How to Calculate Wages + Free Paycheck Calculator

Learn how to calculate wages for hourly, salaried, and piece-rate employees, or use our free calculator to determine gross pay instantly.

To ensure you’re paying your employees properly, it’s important to understand how to calculate wages. In this guide, we’ll walk you through the process of calculating wages for both hourly and salaried employees, explain how to factor overtime pay into wages, provide a time card calculator you can use to calculate wages easily, and share a simpler solution for calculating employee pay.

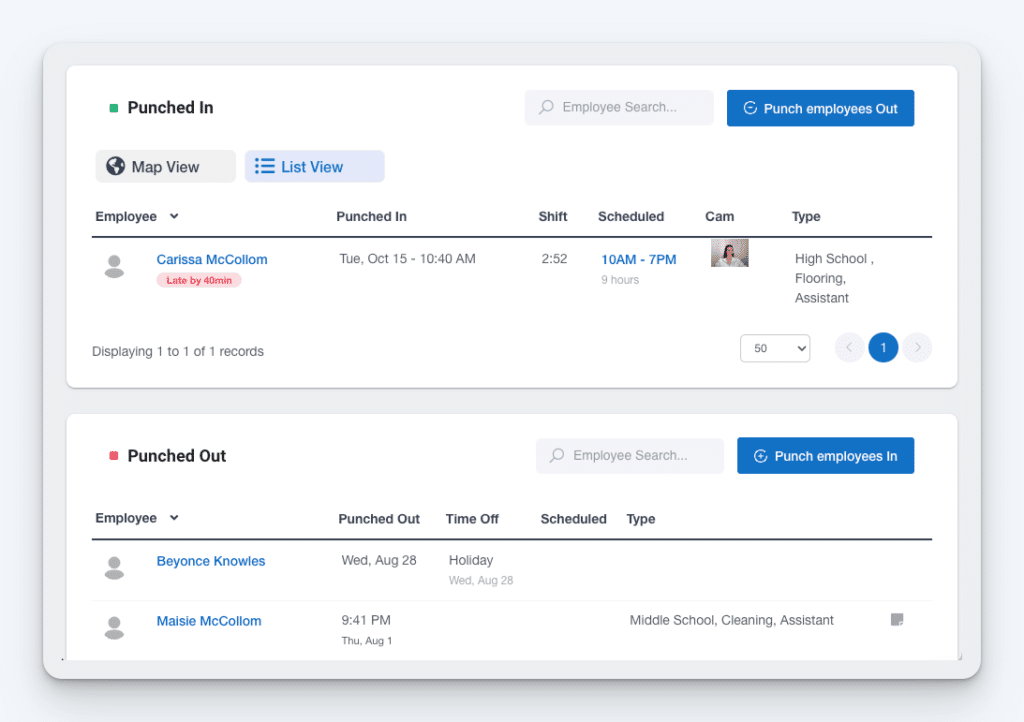

If you’re looking for a way to automate the process of calculating employee wages, check out Buddy Punch. Your employees use Buddy Punch to clock in and out of work from anywhere using a computer, on-site kiosk, or their mobile phones. The system then compiles that data into timesheets with regular hours, overtime hours, and total pay all calculated for you automatically.

What are wages?

Wages are the compensation an employee receives from an employer in exchange for work performed. Wages can be fixed (a set amount per hour) or variable (based on performance, overtime, or commissions).

How to calculate wages

The way you’ll calculate wages will depend on a number of factors, including how you pay employees (hourly rate vs. salary vs. piece-rate), if your employees work overtime, and the length of your pay periods.

How to calculate wages for hourly employees

To calculate wages for hourly employees, you multiply the number of hours worked during the pay period by the employee’s hourly pay rate.

Number of Hours Worked in Pay Period x Hourly Pay Rate = WagesFor example, if an employee makes $10 an hour and worked 40 hours over the course of your pay period, you would multiply $10 by 40 to determine their gross pay: $400.

How to factor overtime into wages

Let’s say that your employee actually worked 45 hours during your pay period, which is one week long. Five of those hours are overtime hours according to Fair Labor Standards Act (FLSA) regulations, so you’ll need to do a more complex calculation to determine their wages.

