Time Clock Rounding: Best Practices and Rules to Follow

Time clock rounding is helpful if all of your employees clock in and out at a kiosk. Here’s how to do it legally and some best practices to follow.

Time clock rounding is a practice where employee clock in and clock out times are adjusted to the nearest designated increment — usually 5, 10, or 15 minutes. For example, if an employee clocks in at 8:03 and the company uses 15-minute rounding, their time may be rounded back to 8:00 or forward to 8:15, depending on the rounding method used.

Time clock rounding is usually done to simplify payroll calculations, but it can also be helpful for businesses that have a kiosk all employees use to clock in and out. Instead of employees not getting paid for minutes when they were standing in line — or getting paid extra to stand in line at the end of the day — you can round their timestamps up or down as needed to account for the time they actually spent working.

However, when done improperly, time clock rounding can become a form of wage theft that leaves business owners open to lawsuits. In this article, we’ll aim to help you avoid those situations by sharing the rules you have to follow when rounding timestamps and some best practices you should implement to do it right.

Want to automatically round employee punches? Buddy Punch’s time tracking software comes with a punch rounding feature that lets you choose the increments you want to round up or down to, then it automatically rounds all real-time employee punches based on those rules.

Is time clock rounding legal?

Within the U.S., time clock rounding is legal as long as it meets the following two criteria under the Fair Labor Standards Act (FLSA):

- Punches can’t be rounded in significant increments, i.e., any increment that’s greater than 15 minutes.

- Timesheet rounding must have a neutral or favorable impact on employees. For example, employers can’t round timestamps up when employees clock in and round them down when they clock out, as this would have a negative overall impact on employee wages.

Some states within the U.S. also have additional laws related to time clock rounding. For example, while it’s legal in California, the state generally discourages the practice when business owners are able to track employee time with greater accuracy than 15-minute intervals (like with an employee time tracking app).

The logic is that if employers can track the exact time down to the minute, employees should be compensated with the same level of precision. Therefore, it’s important to keep informed about all pertinent local and state regulations in addition to federal ones when you’re decide whether or not to implement time clock rounding. Consult with an employment attorney to learn more about the laws in your location.

Methods for time clock rounding

When you implement time clock rounding, you must be both consistent and specific with how punches get rounded, which means settling on a standard time clock rounding rule. Here are three common methods:

1. The 15-minute rule

With this method, punch times get rounded to the nearest quarter hour.

The 15-minute rule is also called the 7-minute rule or the 7/8 rule because the breakpoints — the point in time before which times are rounded down and after which times are rounded up — fall at the 7 and 8 minute marks. In other words, a clock in time of 9:07 would get rounded to 9:00, while a clock in time of 9:08 would get rounded to 9:15.

2. The 6-minute rule

Under the 6-minute Rule, times get rounded to the nearest 6-minute mark (i.e., tenth of an hour). Here’s an example of the increments for sign-ins between the hours of 9 and 10:

- 9:00

- 9:06

- 9:12

- 9:18

- 9:24

- 9:30

- 9:36

- 9:42

- 9:48

- 9:54

- 10:00

So a clock in time of 9:07 or 9:08 would get rounded to 9:06, but 9:09 could get rounded to 9:12.

While this method doesn’t result in multiples of five like the other two rules, it does take advantage of the sixty-minute hour being a factor of six. It does, however, mean the three-minute breakpoint could be rounded either way, necessitating a policy decision for handling breakpoint rounding.

3. The 5-minute rule

The 5-minute rule is arguably the most intuitive in that punch times get rounded to the nearest 5-minute mark. For example, a start time of 9:07 would get rounded to 9:05, while a start time of 9:08 would get rounded to 9:10.

Time clock rounding best practices

Your time clock rounding process will be more successful if you follow the best practices listed below.

Have a simple, standard policy

While having a standard policy might seem obvious, it’s often tempting to experiment with different rules to figure out which one you like best. However, this will result in confused employees and a lot of questions about why hours are different from punch timestamps.

Make sure your policy results in neutral or positive effects on employee pay

In addition to being required by federal law, fair policies are a critical component of employee satisfaction. Planning ahead is the best way to ensure your rounding practices are equitable both in theory and in practice. Considerations for ensuring fairness include:

- Any unavoidable barriers to clocking in or out in a timely fashion (e.g., a line to use a physical time clock every morning).

