What You Need to Know About Supplemental Pay (With Examples)

Discover the different types of supplemental pay, then learn how to calculate them and why documentation matters in this expert guide.

Everyone loves payday — and especially when it involves supplemental pay such as commissions or bonuses.

But then they see the tax, and it’s way more than expected. Or worse, it pushes them into a new tax bracket. This can cause panic and lengthy questions for payroll managers while employees try to understand.

This doesn’t have to be the case. With the right approach, you can calculate and manage extra pay cleanly and accurately while keeping your employees in the loop.

In this guide, I’ll explain common types of supplemental pay and how to handle them without the hassle.

Tired of calculating supplemental pay manually? It might be time to switch to combined time tracking and payroll software like Buddy Punch. It automatically identifies overtime hours based on your policies, calculates total pay (including regular and overtime hours), and deducts the correct amounts from employees’ gross pay for all applicable withholdings.

Types of supplemental pay and what they mean for your business

Supplemental or additional pay is any pay outside of an employee’s base pay. Below, I walk through some common examples, why they can cause confusion, and how to treat them for tax purposes.

One-off payments

Payments such as bonuses, performance incentives, or severance pay count as one-off payments.

Whatever the payment is for, amounts can vary dramatically — meaning taxing them can get complicated fast. One-off payments might also force an employee into a new tax bracket.

The simplest approach to one-off payments is to use the flat 22% withholding rate. This keeps withholding consistent and helps avoid surprises in your employees’ paychecks, such as unexpectedly high or low tax deductions.

Everything else, like Social Security and Medicare, gets taxed the same.

So, for example, if an employee received a $5,000 performance bonus, it could look like this:

| Gross bonus | $5,000 |

| Federal withholding tax –22% | –$1,100 |

| Federal payroll taxes (FICA), minus Social Security at 6.2% and Medicare at 1.45% | –$382.50 |

| State tax –5% | –$250 |

| Total deductions | –$1,732.50 |

| Employee takes home | $3,267.50 |

To further reduce the risks of confusing employees, Anna Kalkman, a small business owner and consultant, suggests you have your accountant calculate the gross amount needed so that the post-tax amount matches the bonus amount you previously discussed with the employee.

“If you planned to give your employee an $800 holiday bonus, your gross amount would [need to] be $1,210 for my region,” she explains to Buddy Punch.

This method means employees don’t need to calculate how much take-home pay they’ll get; they get exactly the amount they were told, and you get fewer questions.

Commissions

While commissions and sales-based pay are great motivators, the fluctuating amount every month can create a headache for your payroll team, especially if commission periods don’t align with your payroll cycle.

As well as the risk of payroll teams accidentally duplicating payments, employees sometimes assume commission is taxed like bonuses, when it’s actually taxed like regular wages.

Further confusion can arise if it’s unclear who closed a particular deal — employees might expect commission that never materializes.

One way to keep on top of commission payments is with customer relationship management (CRM) software like Pipedrive or HubSpot. These tools track every step of the customer journey so you can see who engaged with what lead at which point.

You can then give employees one paycheck for their base pay and a separate one for commission, clearly labeling what taxes, benefits, and pension contributions they’ve paid and how much will go into their bank account.

Check out Buddy Punch’s detailed guide to learn more payroll tips for small businesses.

Overtime

Unless an employee is exempt under U.S. labor laws, overtime is anything they work over 40 hours a week (note that some areas also have their own state overtime laws). So if they worked 41 hours in a week, that final hour would be overtime.

Employees may not understand what counts as overtime, though. For instance, they might think their long commute counts.

Kasey Devine, Founder and CEO of Entravia, has a solid solution to this problem:

“Clear written policies outlining how bonuses, commissions, overtime, or shift differentials are calculated and paid are critical. So are clean payroll records that separate supplemental pay from base wages on pay statements. When employees can see exactly what type of pay they received and how it was processed, conversations become factual instead of emotional.”