You start by calculating their regular pay just like we did in the last example: 40 of those hours are regular hours, and the employee’s regular pay rate is $10/hour, so that’s $400.

Next, you need to calculate their pay for the five overtime hours. FLSA laws state that employees must be paid at least 1.5 times their hourly rate for overtime, so you’ll start by calculating their hourly overtime rate:

Hourly Rate x 1.5 = Overtime RateIn this case, since our employee makes $10/hour, we multiply 10 by 1.5 to determine that the employee’s overtime pay rate is $15/hour.

Now, we need to calculate the employee’s overtime pay:

Number of Overtime Hours Worked in Pay Period x Overtime Pay Rate = Overtime WagesWe multiply the number of overtime hours worked (5) by the overtime pay rate ($15) to find out that the employee earned $75 in overtime pay.

Finally, we add the regular pay to the overtime pay to determine the employee’s wages for the pay period:

Regular Pay + Overtime Pay = Total WagesThe wages this employee earned for working 45 hours in our pay period is $400 + $75 = $475.

Here’s the full formula for calculating wages that include overtime hours.

(Number of Regular Hours Worked in Pay Period x Hourly Pay Rate) + (Number of Overtime Hours Worked in Pay Period x Overtime Pay Rate) = Total WagesKeep in mind

The FLSA states that employees must be paid 1.5x their hourly rate for any hours worked over 40 in a week. However, some states have more stringent overtime regulations.

For example, in California, employees must be paid 1.5x their hourly rate if they work more than eight hours in a day, and 2x their hourly rate if they work more than 12 hours in a day.

For this reason, we recommend consulting with an employment attorney to fully understand the overtime laws in your state.

How to calculate wages for salaried employees

Calculating wages for salaried employees is much simpler because their pay remains the same regardless of how many hours they worked, and as long as they’re exempt, they don’t earn overtime.

To determine a salaried employee’s wages, you take the employee’s annual salary and divide it by the number of pay periods you have in a year.

Salary / Number of Annual Pay Periods = Wages Per Pay PeriodIf you pay employees weekly, you have 52 pay periods in a year. If you pay them bi-weekly, you have 26 pay periods in a year. If you pay them semi-monthly, you have 24 pay periods in a year. And if you pay them monthly, you have 12 pay periods in a year.

Let’s say you have a salaried employee who earns $26,000/year, and you pay employees every two weeks. You would divide $26,000 by 26 to determine that the employee’s wages are $1,000 every two weeks. Those wages will stay the same throughout the year.

Keep in mind

Salaried employees can be either exempt or nonexempt. Exempt salaried employees to not earn overtime. Nonexempt salaried employees do earn overtime. The classification depends on a variety of factors, including the employee’s pay rate, role, and responsibilities.

For this reason, we recommend consulting with an employment attorney to determine if your salaried employees are exempt or non exempt.

How to calculate wages for piece-rate employees

In some industries, such as manufacturing, farming, construction, and transportation, employees are paid according to the amount of work produced rather than hourly. For these employees, you multiply the number of pieces produced during a pay period by the per-piece pay rate:

Number of Pieces Produced x Per-Piece Pay Rate = WagesFor example, say an employee earns $200 per piece of work produced, and over the course of a pay period, they completed 10 units. You’d multiply $200 by 10 to get their wages: $2,000.

Keep in mind

Even if employees are paid per piece, you still have to pay them overtime if they work more than 40 hours per week (or whatever overtime laws you’re subject to in your state), so calculating wages may be more complicated than the calculation above if employees work overtime.

To learn more about calculating overtime for your per-piece employees, check out our detailed guide on how to calculate overtime pay.

How to calculate wages for employees who earn tips, commissions, or bonuses

If your employees earn additional money outside of their hourly rate of pay — such as tips, commissions, or bonuses — those amounts also need to be included to calculate their wages. To calculate their wages, you’ll need to add any additional pay to their hourly pay:

Hourly Pay + Tips/Commissions/Bonuses = WagesFor example, say a server at your restaurant worked 40 hours in a week and earned $500 in tips. You start by calculating the employee’s hourly pay: $2.15 x 40 = $86. Next, you add in their tips: $500. Finally, you add those two amounts together to calculate their wages: $586.

