5 Best Payroll Software with Direct Deposit

The best payroll software with direct deposit will:

- Make it easy for your team to set up direct deposit and receive their earnings on time and into their bank accounts via secure ACH transfer. Plus, it’ll give your team a self-service employee portal where they can make changes as necessary to their direct deposit info as well as tax withholdings, see exactly how much money they made, and the breakdown of their earnings.

- Streamline your entire payroll process. Payroll software works best when it streamlines everything from accurate employee time tracking (from shift workers to salary employees to when your team takes paid time off) to issuing additional earnings (bonuses, commissions, reimbursements, etc.). Otherwise, you’re depositing the wrong amount via direct deposit, creating a headache for you and your employees.

In this post, we take a close look at 5 different payroll software with direct deposit — and other key payroll processing features — including our software, Buddy Punch.

Buddy Punch:

- Automatically tracks all regular work hours and paid time off, and syncs that info into Buddy Punch’s payroll system.

- Sends earnings via direct deposits to your staff, with pay stubs that can be accessed by employees at any time. You can choose 2-day or 4-day payroll processing.

- Handles time off requests, tax filings, accruals, and more.

- Improves employee accountability and accurate time tracking with advanced clock-in and clock-out features such as geofencing, IP Address locking, and Photos on Punch.

If you want to learn more about Buddy Punch, you can:

Keep reading to learn more about Buddy Punch and other payroll software options.

5 Best Payroll Software with Direct Deposit

1. Buddy Punch

Here’s a brief rundown of how you can use Buddy Punch’s payroll system and set up direct deposit.

1. Your team sets up their Buddy Punch account and adds their banking information. This is where they’ll be able to see their pay stub, how much they earned in a specific period (and for the year to date), and any additional earnings on their check. Plus, they’ll be able to see their updated PTO balance, put in any new PTO requests, and see any approved time off they have coming up.

