6 Must-Know Time Clock Rules for Hourly Employees

Deciphering the FLSA’s time clock rules: A guide for business owners to remain in compliance as you optimize employee time and attendance.

Not fully comprehending all the moving parts to time clock rules for hourly employees could cost a business millions of dollars, whether that comes in lost productivity over the years or in fines and lawsuits due to accidentally violating state and labor laws.

There are several time clock rules surrounding breaks, punch rounding, time tracking, overtime, and more that are often difficult to juggle — unless you have the right system.

Here are all the latest time clock rules that you need to know about to manage your hourly employees, as well as how to semi-automate them with software. This guide will instruct you on how you can best stay focused on what matters: productivity and profitability.

If you’re looking for a time tracking system that will help you stay compliant with all relevant U.S. laws and regulations, consider Buddy Punch. With features like overtime tracking, break tracking, three years of historical reporting data, timesheet approvals, punch rounding, and time theft prevention features, you can easily keep your business operations compliant with all applicable state and federal time clock rules.

What is a time clock?

A time clock is any device used to record the start and end times of an employee’s work hours. These devices can be physical or digital and are also known as punch clocks.

What are time clock rules?

Time clock rules are the state laws and federal laws (particularly under the Fair Labor Standards Act, or FLSA) that come into effect when using one of these devices to record an employee’s work hours.

These are important to consider because many time clocks come with additional functions that can be assets in many situations but also raise legal questions and technicalities depending on their implementation.

Hourly vs. salaried employees

One more preliminary thing to note is that time clocks are more commonly relevant when dealing with hourly employees than salaried employees. This is because hourly employees are paid specifically based on the amount of time they work, whereas salaried employees are usually paid a set amount.

However, you do have to consider whether a salaried employee is exempt or non-exempt.

Exempt employees are paid an annual salary and are not subject to overtime or time tracking. Non-exempt employees are paid an hourly wage, and those who work over 40 hours per week are entitled to overtime pay (at a rate of one and a half times their regular rate of pay for each hour worked).

In either case, there is still merit in using a time clock to get a better idea of employee work data and project cost information, but it becomes far more optional in the case of exclusively managing exempt employees.

The 6 must-know time clock rules and labor laws

Now that we’ve covered some of the basics, it’s time to dive into the most important rules for small business owners and their employees to keep in mind while encouraging timekeeping through the use of time clocks.

1. Time clock rounding rules

Time clocks are not at all required under the FLSA. That said, they do note that standard practice is recording the employee’s start and end time to the nearest five minutes, or to the nearest one-tenth or quarter of an hour. Learn more about the rules related to time clock rounding.

2. Rules around who needs to track their hours

Employers, not employees, are required under the FLSA to keep time records of each covered, non-exempt worker. Employers are expected to keep records on wages, hours, and other items as specified in the U.S. Department of Labor regulations. This is further broken down into:

- Hours worked each workday

- Total hours worked each workweek

- Total premium pay for overtime hours

- Total wages paid each pay period

- Date of payment and pay period covered by payment

- And more

These records must include accurate information about the employee and data about the hours worked and wages earned.

The FLSA stipulates that employers should preserve at least three years of payroll records, collective bargaining agreements, and sales and purchase records. Wage computation records (such as time cards and work schedules) should be retained for at least two years.

There is no other requirement for the form these records should take. Paired with the fact that the FLSA allows any timekeeping system so long as it’s accurate, employers are well within their rights to implement a time clock system that automates the time tracking of each individual employee.

3. The 7-minute rule

This is an important addition to the idea of punch rounding under the FLSA. While employers are allowed to round employee time to the nearest quarter hour, you may violate the FLSA minimum wage and overtime pay requirements if you always round down. This is why it’s helpful to remember the 7-minute rule.

The FLSA allows employee time from anywhere between 1 to 7 minutes to be rounded down (and thus not count as hours worked) but employee time from 8 to 14 minutes must be rounded up and counted as a quarter hour of work time.

This becomes important if an employee works hours in excess, reaching overtime hours, but your time clock system is set to automatically round down. This could result in an employee being robbed of that premium rate of pay. Such a scenario constitutes wage theft and would leave you legally liable.

4. On-call and off-the-clock work rules

The FLSA defines on-call work in two different ways. If an employee is required to remain on an employer’s premises while on call, they’re “working while on call.” If an employee can be at home or can leave a message about where they can be reached while on call, they are considered “not working while on call.”

These two definitions determine how employee work hours are meant to be accumulated for on-call scenarios.

