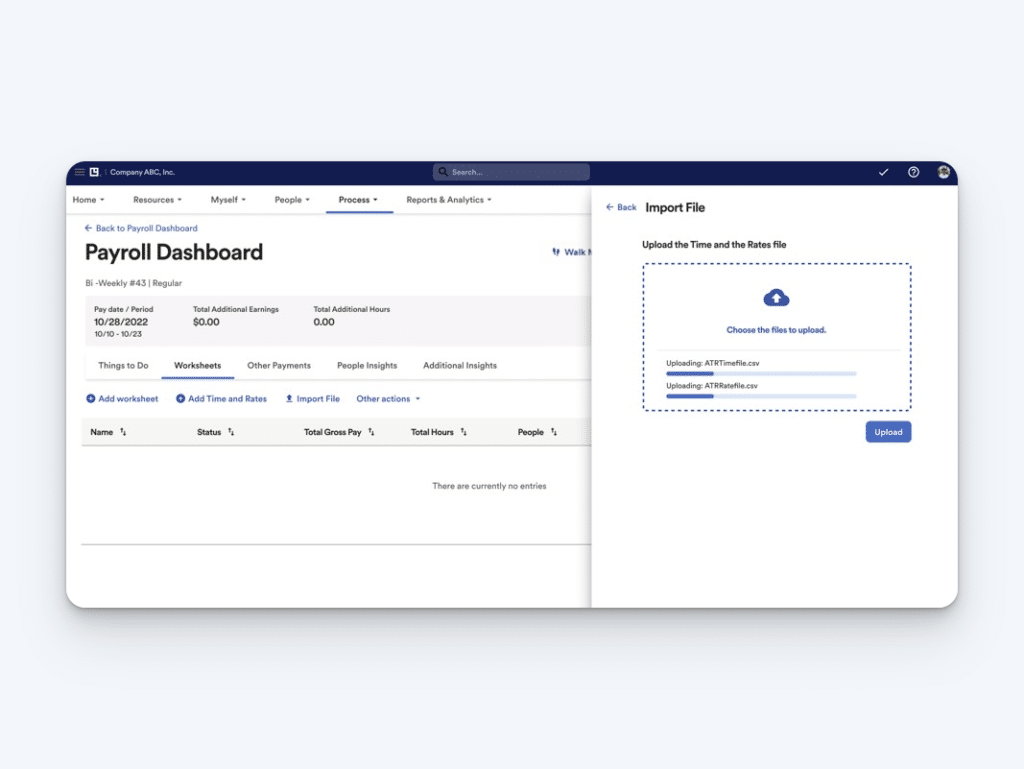

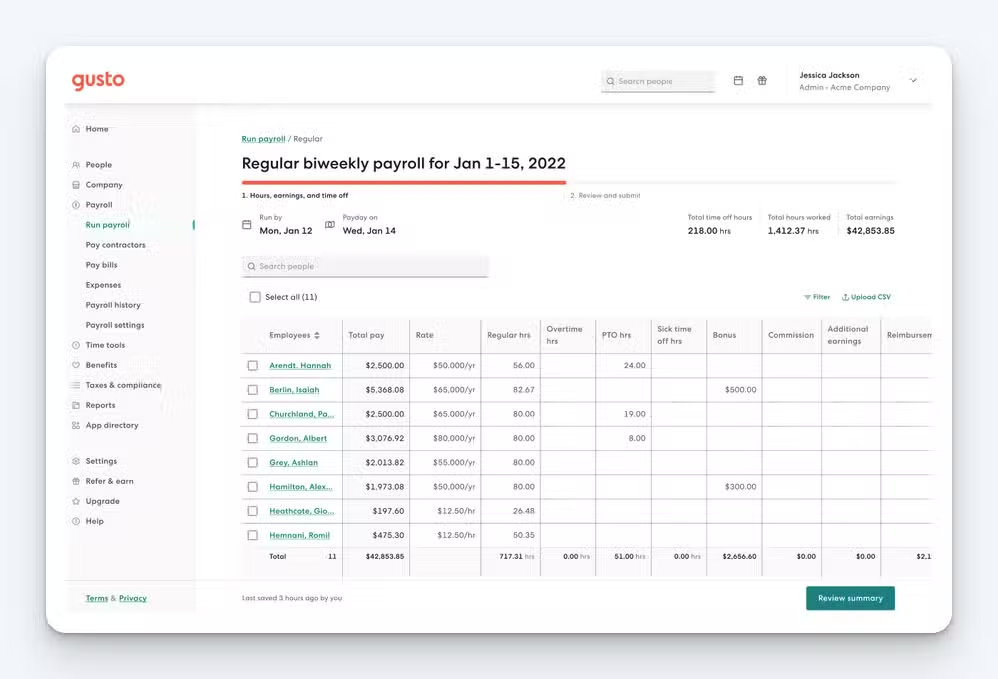

5. Gusto – Best all-in-one payroll and HR platform

Gusto is an affordable all-in one payroll and HR solution. In addition to letting you run payroll and pay employees vis direct deposit, you can use it to track time, create schedules, file taxes, and manage benefits. You also get access to new employee onboarding features that help you draft offer letters, collect electronic signatures, and automatically create forms for tax withholdings and benefits enrollment.

Key features

- Time and PTO tracking

- Benefits management (health insurance, retirement plans, commuter benefits, etc.)

- Employees can access pay stubs, W-2s, benefits information, and time-off requests

- Automates payroll tax calculations, filings, and payments at the local, state, and federal levels

Customer reviews

Gusto has an overall rating of 4.6 out of 5 stars on Capterra across more than 4,000 reviews. Here’s what customers like about the platform:

“This system is not only easy to set up but is incredibly user-friendly. It tracks all of our payroll, PTO, and tax information and all but runs itself. After having used a few other options, this was by far the best value for our money.”

Pricing

Gusto’s Simple plan starts at $6/person per month plus a $40/month base fee and includes single-state payroll with tax filings and payments. To get access to time tracking, you’ll need to be on the Plus plan, which starts at $12/user per month plus a $80/month base fee.