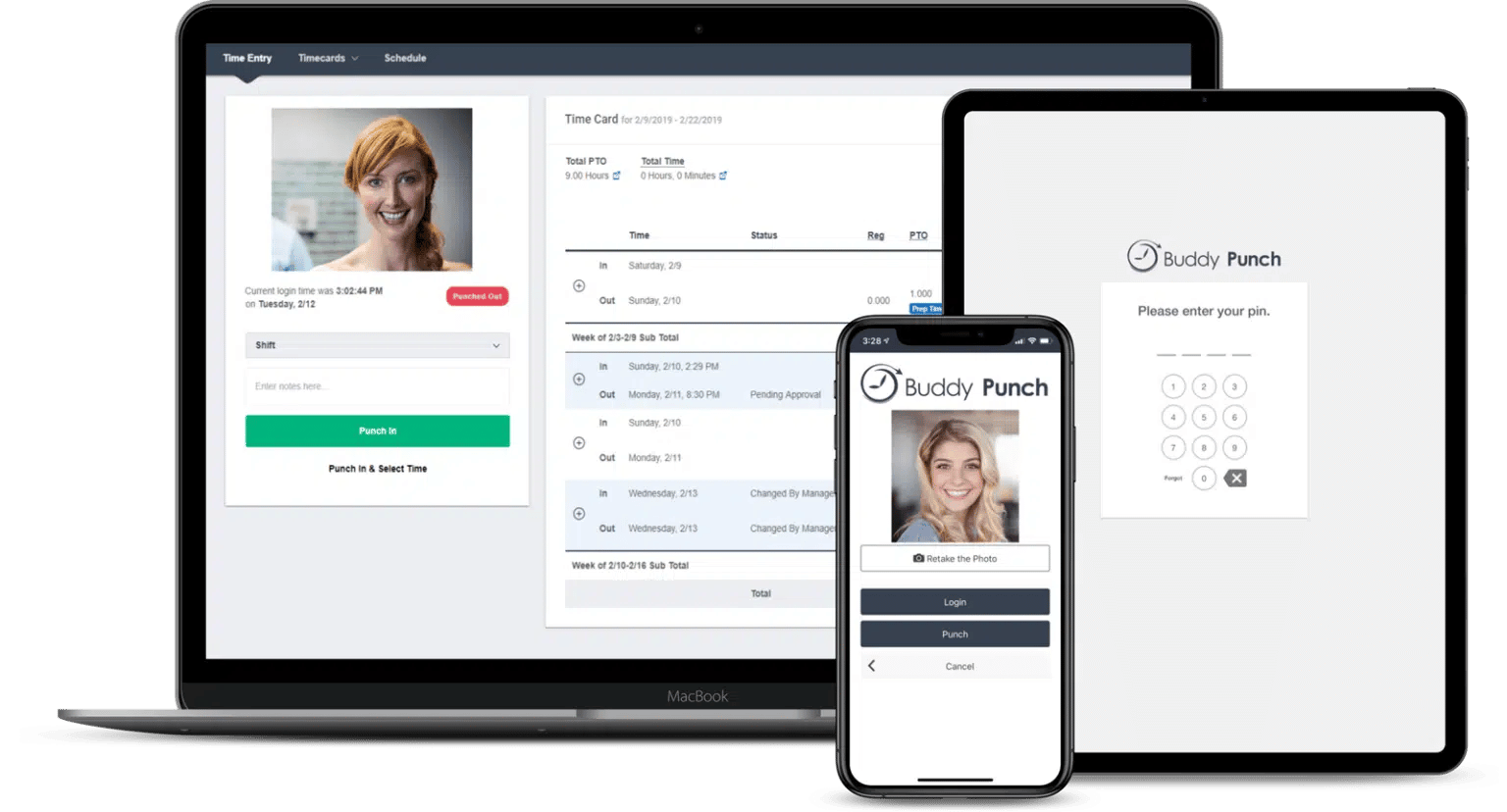

Buddy Punch is an easy-to-use, web-based payroll software. You and your team can access Buddy Punch from a computer browser, or through a smartphone or tablet.

2. All time worked and paid time off (PTO) is tracked by Buddy Punch. Buddy Punch can track shift workers, remote workers, salary employees, freelancers, contractors, and more. Buddy Punch is also a PTO Tracking software, so your team can get paid for their holidays without you having to use different software to track when someone is on vacation.

3. You can easily edit your team’s time-tracking records before submitting payroll. This includes fixing mis-punches (i.e., someone clocked in for work but forgot to clock out), adding overtime, adding additional PTO time to someone’s paycheck, etc.

4. You can add additional earnings to your payroll, such as bonuses, commissions, reimbursement, tips, etc.

5. Payroll is submitted directly through Buddy Punch. This means you’re only using one tool (Buddy Punch) to track all employee time info and issue direct deposit payments. This makes it easy to reconcile your time-tracking records with your payroll.

Note: You can choose 2-day or 4-day payroll processing. For example, if you choose 2-day processing and want your employees paid on a Friday, then you will submit your payroll no later than 2 days prior.

That’s a very high-level overview of how our payroll software works. We know changing your payroll process is a big step. If you want to see more specifically how Buddy Punch can be your all-in-one payroll provider, schedule a free one-on-one demo.

Keep reading to learn more about our payroll software features.

How to Run Payroll with Buddy Punch

Step 1: Use the Buddy Punch Payroll dashboard to review all regular employee hours, time off, preferred payment methods, gross and net pay, and more. (You can also set up auto-pay and review payroll only when necessary.)

Step 2: Edit your team’s payroll information (if needed). Because Buddy Punch also tracks time off and PTO, most issues will have been addressed before you go to run payroll. That being said, maybe an employee forgot to add a PTO day to their pay period, or maybe you’re paying out travel per diems to your on-the-road team. No matter the reason, it’s easy to jump into individual employee time cards to make edits to time tracked and earnings to be paid out.

Step 3: Submit all this information by simply clicking the blue “Submit payroll” button, and allow us to take care of the rest, which includes:

- Sending out direct deposits to staff and offering a self-service option where they can access their own pay stubs and tax information at any time.

- Handling everything you need for state tax and federal taxes, such as filings and payments.

Next, we look at some of the Buddy Punch features that help keep your payroll accurate.

How to Keep Accurate Accurate Payroll

In this section, we look at how you can:

- Ensure accurate time clock behavior

- Edit employee time cards

- Add PTO

- Add additional earnings

Combined, all of these features help make sure your payroll is accurate and ready to submit, so your team’s earnings get issued correctly via direct deposit.

Ensure Accurate Time Clock Behavior

Buddy Punch offers a variety of accountability features that help keep your employees honest when they clock in. All of our accountability features are completely optional, and to be used at your discretion.

