How to Do Payroll Yourself in 9 Steps (+ A Better Method)

Learn how to do payroll yourself in 9 steps, read about the pros and cons of running payroll manually, and discover an easier way to do payroll.

Many small business owners want to save money on payroll by doing it themselves but don’t know where to start. In this article, we’ll go over a nine-step guide on how to do payroll yourself, covering gathering W-4 forms, consulting employee timesheets, creating a payroll schedule, calculating gross and net pay, making tax payments, paying your employees, and filing payroll forms.

The pros and cons of doing payroll yourself

Before we share the required steps, let’s take a closer look at the pros and cons of doing payroll yourself.

- Pro: You’re not paying for software or an accountant. Doing payroll yourself can be a good move if you’re a small business owner who wants to keep funds earmarked for other expenses. As long as you keep good records, can do basic math, and are confident in navigating local, state, and federal tax laws, doing your own payroll can be a money-saver.

- Con: Doing payroll manually is time consuming. One of the biggest trade-offs of doing payroll yourself is time. Gathering necessary records, running calculations, and filing taxes is a cumbersome process, particularly if it’s your first time running your own payroll. In many cases, the cost of the time you spend is greater than the expense of outsourcing payroll or using payroll software like Buddy Punch.

- Con: Manually running payroll has a higher risk of human error and legal liability. When calculating payroll, one misplaced number can be costly. Having to redo an employee’s paycheck is a hassle, but filing your taxes incorrectly can get you in trouble with the IRS. Expert accountants are far less likely to make such mistakes, and payroll programs like Buddy Punch remove the risk of human error.

How to do payroll yourself: 9-step process

The number of things you need to keep track of when doing business payroll yourself can make the whole process feel overwhelming. For some people, it helps to think of doing payroll as three distinct phases: rounding up necessary forms and information, actually calculating employee wages, and submitting payments and tax forms to the appropriate people.

To make it easier to do payroll yourself, follow this step-by-step guide.

1. Gather W-4 forms and your EIN

Employees need to complete form W-4, a document that helps keep track of personal allowances. The more allowances workers have, the less taxes are taken out of their paycheck. If you’re missing any of your workers’ W-4s, you’ll need them to fill it out before you can process their payroll (and always make sure you give this form to new hires!). Note: freelancers and independent contractors will need a form W-9 instead.

You’ll also need to have a federal Employer Identification Number (EIN) ready. This is like an social security number for your business and is used by the Internal Revenue Service to identify a business entity. You may also need to get a state EIN number in order to file taxes in your state.

Keeping track of employee information manually can be tricky, which is why Buddy Punch has a documents tab to keep all your tax paperwork in one place.

2. Calculate employees’ hours

To know how much to pay your employees, you need to know how many hours they’ve worked. This is true even for non-exempt salaried employees; you’ll need to consult their timesheets to determine whether they’re legally entitled to overtime pay.

You can use timesheet software to let your employees track their hours on a computer or app. Or you can try using physical timesheets, like a downloadable timesheet template.

