10 Tips for Managing Payroll for Small Business Owners

It’s essential for you or your Human Resources team to closely process payroll in a way that best suits your specific business needs and supports your employees. How you run payroll accounts for more than just employees getting their direct deposit on a regular basis. Given the complexities of state and federal taxes and the importance of paying your staff on time, keeping good records sets you up for success as your business grows—whether you’re bootstrapping a startup or managing a team.

In this post, we’re going to breakdown some of the most effective strategies for handling payroll – whether that means crafting an effective payroll schedule, looking into payroll services and software, or avoiding common pitfalls. With these 10 comprehensive tips, you should be equipped with a streamlined and effective strategy for dealing with your employees’ paychecks.

Note: If what you’re looking for is the absolute quickest way to simplify and streamline the payroll process, you can’t go wrong with using a tool like Buddy Punch. In addition to employee time tracking and scheduling features, our software has a built-in payroll option with powerful features such as automatic payroll tax filings and employee self-onboarding. We’re proud of what we’ve built, and over 10,000 businesses have made the switch to our software. Click here to learn more about Buddy Punch Payroll.

Tip #1 – Select appropriate payroll software

Payroll software is far from one-size-fits-all, and there are several factors at play to keep in mind while shopping around. From the varying ease of use and automation features to their customer support and updates, there are plenty of different options to choose from.

For an example of what we mean, look no further than our very own Buddy Punch. Though our software comes with payroll integrations for popular tools like QuickBooks and Gusto, it also has its own built-in payroll functionalities. This means that in addition to time tracking and employee attendance features, Buddy Punch can also be a business owner’s payroll solution, making it truly an all-in-one solution for workforce management.

Buddy Punch enables you to keep all of your employee information in one place, while using automated features such as Integrated timesheets, automatic payroll tax filings and payments, easily accessed pay stubs and tax forms, and more. All of this makes it easier to account for state taxes and local taxes.

When you take all of this into account, it’s not a surprise that Buddy Punch reviews so highly with its users. On popular software review site Capterra, Buddy Punch has earned a rating of 4.8 out of 5 stars, with 827 total reviews.

Here’s what one user had to say:

This is an easy product to use for management and employees. All aspects of payroll are at your fingertips. We handle many different project and Buddy Punch makes it easy to track the hours we’re using. Awesome product.

For other business owners, you may want to look for specific features that will help you. What do you struggle with when it comes to bookkeeping? Do you have issues with Employer tax like FICA (Federal insurance contributions act), FUTA (Federal Unemployment Tax Act), or social security taxes? Or maybe you’re dealing with wage garnishments due to a court order, and you’re not pleased with how that’s going.

Even though an all-in-one tool like Buddy Punch can streamline the payroll process for you, it’s worth looking into specific functions to handle what is plaguing you most.

Tip #2 – Create a payroll calendar

The only thing more important than the pay rate you’re offering your employees is how regular the payday occurs. Whether your pay period is are weekly, bi-weekly and semi-monthly – highly skilled, full-time employees are most concerned with their net pay. Mess this up and you might lose them – assuming you don’t make an error to the degree where the Department of Labor (DOL) might get involved.

A payroll calendar considers pay periods and can track important IRS tax filings. Knowing what is due at a particular time allows payroll managers to plan and schedule payments to the government promptly and effectively.

Using a payroll calendar also helps a business manage available funds for payroll each pay period. If you decide to DIY your payroll calendar, consider using a template to organize employee pay and tax filings.

Tip #3 – Hire a payroll administrator

The many details of Payroll information can get overwhelming. Employer identification number (the business equivalent of a social security number), tax deductions and tax withholdings like medicare tax and federal income tax, gross pay, health insurance – it can be a lot to take care of.

Some business owners prefer to save time and effort by simply outsourcing the process entirely to payroll specialists or payroll service providers, such as a professional employer organization (PEO). A payroll administrator will keep the business up to date on tax regulations and employee changes and updates. Even the onboarding of new hires can be handled by an administrator (if you use payroll software like Buddy Punch, you can enable them to create information for new employees in the software).

When hiring for this role, look for people knowledgeable about labor laws, tax liabilities, and workers’ compensation.