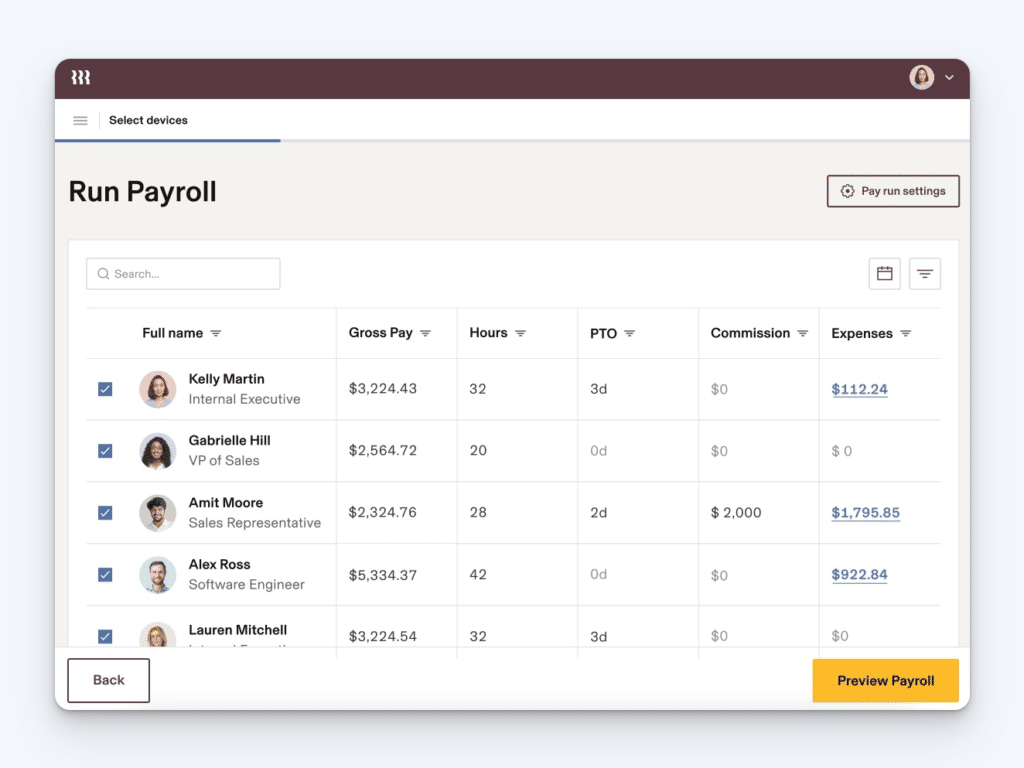

6. Rippling – Best for integrated payroll, HR, IT, and benefits management

Rippling is ideal for businesses that need an all-in-one solution for payroll, HR, and IT. It’s particularly well-suited for tech-savvy companies, startups, and those with remote or international teams. You can use it to run payroll for global, distributed teams, and it will automatically calculate all local taxes for you. You can also use it for software provisioning, allowing IT teams to easily grant and remove access as employees join and leave the company.

Key features

- Pay employees via direct deposit, paper checks, or pay cards

- Issue and manage employee devices, software access, and security settings

- Automated set up of payroll, benefits, and company devices for new hires

- Keeps up with tax and labor law changes automatically

- Handles compliance with local tax and labor laws in over 50 countries

Customer reviews