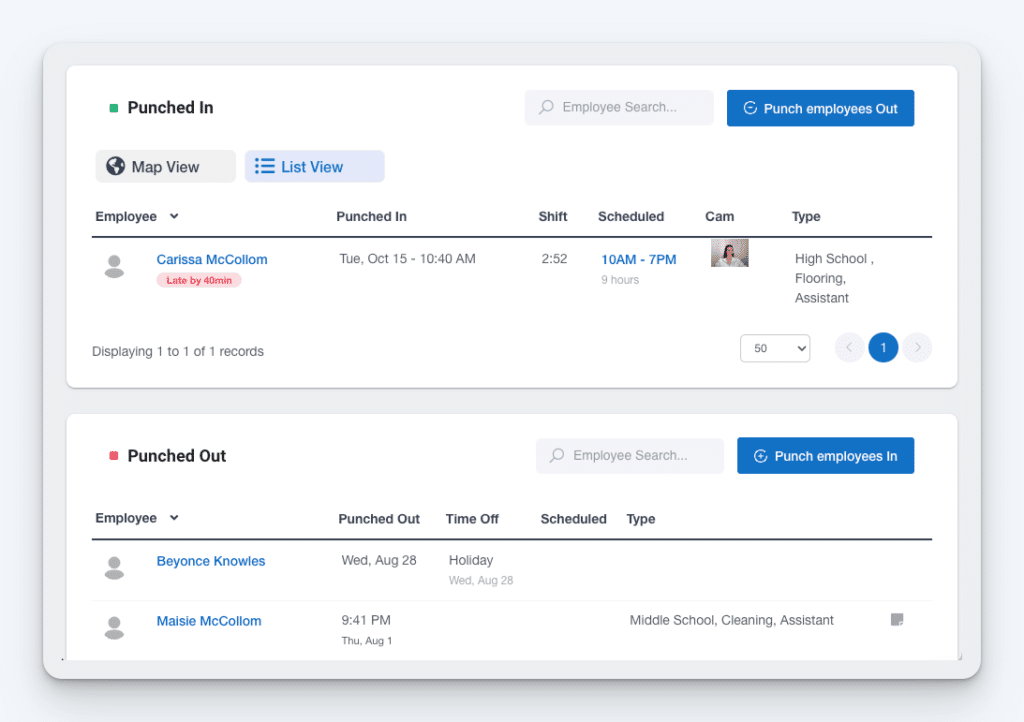

One of the most frustrating parts of manually doing your own payroll is gathering up your team’s timesheets, calculating their total hours and pay, and inputting that data into your payroll system. You can save yourself time and headaches by using Buddy Punch for time tracking.

3. Decide on your pay periods

Before you can calculate payroll, you must decide how often you’ll pay your employees. Businesses commonly compensate their workers on a weekly, biweekly, semi-monthly, or monthly basis. When choosing a schedule, keep in mind you’ll need to run payroll on the same interval as the pay period. Also be sure to account for employee pay dates, tax filing deadlines, and tax payment due dates.

4. Calculate base pay

For hourly employees, gross pay is their wage rate times their hours. For example, if you pay on a biweekly schedule, your employees receive a pay rate of $20 per hour, and an employee worked 80 hours during those two weeks, that employee’s base pay is $1600.

If employees are salaried, their base pay is the portion of their salary due for the pay period in question. Let’s assume a biweekly schedule. If an employee’s salary is $24,000 a year, you divide that amount by the number of pay periods in a year (26 for a bi-weekly pay schedule) to determine their pay ($923.08).

Buddy Punch automatically calculates employees’ regular hours, overtime hours, and total pay for you so you don’t have to do manual calculations. Then, you can run payroll through Buddy Punch itself or integrate with 17 payroll providers like QuickBooks, ADP, Gusto, and more.

Related: The Best Payroll and Timekeeping Software

5. Add in overtime, PTO, and any additional pay

Once you have employees’ base pay, you’ll need to incorporate additional earnings such as overtime, paid time off, and any other tips, commissions, or bonuses. For overtime, you’ll need to consult state and federal laws; for a more complete guide, consult our article on how to calculate overtime pay.

For paid time off, check your records for workers’ approved time off and add that time to their total hours. Next, add any any additional pay they receive: tips, commissions, or bonuses.

If your employees receive compensation in the form of tips, these are legally considered a portion of their base pay in the U.S. Therefore, you need to keep track of your employees’ tips. Learn more in our guide covering how to calculate wages.

When you use Buddy Punch, overtime and paid time off are factored into your team’s pay automatically. You can also add additional earnings like bonuses or commissions before submitting payroll.

6. Calculate net pay

To determine an employees’ net pay (or their take-home pay), you need to calculate tax deductions — federal, state, local, and FICA (social security and Medicare) — and remove those amounts from their gross pay. You may also need to remove any voluntary deductions, such as health insurance, flexible savings accounts, and money for retirement plans.

If you need guidance on tax withholdings and tax rates, consult the IRS and your state and local revenue services.