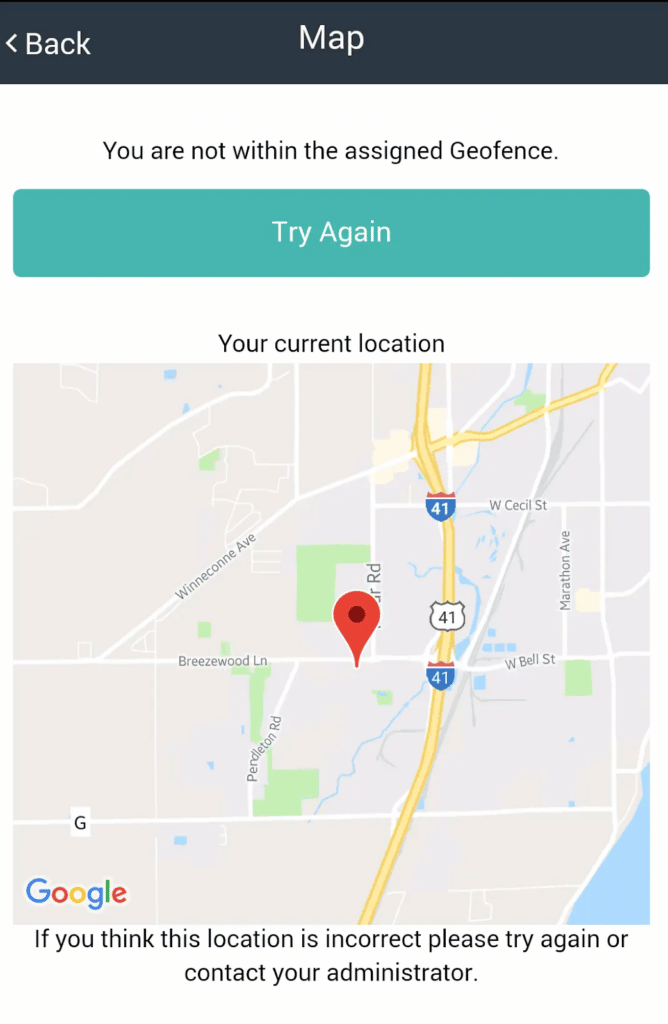

Use Buddy Punch’s geofencing feature to designate a particular radius, or geofence, around a particular location (for example, within 500 feet of your business location).

If an employee attempts to punch in outside of the preset geofence, they will be asked to try again in the right location.

This prevents time theft by ensuring your staff clock in only when they actually arrive to work.

Buddy Punch also allows you to set multiple geofences and punch locations, depending on what makes the most sense for your business.

IP Address locking is another useful way in which you can centralize your punch location.

If your business has a WiFi network that every employee can connect to, you can then designate that network’s IP address as the only one that can be used for clocking in and out.

Similarly, if you have a central device (such as a tablet or computer), you can use IP Address locking to restrict punches only to this particular device.

You can also increase employee accountability without restricting punches by location. Use Photos on Punch to require a photo from staff whenever they clock in, which includes a clear image of their face and surrounding background.

Administrators can easily review these photos within the Buddy Punch dashboard.

These were just a few of Buddy Punch’s many accountability features, and you can see a full list on our website, which includes GPS Tracking, Facial Recognition Punching, PIN Punching, Punch Limiting Rules, and more.