Rippling has an overall rating of 4.9 out of 5 stars on Capterra across more than 3,500 reviews. Here’s what customers like about the platform:

“My overall experience with Rippling has been positive. The platform’s all-in-one approach to HR and IT management has helped streamline many of my day-to-day tasks. Having access to everything from payroll and benefits to device management within a single interface has made it much easier to manage my work-related needs.”

Pricing

Pricing for Rippling is not publicly available. You can request a quote through their website.

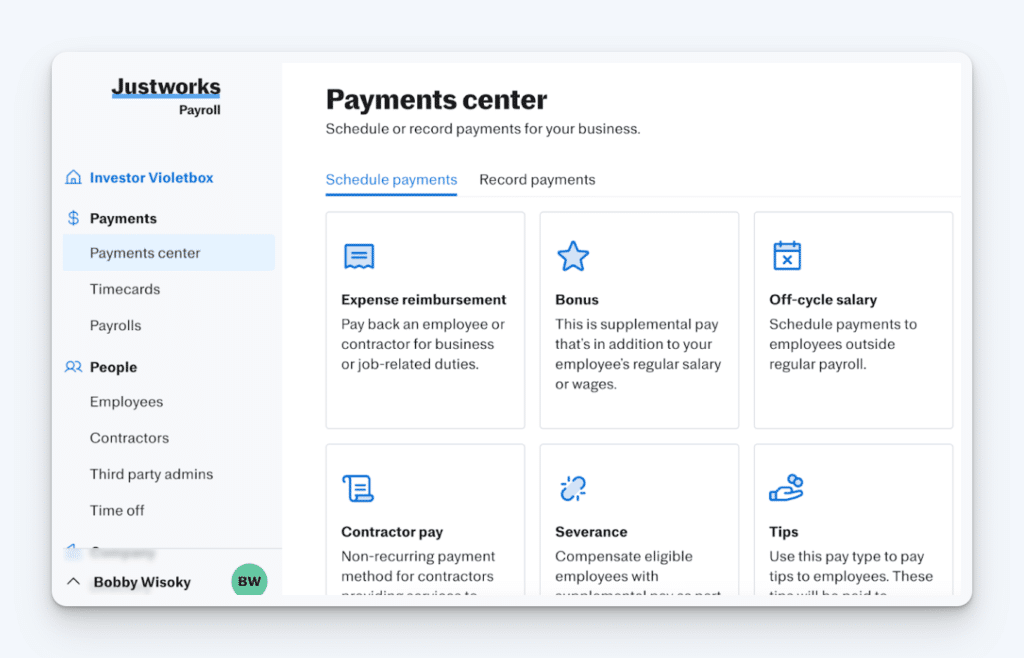

7. Justworks – Best for businesses looking for PEO services

Justworks is an excellent choice for businesses seeking Professional Employer Organization (PEO) services. As a PEO, Justworks becomes a co-employer, sharing legal responsibility for employees. It also negotiates with providers to offer your team access to premium insurance plans, often at rates that are typically only available to large corporations.