Keep in mind

Employees like salespeople and servers who earn an hourly rate that’s below the federal minimum wage of $7.25/hour (or the minimum wage in your state), must have earned at least minimum wage for the hours worked during a pay period once you add in their tips, commissions, or bonuses.

Additionally, calculating overtime rates for these employees is more complicated. We recommend familiarizing yourself with the U.S. Department of Labor’s regulations to ensure your paying your tipped or commissioned employees properly, or consult with an employment attorney for more guidance.

Free wage calculator for hourly employees

If you want to avoid having to manually calculate wages for all of your employees, use the calculator below. Simply enter an employee’s hours for the week, enter their pay, and specify if overtime applies, and the calculator will calculate your employee’s gross wages for you.

| Punch In | Punch Out | Break Time | Total | |

|---|---|---|---|---|

| Monday | Punch In : | Punch Out : | Break Time : | 0.00 |

| Tuesday | Punch In : | Punch Out : | Break Time : | 0.00 |

| Wednesday | Punch In : | Punch Out : | Break Time : | 0.00 |

| Thursday | Punch In : | Punch Out : | Break Time : | 0.00 |

| Friday | Punch In : | Punch Out : | Break Time : | 0.00 |

| Saturday | Punch In : | Punch Out : | Break Time : | 0.00 |

| Sunday | Punch In : | Punch Out : | Break Time : | 0.00 |

| Total Hours: 0.00 | ||||

Gross pay vs. net pay

In the calculations above, the final numbers you arrive at are the employee’s gross pay. However, that amount will only be what you pay if the people you’re paying are independent contractors — not employees.

The key difference between independent contractors and employees is that employees work under the direct control of an employer who dictates their schedule, tasks, and how work is performed. Independent contractors, on the other hand, control how and when they work. Independent contractors are paid their full wages with no deductions removed.

What employees will actually be paid will be less due to mandatory and possibly voluntary deductions, resulting in their actual take-home pay — or net pay.

Gross Pay - Deductions = Net PayAt each pay period, employers are required to remove taxes from employees’ gross pay, including federal taxes, state taxes, FICA taxes (social security and Medicare), and possibly local taxes (depending on where your employee lives).

Employers may also need to deduct fees for voluntary benefits like insurance or retirement plans, or for other mandatory things like union dues or wage garnishments.

While determining an employee’s gross pay is relatively simple (albeit time consuming if you have lots of employees), determining an employee’s net pay is far more complicated. That’s why most employers choose to use payroll software to automate this work for them.

Related: How to Do Payroll Yourself

How Buddy Punch makes it easy to calculate wages

Buddy Punch is payroll and timekeeping software that makes it easy to track employees’ hours and run payroll. Employees simply clock in and out using any device with an internet connection — a computer, tablet, or mobile phone), and Buddy Punch automatically uses that data to create timesheets, calculate regular and overtime hours, and determine each employee’s wages.

Then, when it’s time to run payroll, Buddy Punch pushes your timesheets to payroll, removes all mandatory and voluntary deductions, and pays your employees either via direct deposit or check. It also takes care of tax filings for you and gives you the documentation you need for both IRS and FLSA requirements.

This saves you a tremendous amount of time and ensures your payroll is accurate. Plus, Buddy Punch has a ton of other features that will help you reduce your labor costs, prevent time theft, track attendance, manage paid time off, and create work schedules more quickly. See all of its features here.

Learn more about Buddy Punch

- Start a free trial — no credit card required

- View pricing

- Watch a video demo

- Take an interactive product tour

- Request a personalized demo

Calculating wages correctly is crucial

Calculating wages correctly is essential for paying employees fairly and staying compliant with labor laws. Whether you pay employees hourly, on salary, by piece-rate, or with tips and commissions, understanding the right formulas will help you determine their total earnings.

However, wage calculations can become complicated, especially when factoring in overtime and deductions. To save time and reduce errors, consider using software like Buddy Punch. It automates wage calculations, tracks employee hours, and ensures payroll is accurate — all while handling tax filings for you. Try Buddy Punch today and simplify your payroll process!