This Is Why Padding Your Timesheet Is Fraud

Although there are rules and laws in place against it, many employees are padding out their timesheets; putting down exaggerated work hours and collecting payment for them.

As a business, you rely on the honesty and hard work of your employees. Employees are responsible for entering the correct time and data onto their sheets, and managers are responsible for ensuring pay hours are correct. Unfortunately, though, the process is filled with opportunities for employees to pad out their timesheets, or commit other forms of time theft.

So just how do employees commit timesheet fraud, and what can you do to prevent it?

While most payroll fraud occurs when employees round up their time to the nearest hour, there are many different of falsifying timesheets.

Furthermore, while 10-15 minutes might not seem like a lot, over time, those minutes turn into hours. If someone were to do this every workday, at the end of a year an average employee could easily be compensated 65 hours’ worth of unworked time.

Multiply that by however many employees you have.

The Fair Labor Standards Act (FLSA) enacted by the Department of Labor says that business owners must record, and pay employees for all of their hours worked, but it doesn’t specify how you can ensure you’re keeping accurate time. Since the burden of tracking and paying accurately falls on the employer, it’s in your best interest to ensure that you have a robust timekeeping system in place that’ll make it easier for you to ensure accuracy, and help to prevent time fraud as well as accidental discrepancies.

With this in mind, let’s take a look at a few of the most common types of timesheet fraud, and see what steps you can take to help prevent it from happening.

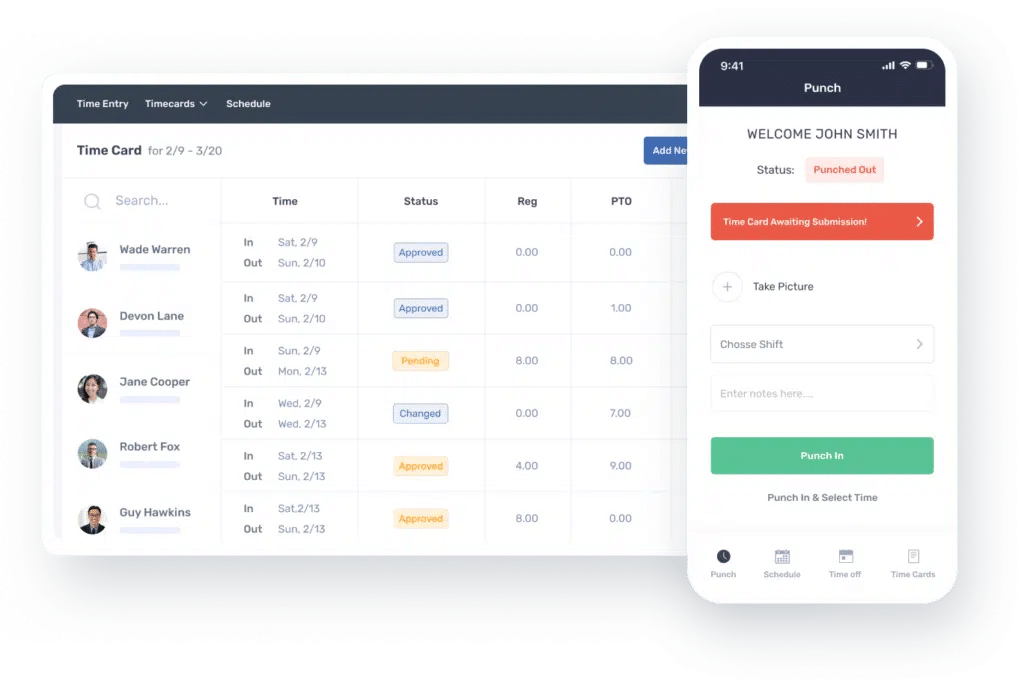

Note: If you’d prefer to automate how you keep track of the amount of time your employees work, you can’t go wrong with an attendance system like Buddy Punch. In addition to the many time tracking features our time clock system has, there are built-in options like GPS tracking and Webcam Photos on Punch that you can enable to stop falsification of time cards. Click here to learn more about why over 10,000 businesses have chosen Buddy Punch.

Inflated Hours

When paper sheets were the only form of time tracking, padding hours was a lot easier, making it the most common timesheet fraud case you’d see. Employees could cover for lateness by just writing that their punch in was on time, leading to an inflation of work hours since there was no way for a manual timesheet to correct for this. One way you can deal with this fraudulent activity is to make it clear in a time theft policy that this is against the rules, and encourage team members to keep each other accountable. After all, one person getting paid for doing less is enough to irritate anybody (which means impairing your employee morale). Additionally, most online time clock solutions have automatic ways to track clock ins and outs, meaning the number of hours worked is always accurate and can’t be gamed.