Key features

- Get access to Fortune 500-level benefits, including insurance and retirement plans

- Handles compliance with labor laws, employee classifications, and tax regulations

- Administers multi-state payroll and handles compliance

- Employees can manage their benefits, access pay stubs, and review tax forms

- Employee onboarding features like digital offer letters, e-signatures, and automated setup for payroll and benefits

Customer reviews

Justworks has an overall rating of 4.6 out of 5 stars on Capterra across 700+ reviews. Here’s what customers like about the platform:

“We love the easy functionality of the website. The time tracking and time off features have been great in implementing consistent policies. We employ people in multiple states, so the work they do to manage the unemployment accounts in each state has really been the backbone that has allowed our rapid growth.”

Pricing

Justworks has a non-PEO payroll-only plan that starts at $8/employee per month plus a $50/month base fee. This plan only includes payroll, time tracking, and HR features — not any of the PEO benefits. The PEO plans range from $79/employee per month to $109/employee per month.

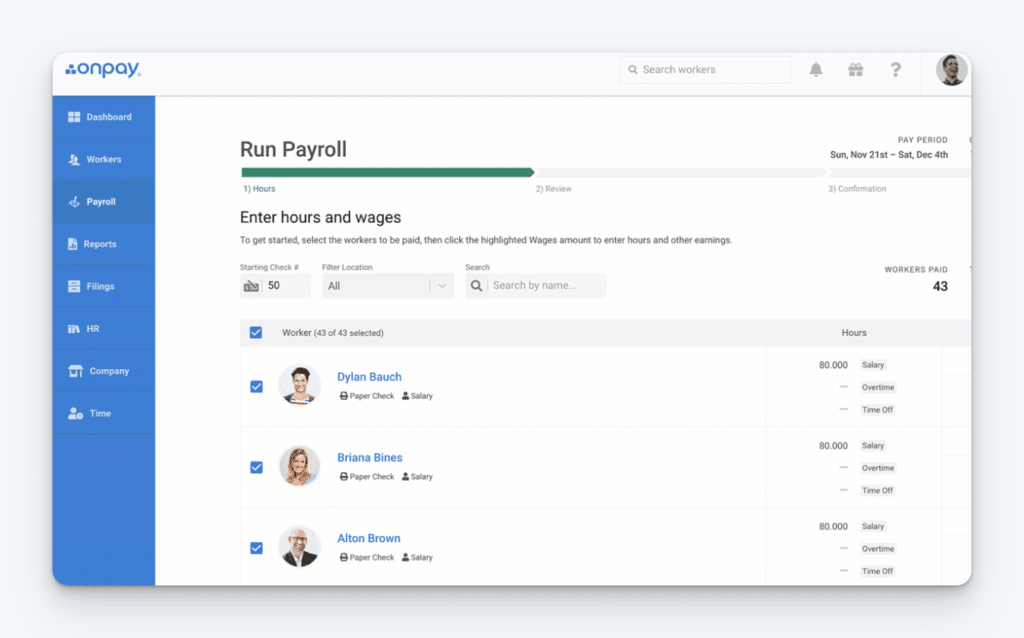

8. OnPay – Best for straightforward payroll needs

OnPay is ideal for small businesses that want an easy-to-use payroll solution. It’s perfect if you’re looking for a reasonably priced tool that handles payroll and taxes without unnecessary complexity. While it lacks many of the features of other tools on this list (such as time tracking and HR features), that can be ideal if you’re solely looking for something simple and affordable.

Key features

- Multi-state payroll with tax calculations, filings, and payments for federal, state, and local

- Pay employees via direct deposit, paper checks, or pay cards

- Employee self-service for viewing pay stubs, accessing tax forms, updating personal details, and managing direct deposit preferences

Customer reviews

OnPay has an overall rating of 4.8 out of 5 stars on Capterra across 400+ reviews. Here’s what customers like about the platform:

“I have an employee with two local city withholdings and a school district withholding that I thought I was going to have to manually withhold for. Turns out that a few minutes with online chat support is all it took to get OnPay to handle it.”