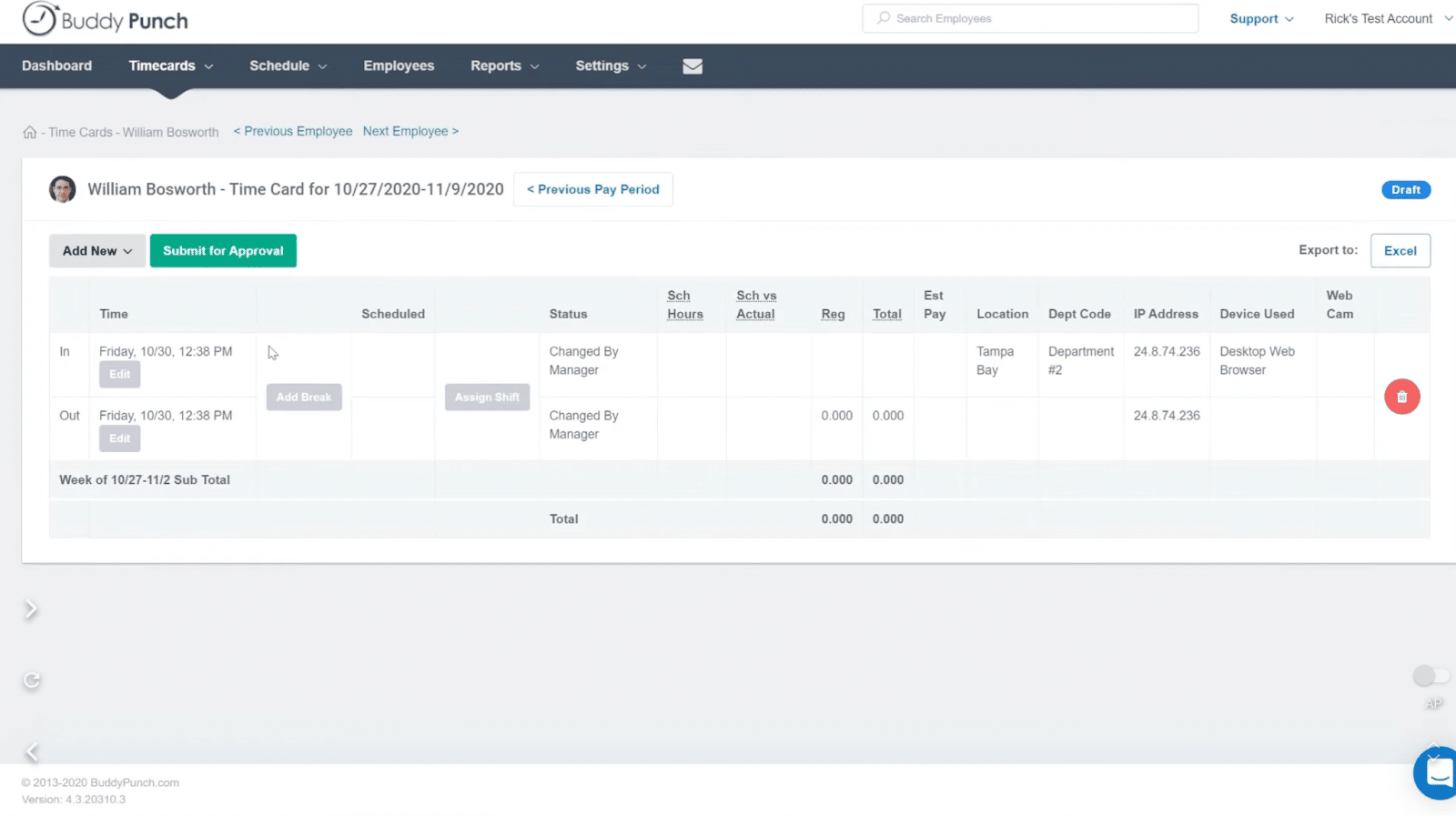

Edit an Employee Time Cards

You can easily access and edit any employee’s time card. This is perfect because you don’t need to juggle two platforms (one for time tracking and one for payroll).

Instead, just go to “Timecards” and click on “View all”.

Then click on the employee whose time card you want to view.

Here you can edit their punches, including adding breaks or a clock out period.

Once your timecards are updated, you can run payroll, and your team will get paid the correct amount.

Add/Approve PTO

When it comes time to take paid time off — whether a holiday or a sick day or some other leave type — your employees will input their request within Buddy Punch.

You can set it up so that PTO requests are automatically approved (as long as your team has the appropriate PTO balance and their request doesn’t fall on any restricted dates) or you can set it up so that every request requires manager approval.

You can also go into an employee profile and update PTO balance or add a PTO day to their current pay period.

For more information on PTO tracking, including setting up accruals and putting in a time off request, see our page dedicated to paid time off tracking.

Add Additional Earnings

Finally, you can add additional earnings to your payroll, such as reimbursements, bonuses, tips, and more.

This is easier than issuing single payouts in addition to your regularly scheduled payroll. Now you and your employees can accurately record all expenses/earnings.

When running payroll, just click on “+ Additional Earnings” next to an employee’s name.

Here you can put in the additional earnings amount that you want to add to their deposit. You can also list the category and what the additional pay is for.

Check Out all of Buddy Punch’s Features

Above we looked at how you can use Buddy Punch’s payroll software to set up direct deposit with your team and get everyone paid accurately and on time, all while adhering to local, state, and federal tax filing regulations.