In other words, requiring an employee to be on the premises while on call counts as them working, while letting them leave but having them on call does not — until they’re called in.

Meanwhile, off-the-clock work is any work that is done by one of your employees without them receiving compensation. Off-the-clock work is generally illegal and a violation of the FLSA. This means that if you send a work email to an employee after hours and they respond, that time spent is compensable, even if it’s just five minutes.

5. Overtime rules

The FLSA is very clear that any and all nonexempt employees must be compensated for hours worked in excess of 8 hours in a workday or 40 hours in a workweek. This compensation must come at a rate not less than one and a half times their regular rate of pay.

This even holds in the case of non-exempt employees working fluctuating workweeks, where workweeks are defined as fixed periods of 168 hours (7 consecutive 24-hour periods).

The most important concern here is the 40 hours worked in a week, in addition to considering any punch rounding rules you’ve implemented in your time clock.

Overtime pay (one and a half times an employee’s regular rate of pay) is not required for any work that happens to occur on Saturdays, Sundays, holidays, or regular days of rest unless the hours worked on those days exceed the 40-hour threshold and thus count as overtime hours.

6. Meal and rest break rules

The FLSA outright states that rest periods of 20 minutes or less are common to promote employee productivity. Since breaks can help an employee be more efficient, the FLSA demands that these short breaks still count toward hours worked.

However, unauthorized extensions of authorized work breaks (such as 10-minute smoke breaks being extended to 18 minutes by employees delaying) do not have to be counted as hours worked, so long as you’ve effectively communicated the intended duration of a break.

Employers often use attendance policies for unambiguous communication of how breaks (and other employee timekeeping) are meant to be handled.

Meal periods are handled differently from rest periods. They’re usually 30 minutes or more and do not need to be compensated as work time under the FLSA. That said, employees must be completely relieved from duty for the purpose of eating meals.

Even sending an email or an SMS message will violate this complete alleviation from duty if you require an employee to respond while on their meal break.

Common time-tracking mistakes to avoid

The FLSA demands that employers need to keep an accurate record of employee hours worked to ensure that team members are properly compensated for their time. This means that anything that contributes to inaccuracy is a mistake that needs to be avoided in order to ensure compliance. This includes things such as:

Failing to maintain an accurate timekeeping system

For some employers, simply establishing any method of time tracking, such as the filling out of manual paper timesheets or using a time card reader, is the start and end of their enforcement of time tracking rules. However, physical time clocks can malfunction, and both methods can be cheated with falsified data.

In order to ensure you’re always in compliance with the FLSA’s rules, you’ll want to keep up maintenance of your physical time clock, update your digital time clock, and enable any extra measures that keep employees accountable for their time data.

Misclassifying employees

This is a common issue for small business owners where a limited team size means that employees may take on multiple different roles, confusing how their duties should be defined. The two categories of employees under the FLSA are exempt employees and non-exempt employees.

Exempt employees are not entitled to receive overtime pay for hours worked before 40 in a workweek or 8 hours in a workday. Non-exempt employees must be paid overtime for these hours worked in excess. Non-exempt employees are also entitled to minimum wage under the rules outlined in the FLSA.

Exempt employees are employees such as doctors, lawyers, or business executives, whereas non-exempt employees tend to be blue-collar workers such as retail employees, construction workers, and restaurant workers.

Allowing time theft in the workplace

Employers who fail to enact measures to prevent time theft are more likely to become victims of it. Data has shown that employers across the U.S. lose an estimated $400 billion due to the sort of lost productivity covered by time theft.

An employer that allows time theft such as buddy punching in their workplace is not only losing money but is also failing to track the actual work of their employees. This could mean there are other gaps in your timekeeping method that need to be filled.

Many time clocks come with features that can help reduce time theft. In the case of physical time clocks, this may require you to purchase expensive add-ons or upgrade to wholly different versions of a time clock to make use of a biometric timekeeping feature like fingerprint scanning or facial recognition.

For digital clock in and out apps and time card apps, however, many of these tools are built into their functions and can be enabled or disabled easily.

Common forms of time theft include

- Buddy punching: When one employee punches in for another, such as scanning their card through a physical time card, to cover for tardiness or absences.

- Extending unauthorized breaks: When an employee takes an allotted break, such as a 30-minute lunch, and extends it to 37 minutes.

- Clocking in or out outside of their scheduled start and end times: Such as arriving at 9:11 AM when they’re meant to work at 9:00, but claiming to have arrived right on time.