Pricing

OnPay has only one plan that includes all of its features, so you don’t have to scroll through complex feature comparison tables to determine what you’ll need to pay. Its plan is $6/person per month plus a $40/month base fee.

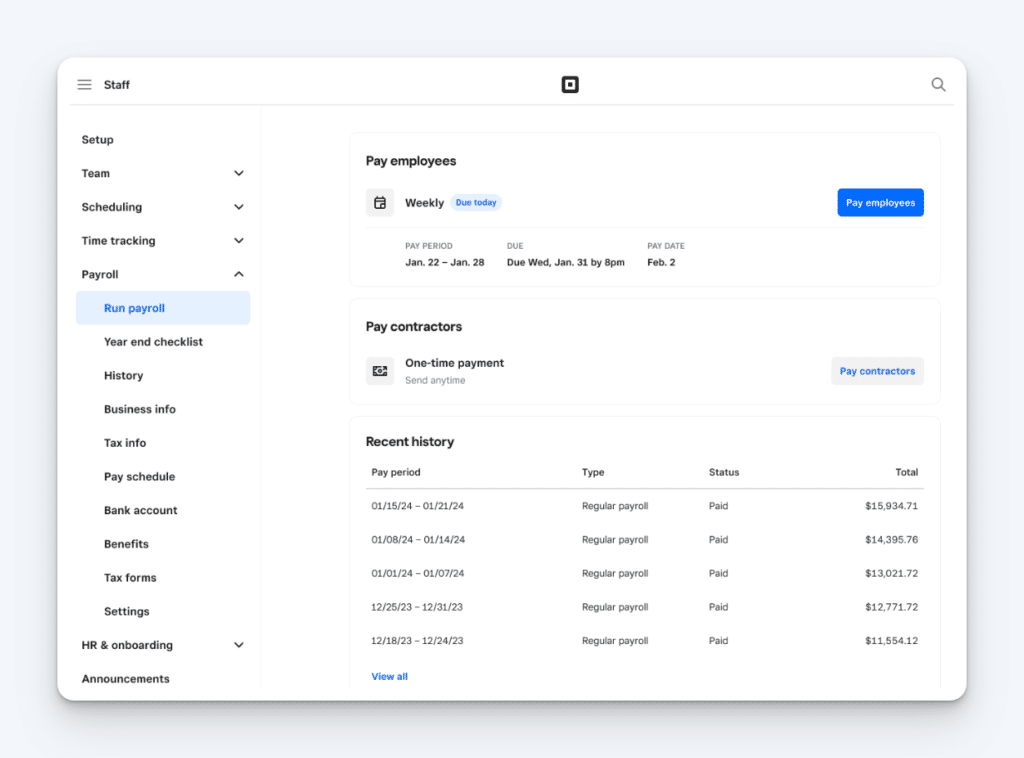

9. Square Payroll – Best for retail or service businesses using Square for payment processing

Square Payroll is ideal for retail, restaurants, and service businesses that already use Square’s payment processing system. It makes it easy to automatically sync sales data, track employee hours, and run payroll from a single system. Employees can clock in and out using the Square app or your point of sale system, and all of the data is aggregated for you to make running payroll easy.

Key features

- Track employee time using your existing point-of-sale (POS) system

- Multi-state payroll with automated tax calculations and filings for federal, state, and local taxes

- Pay employees via check, direct deposit, or Cash App

- Employees can access their pay stubs and tax forms and update their personal information

- Manage benefits like insurance, PTO, and 401k plans through the platform

Customer reviews

Square Payroll has an overall rating of 4.7 out of 5 stars on Capterra across more than 600 reviews. Here’s what customers like about the platform:

“Like many small businesses, payroll is not something I know how to do. I needed a quick and easy way to handle this and still be in compliance with all the laws. It’s a bit daunting, but Square Payroll made it so simple. I don’t have to worry about anything because they handle everything with incredible efficiency.”

Pricing

Square Payroll’s pricing starts at $6/person per month plus a $35/month base fee. If you don’t have employees and just need to pay contractors, you can use Square Payroll for those payments for just $6/contractor per month — no base fee is charged for contractor-only payments.