Buddy Punch has even more payroll and time tracking features that were not covered in this article. See a comprehensive list here, which includes but is not limited to:

- Employee Scheduling

- Overtime Calculations

- Job Codes / Project Tracking

- Time Card Approvals

- Multiple Punch and Login Options

- Adding, Editing, or Deleting Punches

- And more

Online Reviews (Pulled from Capterra)

At the time of writing this article, Buddy Punch has 4.8 out of 5 stars on Capterra (a popular software review site) with over 750 reviews.

Here are just some of the reviews left by customers:

“This tool has vastly improved my ability to manage timesheets and payroll for my company..”

Click here to read the full review.

“Buddy Punch has streamlined the clock-in/clock-out system for the firm I work for. Previous employers used different systems for timekeeping and they always seemed to cause more of an issue at the end of the month when billing and payroll would hit.”

Click here to read the full review.

“In running payroll, since employees will punch in, be able to track their time as well as PTO in one place; this saves me time on my end. I simply run a report at pay period end to access a summary for each employee.”

Click here to read the full review.

“Whether we have two or ten employees, Buddy Bunch’s Time Tracking, Vacation/ Leave Tracking, and Analytics features are most helpful with bi-weekly payroll. Buddy Punch has never failed to assist me with those annoying payroll problems that interrupt workflow.”

Click here to read the full review.

“The team is responsive, and eager to assist. Any questions we’ve had, whether using the free trial, or after we signed up as a customer, have been answered quickly”.

Click here to read the full review.

“The software is straightforward and well-run, and was easily understood by our team of 55+ non-technical staff of all ages.”

Click here to read the full review.

- Click here to see the full list of Buddy Punch’s Capterra reviews.

- Click here to check out the Buddy Punch website.

- Click here to schedule a free one-on-one demo.

2. QuickBooks Payroll

QuickBooks Payroll is a full-service payroll software that offers a variety of features and functionality, including:

As of this writing date, Quickbooks Payroll has 4.5 out of 5 stars on Capterra with over 750 reviews.

“I liked the interface when running payroll – the way the program is setup when you are running payroll (and commissions), it allows you to pick and choose what is being paid. For example, if you pay Health Insurance stipend only once/month, you have the option to just “check the box” to add that to your paychecks that week.”

Click here to read the full review.

3. Paychex

Paychex offers a variety of features and functionality, including:

- Payroll processing and a variety of data syncing options

- Tax filing and payment

- Direct deposit

- Ability for employees to verify their paychecks before they are sent out

- And more

As of this writing date, Paychex has 4.1 out of 5 stars on Capterra with over 1300 reviews.

“I enjoy using Paychex Flex because it is simple to use and provides me with all the information I need to know about my payroll and employees. I can easily access my payroll information and run reports. The customer service is also excellent and they are always available to help me with any questions I have.”

Click here to read the full review.

4. ADP

ADP offers a variety of features and functionality, including:

- Payroll services, which includes tax support and digital payments

- Regular hours and time off tracking

- Time clock system

- And more

As of this writing date, ADP has 4.4 out of 5 stars on Capterra with over 6,000 reviews.

“User friendly application, easy to access all hr services and payroll services, User interface is so easy to understand, tax related all queries has already updated no worry which companies had this application.”

Click here to read the full review.

5. Gusto

Gusto is a payroll solution that offers a variety of features and functionality, including:

- Built in payroll integration

- Tax filings

- Easy access to pay stubs and direct deposit

- Time tracking tools

- And more

As of this writing date, Gusto has 4.6 out of 5 stars on Capterra with almost 4,000 reviews.

“This software has been of great importance for our business in managing payroll as well as other HR services. We implemented this software as we hit 9 employees as we were having issues relating to payroll receiving several complaints from our employees. The complaints have reduced drastically as soon as we implemented Gusto, which hence resulted in time as well as cost savings as well as more satisfied employees.”

Click here to read the full review.

See Why Buddy Punch is the Best Payroll Software with Direct Deposit

Visit our site to see if Buddy Punch is right for you. You can also:

For more information about our payroll software and time tracking, check out these posts:

- Buddy Punch’s pricing plans (with options for different sized businesses)

- Common problems that are hurting your small business

- 5 accounting software options for accountants

- An overview of payroll taxes

- Time saving tips for small business owners

- Best cloud-based time clock software

- More information on how Buddy Punch handles small business payroll

- An online database of our customer support tutorials