- Excessive socializing: Taking time away from their productivity to talk casually with team members for an extended amount of time.

- Browsing social media: Using time on the clock to check their social media feeds.

Inaccurately calculating overtime

Rules around overtime are so strict under the FLSA that they impact how other components of timekeeping are meant to be handled, such as rounding employee minutes.

This is because one and a half times pay is such a significant rate of pay, and asking employees to work over the standard 40 hours per workweek or 8 hours per workday is a huge strain on them mentally and physically.

Not maintaining employee time and attendance records

Part of the FLSA’s rules regarding timekeeping dictate that an employer is meant to keep records of an employee’s time and attendance.

Records for employee wages (such as time cards) are meant to be retained for two years, should be available at the place of an employee’s employment, and must include full information such as an employee’s name, hours worked each day, total hours each workweek, and total wages for the pay period.

This means you’ll want to ensure that employee records can be easily accessed while still being secure and that the data in them is accurate. If a dispute arises, it’ll be harder to come back a year or two later and pinpoint where human error or falsification may have taken place.

This is another area where electronic time clocks empower business owners, maintaining accurate records and even producing backups of records in the case of cloud-based software.

Not accounting for state and local laws

The FLSA sets the standards across the U.S., but states and cities can implement their own additional laws for hourly employees that business owners need to consider. These rules have to comply with the FLSA but also set their own specific standards that must be obeyed or you may face legal issues.

For example, there are time clock rounding laws that some states took upon themselves to implement in their state legislature. Since employers tend to track employee time in 15-minute increments, the FLSA says that employers can round to the nearest 15 minutes.

This 15-minute time rounding is something that Colorado, Nevada, and Oregon also explicitly outline in their state laws. Similarly, New York says employers can round to the nearest 15 minutes, but the New York law only applies to non-exempt employees specifically.

Meanwhile, Illinois and California took a different tactic that, while remaining in compliance with the FLSA, is stricter. Illinois says that employee hours can be rounded to the nearest 10 minutes, while California says the employee time tracking can only be rounded to the nearest 5 minutes.

How Buddy Punch transforms your time tracking

Keeping a handle on all these time clock rules can be a challenge for business owners, which is why we encourage you to make sure that any time clock you implement into your workplace is making timekeeping easier in all aspects possible.

This includes remaining in FLSA compliance, helping you avoid common timekeeping mistakes, ensuring the accuracy of employee data, being precise with any employee time rounding, and storing records with backups.

For employee time clock software that achieves all of this and more, look no further than our very own Buddy Punch.

We built our time-tracking software due to struggling with continuing to use manual employee tracking systems for an expanded team of 20 employees at three different locations.

Our business needs had grown more complex, which called for a more efficient way of ensuring accurate time records and recordkeeping to remain FLSA compliant. This led to us creating Buddy Punch from scratch.

Today, we’ve grown our tool into an all-in-one time clock with many effective features that improve timekeeping and attendance management for business owners of any size and industry.