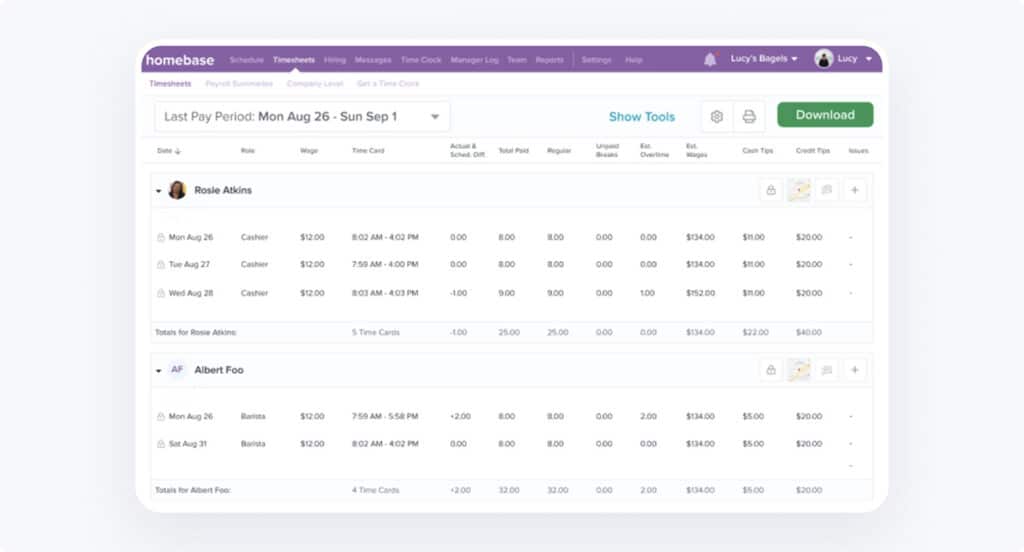

10. Homebase – Best time tracking, scheduling, and payroll app for businesses with hourly teams

Homebase is built for businesses that rely on hourly workers, such as restaurants, retail shops, salons, healthcare clinics, and service teams. It brings scheduling, time tracking, and payroll together in one app, eliminating manual timesheet entry, cutting payroll prep time in half, and ensuring your team gets paid accurately every time.

Key features

- Automated payroll with direct deposit and printable checks

- Automatic tax calculations, filing, and deposits for federal, state, and local taxes

- Time tracking synced directly to payroll

- Tip pooling and distribution

- Unlimited payroll runs

- Multi-location and multi-state payroll support

- Overtime, paid time off tracking, and contractor payments (1099s included)

- New-hire onboarding with e-sign I-9s and W-4s, plus garnishments and reimbursements

- Earned wage access and integrated pay-as-you-go workers’ comp

- Employee scheduling that manages availability, shift trades, and covers

Customer reviews

Homebase has an overall rating of 4.6 out of 5 stars on Capterra across more than 900 reviews. Here’s what customers say:

“Before Homebase I was manually tallying up my team’s work hours and entering them into payroll, crossing my fingers I hadn’t made any mistakes. Now our entire team logs in and out quickly and easily with the Homebase app, and all I have to do is send their hours to my payroll program with the click of a button.”

Pricing

Homebase Payroll starts at $6/employee per month plus a $39/month base fee and includes unlimited payroll runs, automated tax filing, W-2s and 1099s, workers’ comp integration, and free scheduling and time tracking.

Choosing the best payroll software for your team

The best payroll software for your business will depend on your unique needs:

- If you want to consolidate time tracking and payroll into one easy-to-use and affordable platform, Buddy Punch and Homebase are both great choices.

- If QuickBooks Online is integral to how your business operates, you’ll probably want to go with QuickBooks Payroll.

- If you’re looking for something with basic, affordable features, check out Gusto, OnPay, and Square Payroll.

- ADP RUN and Rippling are great options to consider for businesses with more complex payroll and compliance considerations.

- Justworks and Paychex Flex are worth considering if you want to take a more hands-off approach to payroll and benefits administration.

Whichever option you go with, spend the time needed upfront to make sure it’s right for your organization. Switching payroll providers later can cause a lot of rework and headaches — and delay your ability to pay your employees — so make sure you do your due diligence and explore the tools you’re considering fully before making a choice.