False Entries

Unfortunately, of the worst offenders for inaccurate timesheet data is human error. When the human resources or payroll department manually enters the numbers off the work schedule, there’s always a chance of that work time data being entered incorrectly. While this might not be a form of fraud in the strict sense of the word, the bottom line is it still results in paying out for time that wasn’t worked, meaning financial losses. If you’re using manual timekeeping there isn’t much you can do to prevent this, but if you’re using digital tools many of them have options to transfer over all data to payroll systems at the end of each pay period. The less susceptible you are to human errors in your work environment, the better.

Clocking in for Coworkers

Buddy punching is another form of fraud that occurs when employees clock in a false arrival and/or leaving time for an absent coworker. It’s unfortunate, but sometimes employee loyalty is extended more to other team members than your business. Beyond warning against this sort of activity in your written policies, you can encourage other team members to crack down on this, and make it clear you’re not using favoritism to let a few employees get away with adding extra hours to their timesheets.

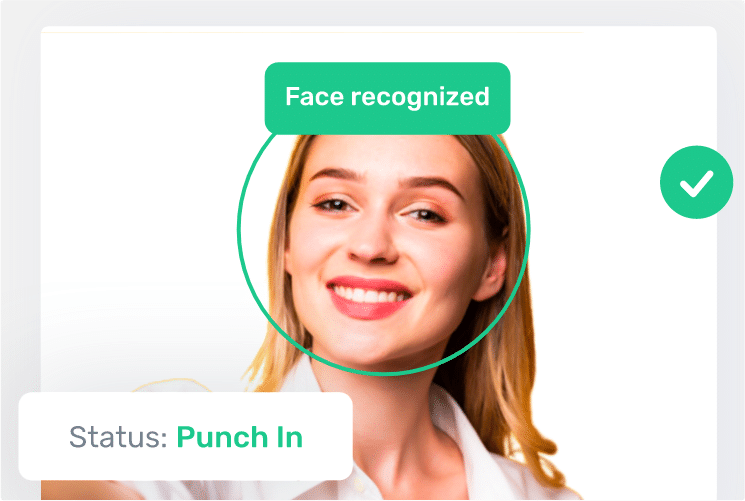

With modern updates, it’s far more difficult to falsify an attendance record on electronic timesheets. This is especially the case if you have a system that requires verification at the time of sign-in, such as a code from their phone or webcam verification.

Break or Personal Time Abuse

Taking an extra long lunch break, sneaking an unauthorized break from your workload, or having personal time while on the clock can also add up over time. Long breaks can add up, but it’s not as if they’re such a big deal that you have to bring criminal charges. Sometimes they’re honest mistakes.

If you want to to stop employees from taking long or excessive breaks, you’ll want to make sure you have clear attendance policies in place that outline the importance of taking designated breaks, and returning to work on time, as well as policies that outline which activities are prohibited; such as browsing social media or using phones while they’re on the clock.

Ghost Employees

Another form of employee fraud involves creating ghost hourly employees and paying them. This is an especially serious form of time fraud, and is more likely to happen in a larger organization than a smaller one. Still, holding regular audits is the best way to make sure there is no fraud occurring in your payroll calculations, and that you only have accurate records.

Working Unauthorized Hours

Working time that hasn’t been authorized is another form of time fraud. When it comes to your team, consider requiring a manager’s signature on timesheets to streamline timekeeping and prevent employees from working unauthorized hours.

Using Time Tracking Software to Prevent Time Sheet Fraud

As we’ve mentioned several times in this article, the easiest way to crackdown on timesheet fraud in your business is to make use of a time & project management software. This is because of the many automatic features that time tracking systems have to reduce human error and automatically safeguard against most methods of timesheet padding.