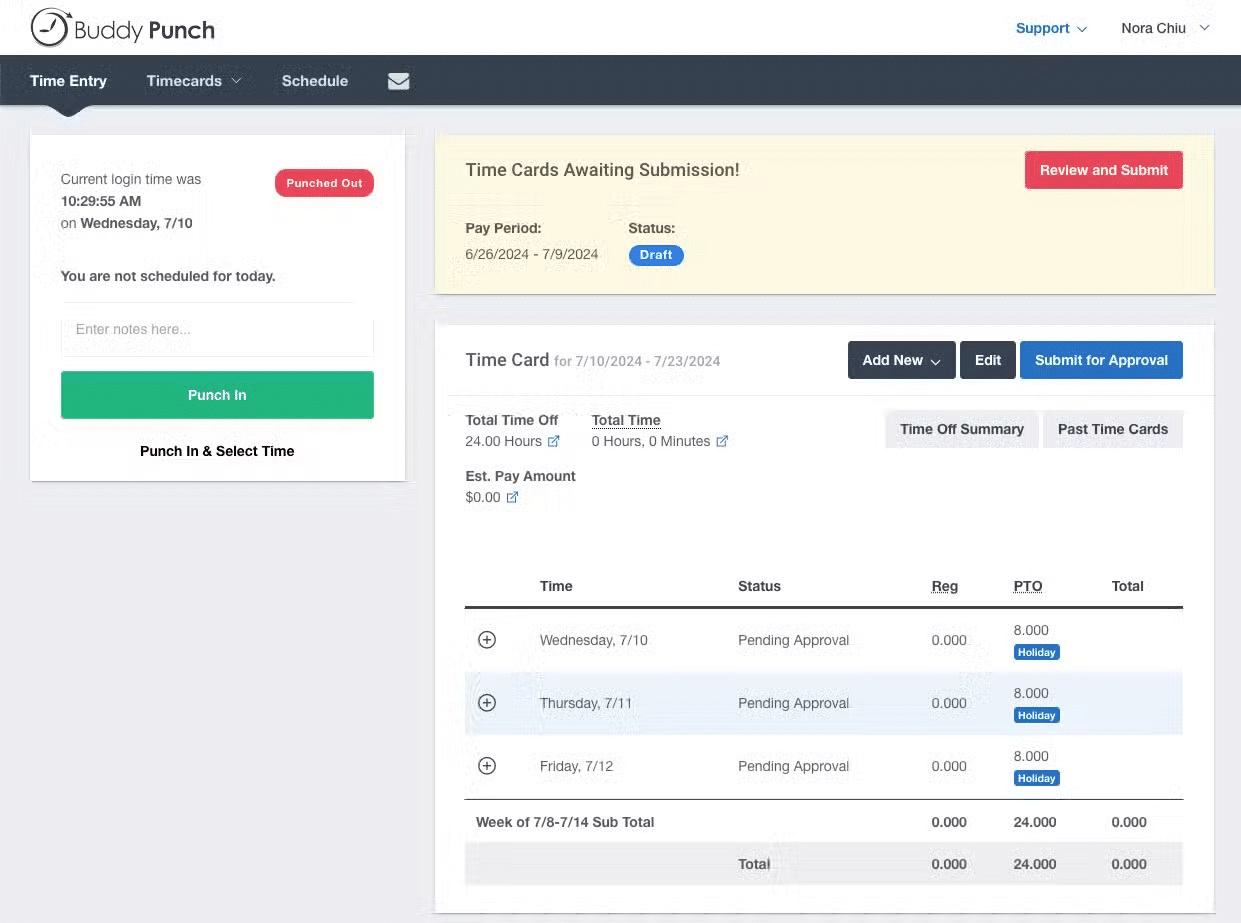

Simple clock in / clock out

After your employees log into Buddy Punch, they’re presented with a screen with just three options: clock in, clock out, and view or submit their timesheet. This streamlines when an employee clocks in, regardless of how tech-savvy your team members are.

That said, this simplicity doesn’t limit your employees. Team members can still request time off, submit requests to correct any clock-in mistake, and view their estimated pay. These features are simply on the backend to simplify the day-to-day timekeeping experience.

Overtime tracking software

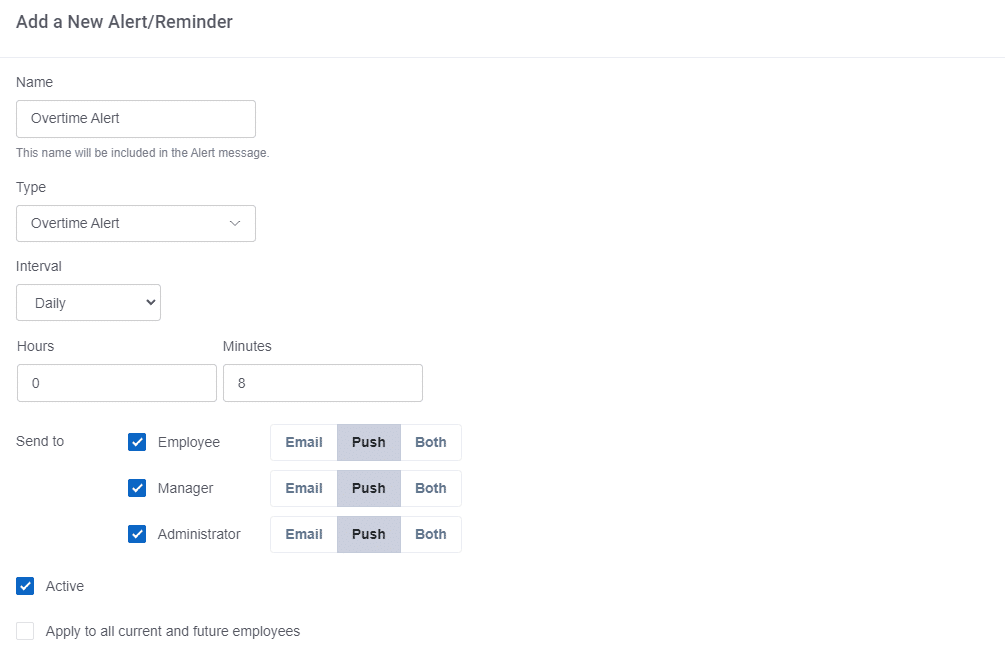

Buddy Punch comes with the ability to create a custom overtime rule if our pre-existing list doesn’t meet your needs. You can set up a weekly and daily overtime threshold to trigger when hours worked enter the overtime category. You can even establish if employees should not work overtime or double overtime on specific days.

