10 Helpful Payroll Tips for Small Businesses

With these 10 tips, you should be equipped with a streamlined and effective strategy for managing your small business’s payroll.

How you run payroll accounts for more than just employees getting their direct deposit on a regular basis. Given the complexities of state and federal taxes and the importance of paying your staff on time, keeping good records sets you up for success as your business grows — whether you’re bootstrapping a technology startup, starting a trade business, or running a small local shop.

In this post, we’re going to breakdown 10 of the most helpful payroll tips for small businesses — whether that means crafting an effective payroll schedule, looking into payroll services and software, or avoiding common pitfalls. By the end, you should be equipped with a streamlined and effective strategy for dealing with your employees’ paychecks.

1. Select the right payroll software

Payroll software is far from one-size-fits-all, and there are several factors at play to keep in mind while shopping around. From the varying ease of use and automation features to customer support and updates, there are plenty of different options to choose from.

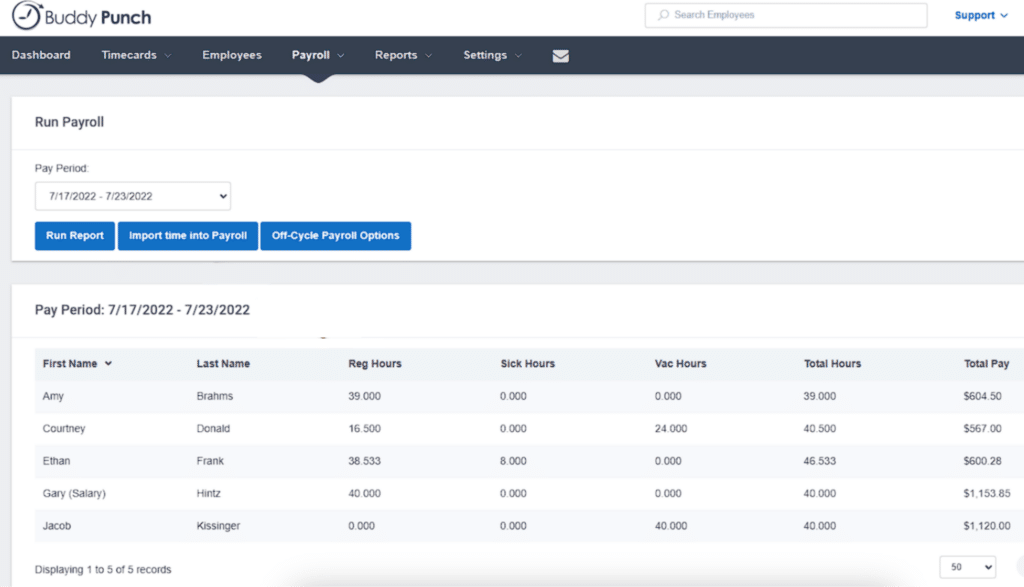

For an example of what we mean, look no further than our very own Buddy Punch. In addition to time tracking and employee attendance features, Buddy Punch can also be a business owner’s payroll solution, making it truly an all-in-one solution for workforce management.

Buddy Punch enables you to keep all of your employee information in one place, while using automated features such as integrated timesheets, automatic payroll tax filings and payments, easily accessed paystubs and tax forms, and more. All of this makes it easier to account for state taxes and local taxes.

For other business owners, you may want to look for specific features that will help you. What do you struggle with when it comes to bookkeeping? Do you have issues with employer tax like FICA (Federal Insurance Contributions Act), FUTA (Federal Unemployment Tax Act), or social security taxes? Or maybe you’re dealing with wage garnishments due to a court order, and you’re not pleased with how that’s going.

If you have specific features you know your business needs, choose a payroll software provider that can help you solve those problems.

Learn more about Buddy Punch

- Start a free trial — no credit card required

- View pricing

- Watch a video demo

- Take an interactive product tour

- Request a personalized demo

2. Create a payroll calendar

Whether your pay periods are weekly, bi-weekly, or semi-monthly, a payroll calendar considers pay periods and can track important IRS tax filings. Knowing what is due at a particular time allows payroll managers to plan and schedule payments to the government promptly and effectively.

Using a payroll calendar also helps a business manage available funds for payroll each pay period. If you decide to DIY your payroll calendar, consider using a template to organize employee pay and tax filings.

3. Hire a payroll administrator

The many details involved in running payroll can get overwhelming. Employer identification number, tax deductions, tax withholdings, gross pay, health insurance — it can be a lot to manage.