For a great example, look no further than our very own timesheet system Buddy Punch. Here are just a few of the features we have that can help hold your employees accountable for their time on the clock:

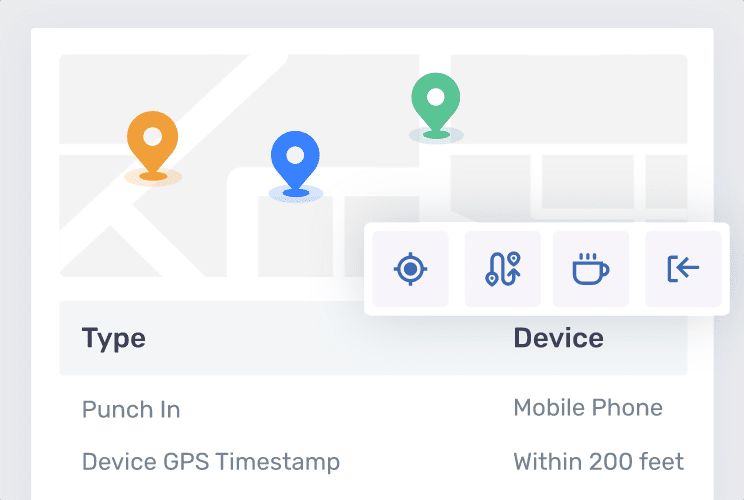

GPS Tracking and Geofencing

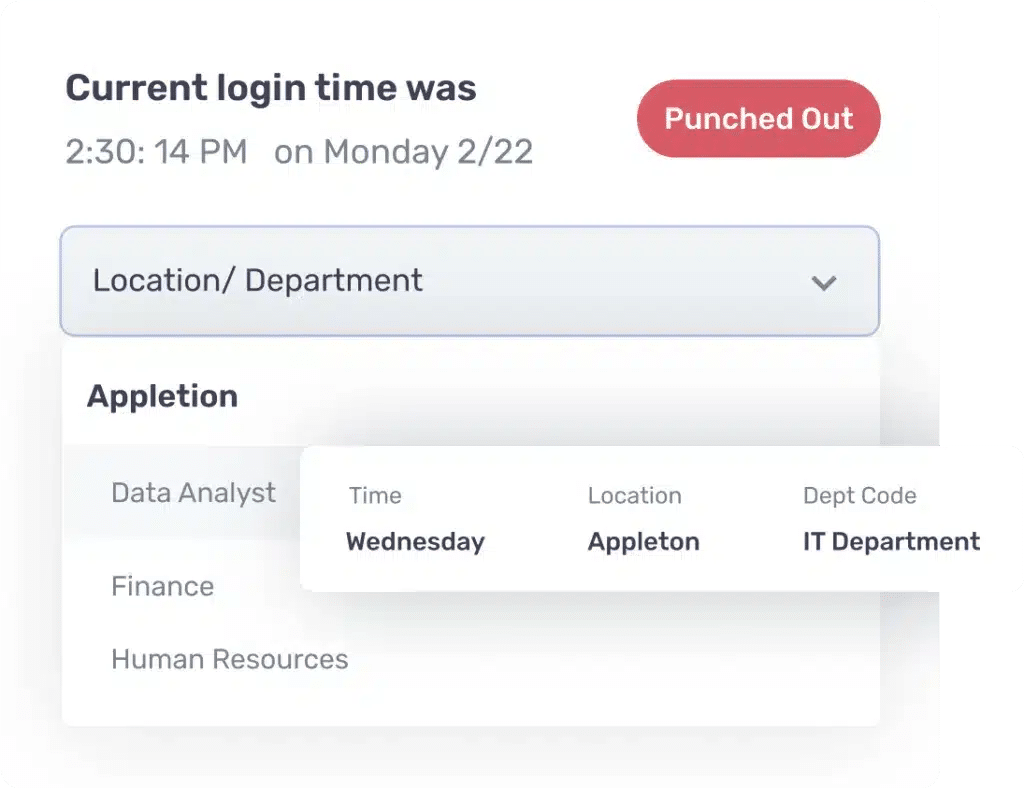

For business owners with team members working remote or at multiple locations, Buddy Punch has a GPS tracking option so you can see where employees are located when they clock in and clock out. Additionally, the Geofencing option allows you to create a radius around specific locations. If your employees attempt to clock in while outside one of these radii, they’ll receive an error notification.

Webcam Photos on Punch

Worried about buddy punching? Our Webcam Photos on Punch feature makes this nearly impossible by taking a picture of whoever’s clocking in and comparing it to saved employee records. You’ll always know who’s clocking in for who, and when.