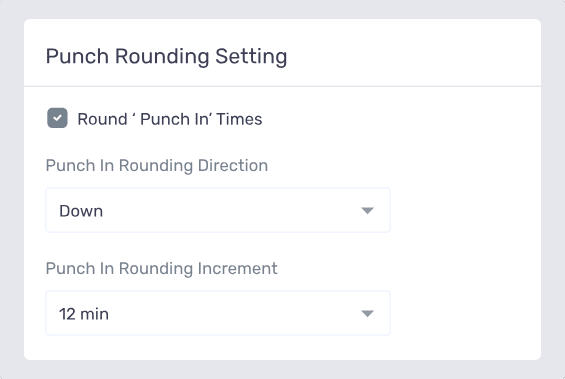

Punch rounding

Buddy Punch allows you to establish a rule to automatically round punches up, down, or to the nearest predetermined interval you select, anywhere from 2 minutes to 30 minutes. This is particularly useful if employees are only clocking in and out on one device, such as if you set up Buddy Punch as a kiosk in the office.

Punch limiting

Punch limiting allows you to specify timeframes where employees are allowed to punch time.

There are two different ways Buddy Punch allows you to enforce this timekeeping limit. Either employees can be limited to only clocking time within a few minutes before or after when they’re actually scheduled on the shift, or you can set it so that employees can only punch in during a specific time frame.