Some business owners prefer to save time and effort by simply outsourcing the process entirely to payroll specialists or payroll service providers, such as a professional employer organization (PEO). A payroll administrator will keep the business up to date on tax regulations and employee changes and updates. Even the onboarding of new hires can be handled by an administrator.

When hiring for this role, look for people knowledgeable about labor laws, tax liabilities, and workers’ compensation.

Knowing when to hire a payroll administrator will depend on how many employees you have and if you support remote workers. Whether you decide to outsource or do payroll yourself, you’ll need someone to provide quality checks on your payroll processes.

4. Keep payroll and operating expenses in separate accounts

The adage “Don’t put all your eggs in one basket” applies to managing payroll for your small business. Keep your bank account for payroll separate from your general operating expenses. Doing so will help your accountant track transactions, keep records updated, and make it easy to file payroll taxes.

See if your current bank can add another account for payroll at no added cost. While it may appear easier to keep all of the accounts connected, you’ll have more to manage as your business grows. Start out with a payroll clearing account to maintain financial security and allocation.

5. Never dip into payroll tax funds

There are huge implications with the IRS for not paying payroll taxes. Although some businesses may need the money to take care of other business expenses, it’s never a good idea to borrow from your business’s tax funds. One option that small business owners may consider is taking out a loan to cover miscellaneous expenses rather than using payroll funds and risk missing important tax payments.

If your company uses payroll tax funds to pay for other operations, it may be time for a business audit. Consider creating a rainy day fund for your business to discourage any payroll account dipping.

6. Document your payroll process

Sweat the small stuff. No matter the size of your small business, good record-keeping will serve your business well in the long run.

From one employee to multiple, it’s critical to keep meticulous records of employee wages and your payroll reports. The IRS expects you to maintain payroll records for at least three years. A well-documented process will help your business comply with tax laws, keep track of your employees’ pay and updates, and stay compliant with specific requirements such as:

- Tax rates (state and federal)

- Tax deposit timing

- W-4 forms

- Retirement plans

If you are the sole employee of your business, make it a habit to record everything: This process will allow you to see the overall health of your business and allow for future planning. If you find this too time-consuming to maintain manually (through spreadsheets for example), use software.

7. Develop a thorough timekeeping system

Setting up a good digital system to track your employees’ time is crucial in making your business more efficient. Accurate timekeeping will help with accounting and payroll records, and there are plenty of resources that make the process easier.

Some business owners use digital time clock software to automate a lot of this process. For example, Buddy Punch’s employee time clock software comes with powerful features like job codes, GPS tracking, time card approvals, overtime pay calculations, and many more. These features not only keep your employees more accountable for the work they do on the clock but also help ensure accuracy for the time they log.

Hourly wages can be expensive — make sure the time logged on those time cards is accurate.

Related: The Best Payroll and Timekeeping Software

8. Talk to employees about what works and what doesn’t

For new businesses, polling employees about their preferences can help you decide on what options to use. Some workers prefer biweekly pay periods, but others may prefer to be paid weekly. Take the opportunity to ask your employees what works for them and structure your system accordingly.

9. Keep employee info well-organized and secure

Protecting small business payroll data is just as important as protecting data files, and secure systems will do both. Employees can access their payroll system to update records and view paystubs, which should be made available through payroll system training.

Ensure the integrity of your business by protecting your employees’ data. Implementing a strong payroll system includes limiting who has access to sensitive employee data.

10. Keep up with state, local, and federal payroll rules

Staying updated on payroll rules can keep your business running smoothly without the stress of audits or fines. Payroll systems will manage this for you.

For a business without the capacity or expertise to track local and federal changes, business owners should consider outsourcing this work to a contractor who can. Subscribing to local and federal mailing lists may be useful to stay abreast of new updates.

Now that we’ve run through the entire list of tips, you might see why our top tip advice was to find high-quality payroll software. Payroll is a complicated process with a lot of moving parts, but embracing digital solutions makes it all substantially easier.

This is something we kept in mind when we designed Buddy Punch’s Built-in Payroll System to help streamline the process for small businesses and enterprises alike. It has features like unlimited payroll runs, integrated timesheets, W-2s and 1099s, automated payroll payments, tax filings, direct deposit, printable checks, employee self-onboarding, and more.

If you’ve decided that Buddy Punch could be the right payroll software for your small business, you can sign up for a 14-day free trial of Buddy Punch, book a one-on-one demo, or view a pre-recorded demo video.