Knowing when to hire a payroll administrator will depend on how many employees you have and if you support remote workers. Whether you decide to outsource or do it yourself, you’ll need someone to provide quality checks on your payroll processes.

Tip #4 – Keep payroll and operating expenses in separate accounts

The adage “Don’t put all your eggs in one basket” applies to managing payroll for your small business. Keep your bank account for payroll separate from your general operating expenses. Doing so will help your accountant track transactions, keep records updated, and make it easy to file payroll taxes.

See if your current bank can add another account for payroll with no added costs. While it may appear easier to keep all of the accounts connected, you’ll have more to manage as your business grows. Start out with a payroll clearing account to maintain financial security and allocation.

Tip #5 – Never dip into payroll tax funds

There are huge implications with the IRS for not paying payroll taxes. Although some businesses may need the money to take care of other business expenses, it’s never a good idea to borrow from your business’s tax funds. One option that small business owners may consider is taking out a loan to cover miscellaneous expenses rather than using payroll funds and risk missing important tax payments.

If your company uses payroll tax funds to pay for other operations, it may be time for a business audit. Consider creating a rainy day fund for your business to discourage any payroll account dipping.

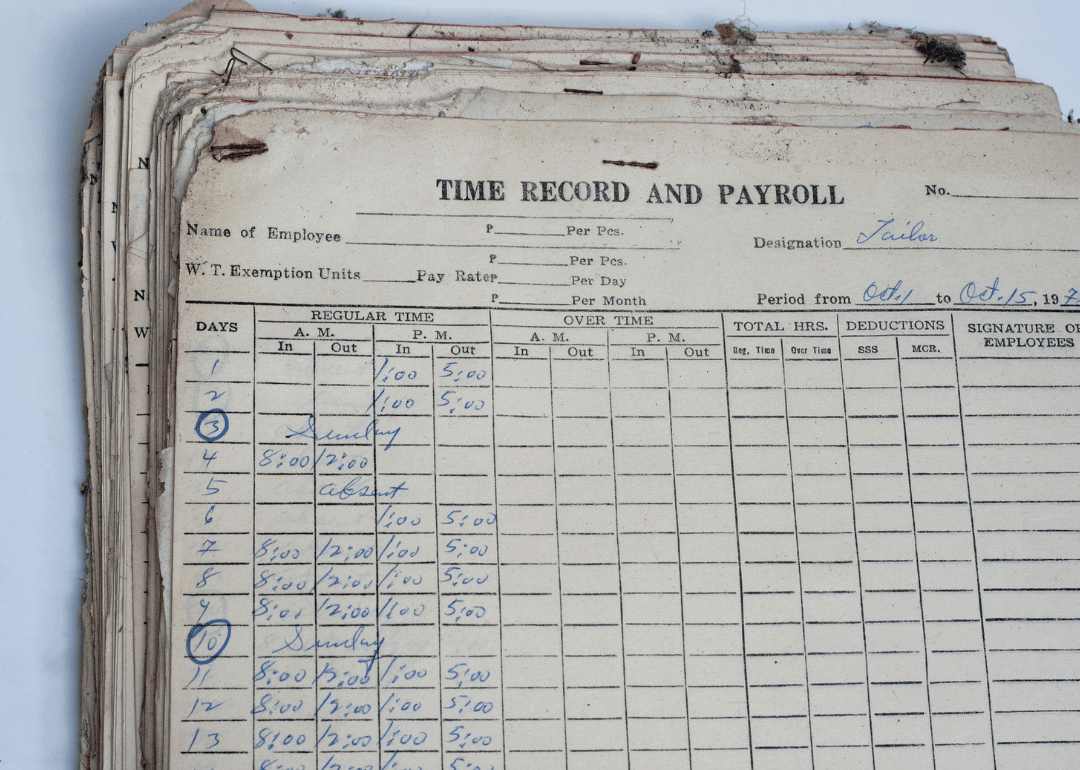

Tip #6 – Document your payroll process

Sweat the small stuff. No matter the size of your small business, keeping good record-keeping will serve your business well in the long run.