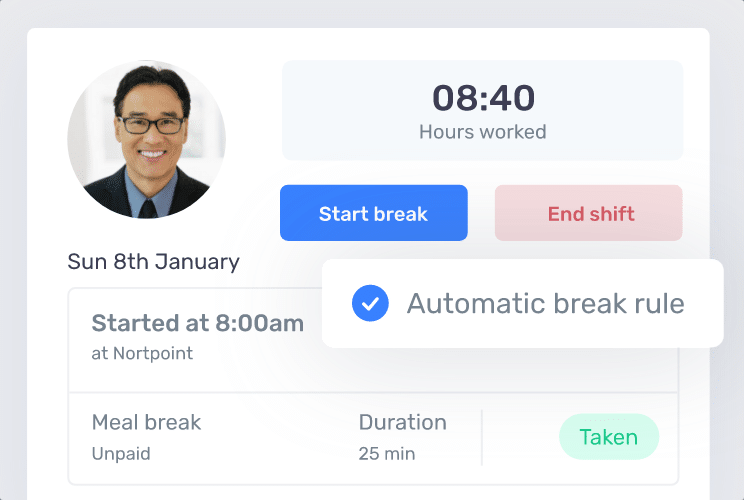

Automatic Breaks

You’ll never have to worry about overly long break times again. With the Automatic Breaks feature, Buddy Punch lets you specify how many hours employees need to work until a break is automatically triggered. You can also choose how long that break should last. Then, that time is automatically deducted from your employees’ time cards.

Punch Rounding

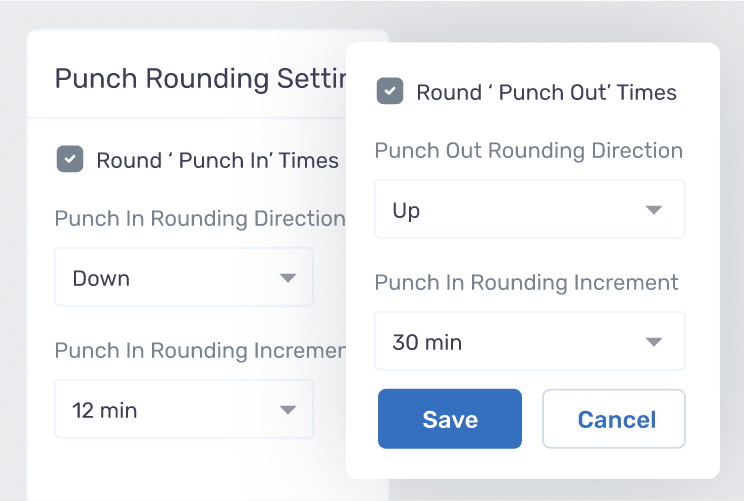

If you notice widespread padding of clock ins and outs in your business, you can use the Punch Rounding feature to set a rule where punches are automatically rounded up, down, or to the nearest increment (anywhere from 2 minutes to 30 minutes).

Job Codes

The job codes feature, also known as department codes, allows your team members to clock into a specific job or task during their workday. If you ever begin to suspect an employee is padding their time, you can check records and see how long a certain task usually takes them.

Even with every feature we’ve just mentioned, we’ve only scratched the surface of all the real-time attendance tracking options Buddy Punch gives business owners. Best of all, most of Buddy Punch’s functions that stop time theft are completely noninvasive to employee workflow. Click here to learn more about what our software has to offer.

When it comes to preventing time card fraud, having an updated timesheet approval system is an important part of reducing fraud. It’s also a good idea to have clear company policies that your employees have read and signed. You may also want to consider having your managers sign off on your employees’ timesheets to verify that they authorized the hours worked. You should also make sure you perform regular audits of your payroll, just to keep everyone honest.

Or, if you want to drastically simplify all of these options, you can invest in a solid employee tracking system created with both business owners and their team members in mind.

Try Buddy Punch for Free

If you want to see if Buddy Punch could be the solution to timesheet padding you’ve been looking for, sign up for the free 14-day trial. You can also book a one-on-one demo, or view a pre-recorded demo video.

You May Also Like…

- Lower Your Labor Costs by Eliminating Time Theft

- 13 Best Employee Time Tracking Software & Apps for Small Businesses in 2022

- How to Create an Employee Handbook

- Project Management Software to Keep Your Employees On Track

- What Happens if You Steal Time at Work?

- 4 Best Ways to Track Employee Work Hours (Software, Paper Time Cards, Spreadsheets, and Mechanical Punch Clock)

- What to Include in a Time Card Policy

- Buddy Punch Features: Text to Punch (Turn Text Messages to Clock Ins)

- 5 Best Timekeeping Software for Employees (In-Depth Look)

- Simple Techniques for Administering Disciplinary Action

- What to Say to an Employee Who Falsifies Their Time Card

- Employees Working in the Field – How to Track Their Time