- Whether to use the same rounding rule for clocking in and clocking out.

- The direction of rounding (i.e., up or down) with regards to arriving at and leaving work.

Be transparent about your policy

Ensuring your employees know and understand your time clock rounding policy has two beneficial effects: It increases compliance with the policy, and it prevents employees from assuming they’re being nickel-and-dimed. Be sure to communicate your policy to your employees in your employee handbook, and if you have a kiosk, ledger, or physical time clock, it will also help to keep a copy of the policy nearby.

Enforce your policy consistently

A rounding policy that only applies to some employees — or that’s only implemented some of the time — results in more errors and more work than not having a rounding policy at all. If you enforce your policy consistently and equitably, it will quickly become a habit for your workforce.

How to make time clock rounding easier

Buddy Punch is an employee time tracking app that offers the option to enable automatic punch rounding when workers clock in and out. This includes specifying whether punches are rounded based on clock in/out times or scheduled shift times, designating the rounding increment, setting different rounding rules for clocking in and clocking out, and customizing rounding policies by location.

For example, consider a company where Worksite 1 is an office where employees clock in from their computers and Worksite 2 is a construction site with a shared time clock kiosk. Since employees are likely to get delayed in line when punching in at Worksite 2, the punch rounding setting can be used to give these employees a grace period for clocking in.

Buddy Punch allows you to automatically round up, down, or to the nearest interval you select, ranging from 2 to 30 minutes. Here’s how you can easily set it up:

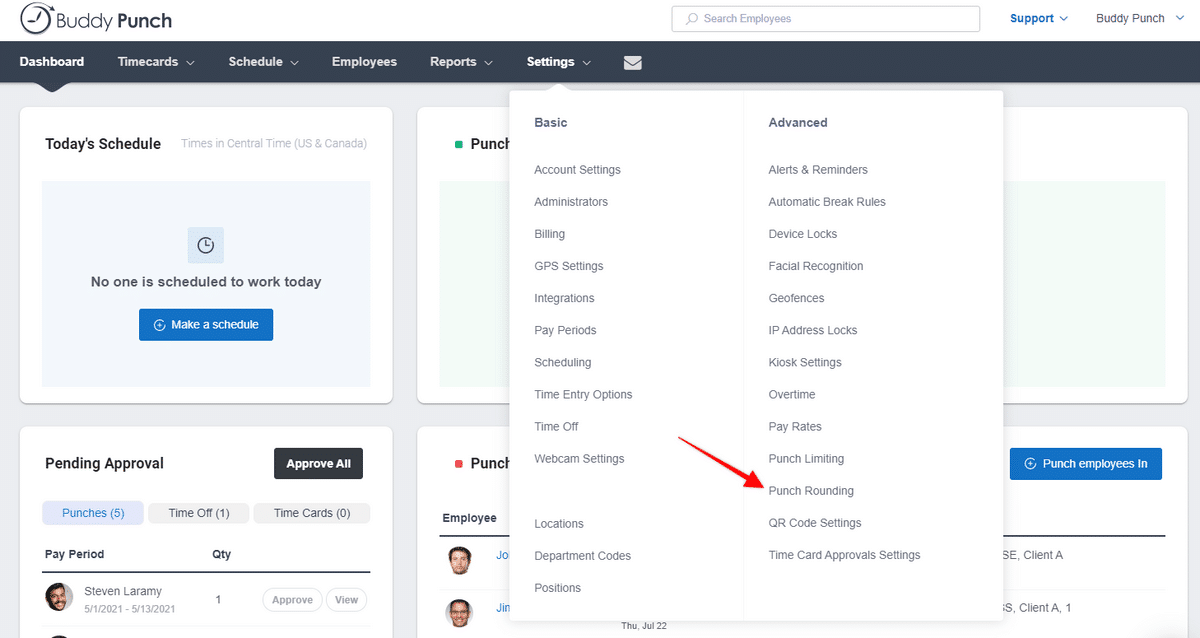

1. Click “Settings” and then “Punch Rounding.”

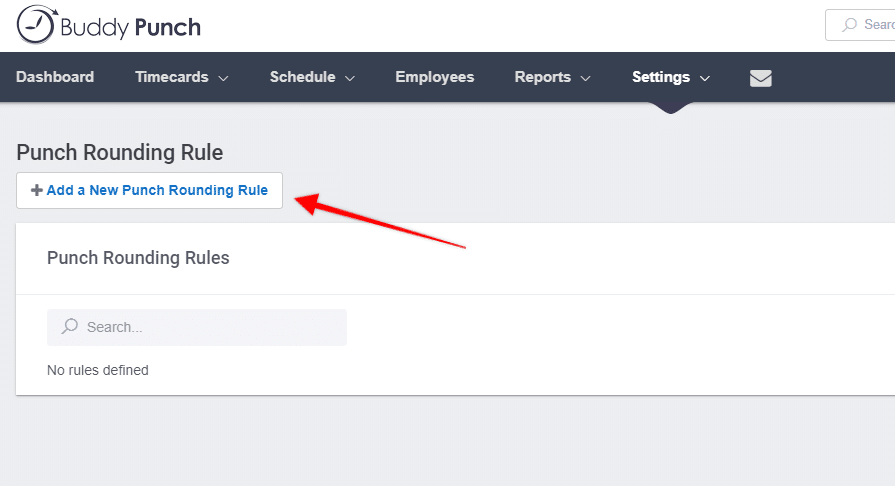

2. Click “+ Add a New Punch Rounding Rule.”

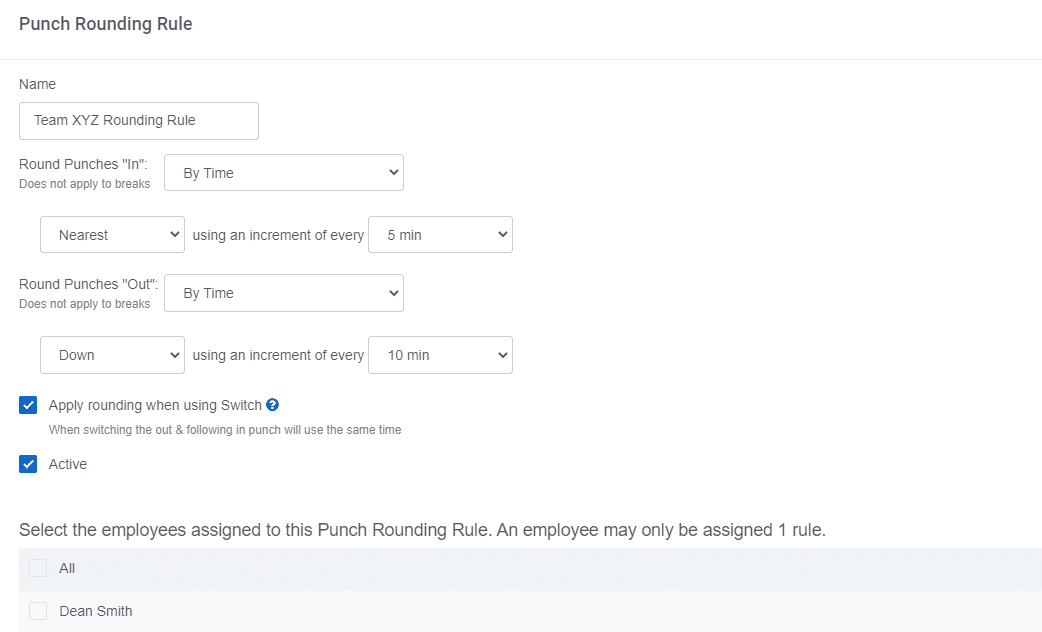

3. To have punches rounded based on time, choose the “By Time” option. You can then specify if punches will round up, down, or to the nearest increment chosen.

4. If you want punches to round when an employee uses the ‘Switch’ option (which means an employee has changed locations or job code during their shift), check the box next to “Apply rounding when using Switch.”

5. Assign the appropriate employees, and click “Save” once done.

And that’s it! Buddy Punch takes any guesswork out of rounding time for payroll. To learn more or explore the tool yourself, check out the links below.

Learn more about Buddy Punch

- Start a free trial — no credit card required

- View pricing

- Watch a video demo

- Take an interactive product tour

- Request a personalized demo