From one employee to multiple, it’s critical to keep meticulous records of employee wages and your payroll reports. The IRS expects you to maintain payroll records for at least three years. A well-documented process will help your business comply with tax laws, keep track of your employees’ pay and updates, and stay compliant with specific requirements such as:

- Tax Rates (state and federal)

- Tax Deposit Timing

- W-4 Forms

- Retirement Plans

If you are the sole employee of your business, make it a habit to record everything: This process will allow you to see the overall health of your business and allow for future planning. If you find this too time-consuming to maintain manually (through spreadsheets for example), use software.

Tip #7 – Develop a thorough timekeeping system

Setting up a good digital system to track your employees’ time is crucial in making your business more efficient. Accurate timekeeping will help with accounting and payroll records—and there are plenty of resources that make the process easier.

Some low-cost options work with other business tools to streamline the process of payroll compliance. You don’t have to keep it in-house, either. Consider outsourcing payroll timekeeping to meet the demands of your growing workforce.

Some business owners turn to use digital time clock software to automate a lot of this process. For example, our tool Buddy Punch comes with powerful time tracking features such as Job Codes, GPS Tracking, Time Card Approvals, Overtime Pay Calculations, and many more. These features not only keep your employees more accountable for the work they do on the clock, but also help ensure accuracy for the time they log. Hourly wages can be expensive – make sure the time logged on those time cards is accurate.

Tip #8 – Talk to employees about what works and what doesn’t

For young businesses, polling employee preferences can help settle certain payroll options. Some workers prefer biweekly pay periods, but others—often hourly employees—may prefer to be paid weekly. Take the opportunity to ask your employees what works for them and structure your system accordingly.

Tip #9 – Keep employee info well-organized and secure

Protecting small-business payroll data is just as important as protecting data files, and secure systems will do both. Employees can access their payroll system to update records and view pay stubs, which should be made available through payroll system training. Ensure the integrity of your business by protecting your employees’ data. Implementing a strong payroll system includes limiting who has access to sensitive employee data.

Tip #10 – Keep up with state, local, and federal payroll rules

Staying updated on payroll rules can keep your business running smoothly without the stress of audits or fines. Payroll systems will manage this for you.

For a business without the capacity or expertise to track local and federal changes, business owners should consider outsourcing this work to a contractor who can. Subscribing to local and federal mailing lists may be useful to stay abreast of new updates.

How Buddy Punch Empowers Business Owners

Now that we’ve run through the entire list of tips, you might see why our #1 advice was to find high-quality payroll software. Payroll is a complicated process with a lot of moving parts, but embracing digital solutions makes it all substantially easier. This is something we kept in mind when we designed Buddy Punch’s Built-in Payroll System to help streamline the process for small businesses and enterprises alike.

But don’t just take our word for it. Here are some of the payroll features we included in our software:

- Unlimited Payroll Runs

- Integrated Timesheets

- W-2s and 1099s

- Automated Payroll Payments

- Tax Filings

- Direct Deposit

- Printable Checks

- Employee Self-onboarding

And more.

With power like this at their fingertips, it’s no surprise that business owners come to rely on Buddy Punch’s combination of built-in payroll features in addition to time tracking and employee scheduling options. This is a powerful all-in-one software for ensuring all of your team members are compensated appropriately for their time.

Try Buddy Punch Free

If you’ve decided that Buddy Punch could be the right payroll software to streamline your payroll process, you can sign up for a 14-day free trial of Buddy Punch here. You can also book a one-on-one demo, or view a pre-recorded demo video to see Buddy Punch in action.

You May Also Like:

- The Best Employer Time Clock System: 4 Key Benefits

- 5 Best Payroll Software with Direct Deposit

- QuickBooks Time Tracker: 5 Powerful Time Clock Apps That Integrate

- Invoicing Habits: How To Meet Your Bottom Line

- How to Calculate Paid Vacation for Hourly Employees

- 10 Best Clock In Clock Out Apps for Small Businesses (2024)

- Payroll Compliance in the United States (Small Business Owner Guide)

- 8 Common Hoops to Jump Through in the Payroll Circus

- How do I calculate my salary per hour?

- 7 Best Payroll Software for Contractors in 2024