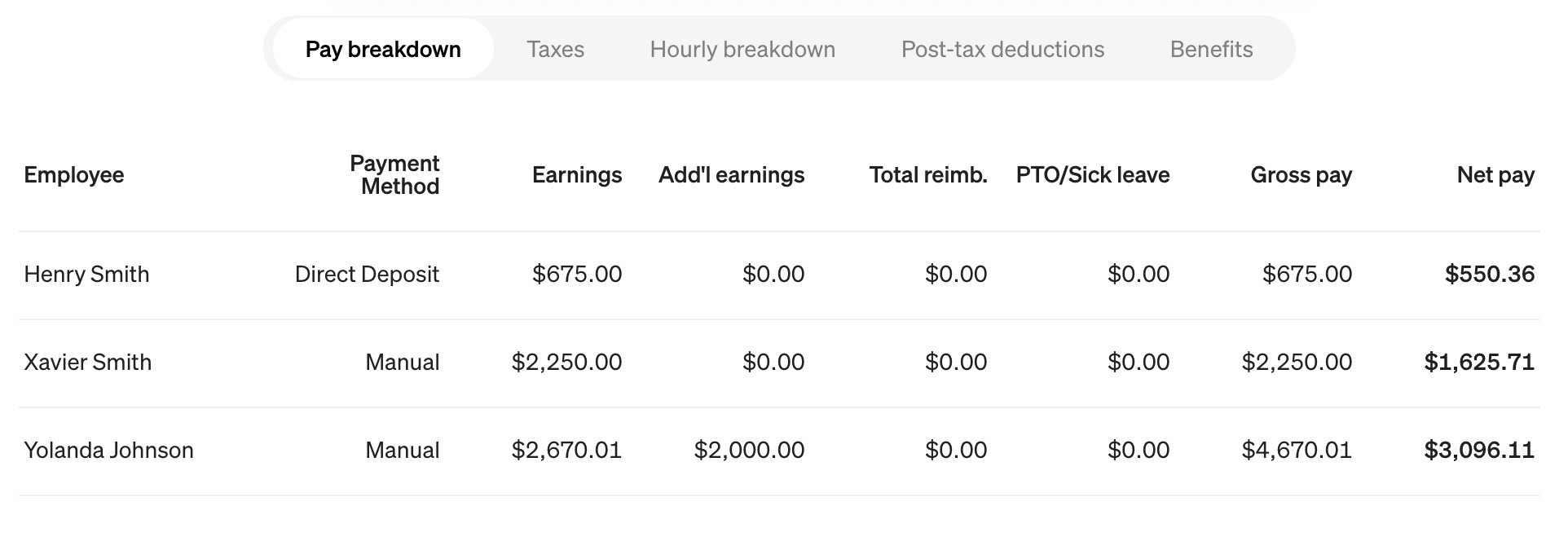

Buddy Punch handles all tax withholdings for you and your team, including local, state, and federal taxes. Your employees and independent contractors can log into their self-service portal and see their paystubs and tax documents like 1099s and W-2s.

7. Plan for and make tax payments

Once you’ve calculated your tax withholdings, you need to ensure the money withheld goes to the appropriate agency. Depending on the tax, you may either send the money immediately or set it aside, only withdrawing the tax deposits from your bank account closer to the payment deadline. Consult the guidelines of the corresponding agency for more detailed instructions on how to handle tax payments.

8. Pay your employees

When you pay employees, consider what payment methods you can offer. Examples include direct deposit, checks, or wire transfers. If you offer more than one, be sure to send their compensation by their preferred method. You also should send employees a copy of their paystubs even if you’re paying them electronically.

Buddy Punch allows employees to use their self-service portal to opt in to automatic direct deposits to get their paychecks deposited directly into their bank accounts.

Related: How to Set Up Direct Deposit for Employees

9. File payroll reports

Once you’ve filed or set aside withholdings and paid your employees, you’ll need to file payroll reports with the Internal Revenue Service (IRS) and the Social Security Administration (SSA). Both for logistical reasons and in the case that you’re audited by one of these agencies, retain all payroll records and proof of your filing status for at least three years.

Doing payroll yourself is easier with Buddy Punch

Buddy Punch is an all-in-one platform for payroll, time tracking, and scheduling. Employees use it to clock into and out of work (via a computer, tablet, or mobile phone). Their hours are compiled into timesheets with regular hours, overtime hours, and pay automatically calculated for you. Buddy Punch also offers PTO tracking and calculates PTO accruals. Any taken PTO is automatically added to employees’ timesheets.

All of this information gets directly imported into Buddy Punch’s payroll feature, allowing for accurate and efficient calculation of wages, withholdings, and take-home pay. Once you approve payroll, Buddy Punch automatically generates the proper tax forms and releases payments to employees. And if you’d rather use a payroll service, Buddy Punch integrates with other leading payroll providers.

Learn more about Buddy Punch

- Start a free trial — no credit card required

- View pricing

- Watch a video demo

- Take an interactive product tour

- Request a personalized demo

Other ways to do payroll

As a business, you have four options when it comes to doing payroll:

- You can do it yourself using the step-by-step process we walked through above.

- You can use payroll software like Buddy Punch to automate the process of running payroll.

- You can hire an accountant (either an employee or independent contractor) to do payroll for you.

- You can outsource the work to a third-party service.

Each of these options offers its own set of advantages and disadvantages, so the best way to decide is to experiment with the different methods to find the one that works best for your business.