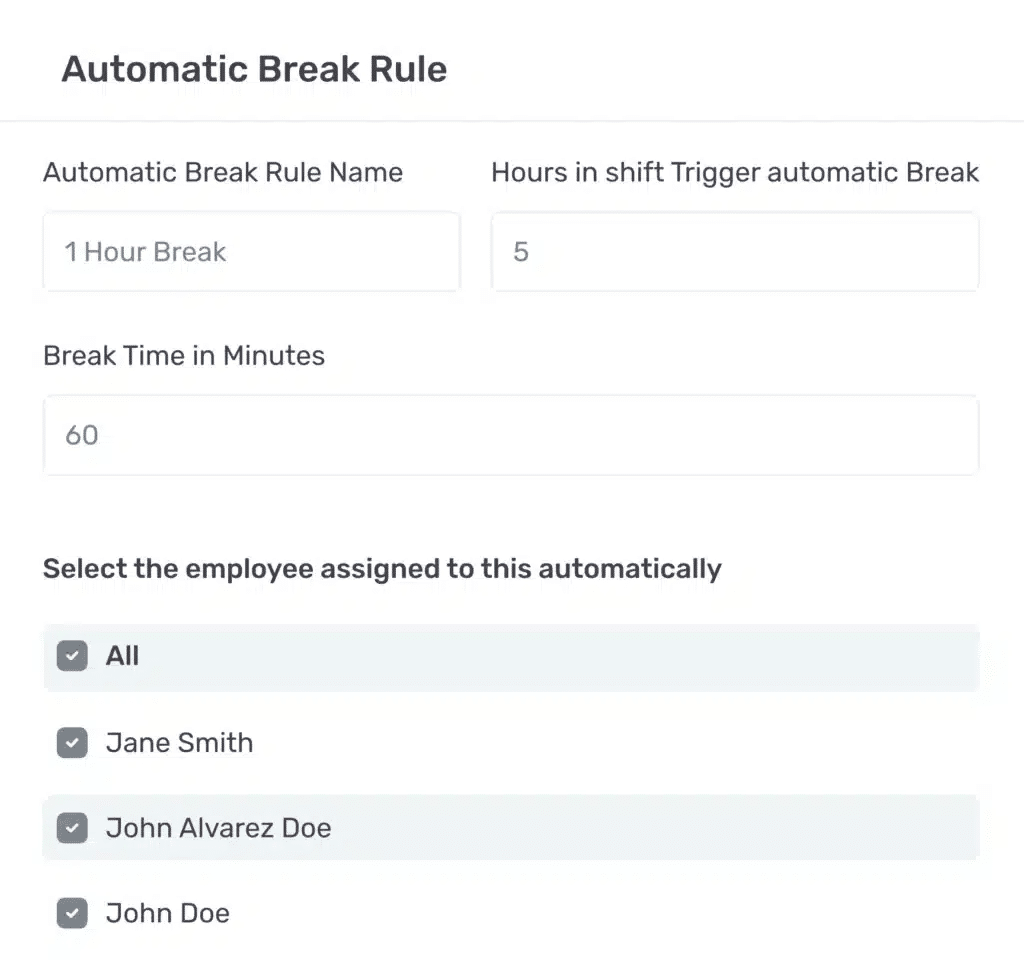

Break time tracker

Having trouble with employees not taking breaks as specified? Buddy Punch helps automatically enforce your break rules. Name a rule, specify the number of hours of work that should pass before it triggers, set the break length, and assign it to employees.

For example, setting a lunch break to trigger after 3 hours of work for 30 minutes exactly.

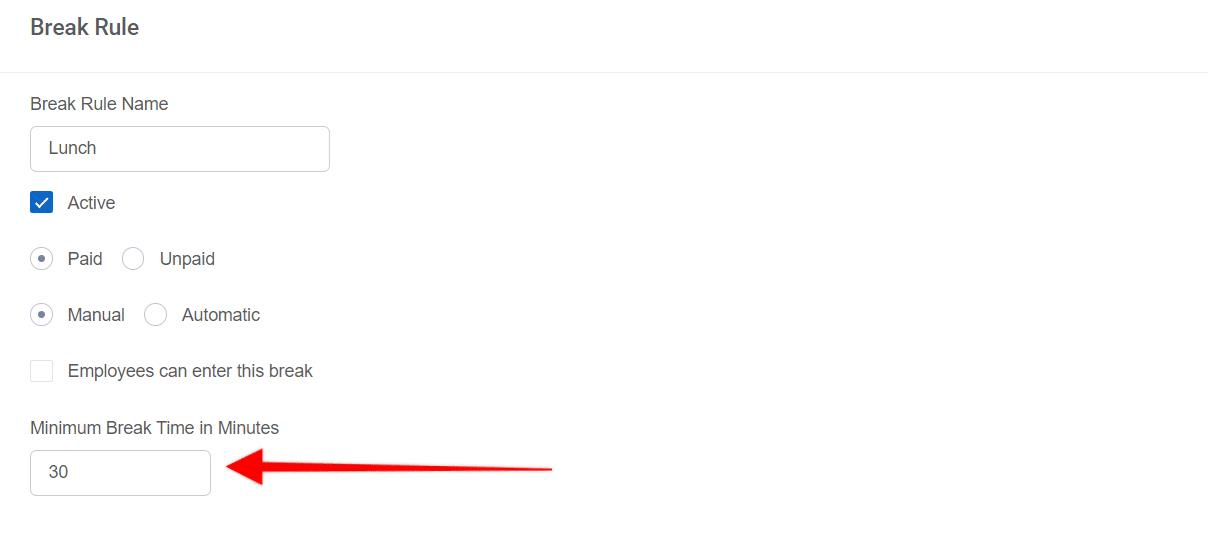

Minimum break times

In case you’re worried about employees improperly taking or logging breaks, you can enforce a hard rule of how long they’re meant to take a break to enforce FLSA standards. This helps ensure the difference between a 20-minute paid break and a 30-minute unpaid break is respected.

Name a break, establish whether it’s paid or unpaid, and decide if it will be automatically applied to employee time cards or require the employee to enter the break manually.

Notifications

Buddy Punch’s robust notifications system can be used to keep employees apprised of many important timekeeping updates, such as needing to clock in or clock out, when they’re approaching overtime, when they need to submit their time cards, or when you or your HR administrators have approved their time cards.

These are just the most obvious ways that Buddy Punch can keep you and your employees in compliance with FLSA rules, but there are more tools that our time-tracking software comes with to empower you, such as GPS tracking, geofencing, drag-and-drop employee scheduling, and even a built-in payroll option.

Learn more about Buddy Punch

- Start a free trial — no credit card required

- View pricing

- Watch a video demo

- Take an interactive product tour

- Request a personalized demo

Bottom line

While the various time clock mandates featured in the Fair Labor Standards Act may seem complicated, understanding them is critical for any business owner.

That said, there’s no reason you can’t upgrade to a versatile and easy-to-use time clock that helps you automate every feature you’d need to remain compliant with the FLSA, as well as state laws.