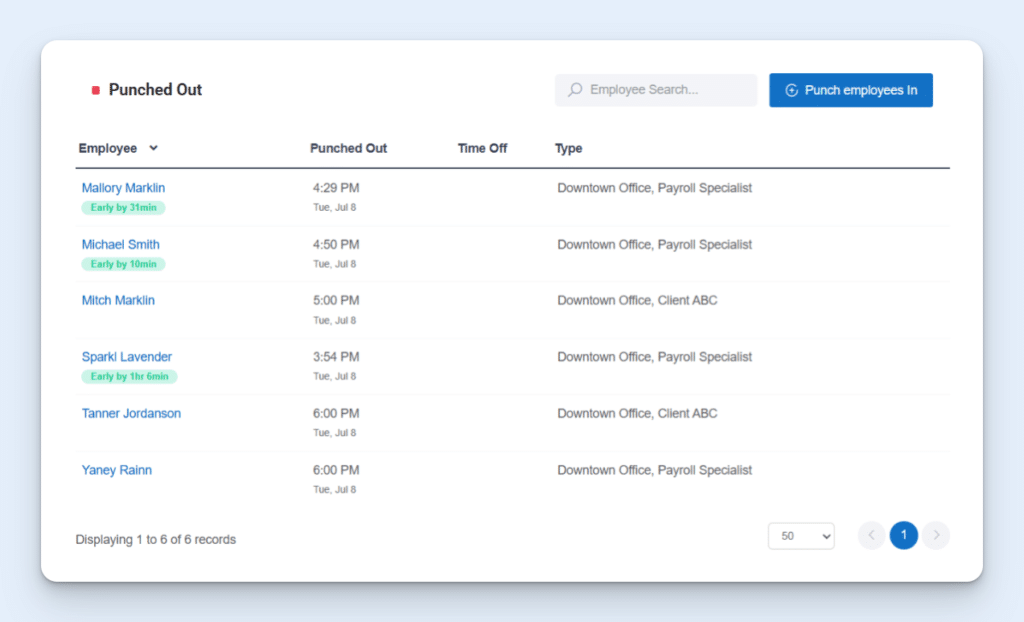

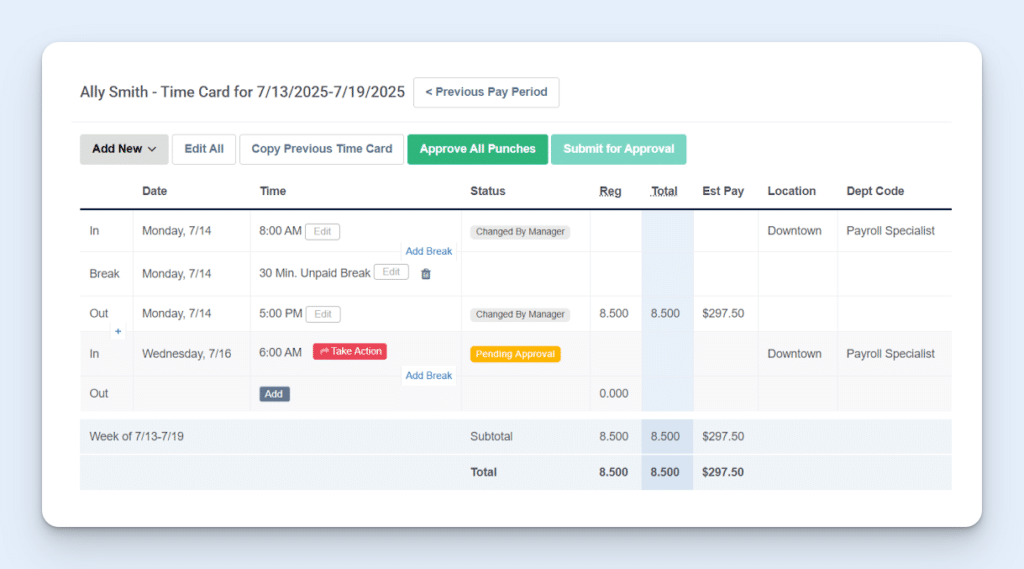

To clearly label this information, calculate overtime, and pay workers accurately, you need to track which hours were worked at their base rate and which were worked at overtime rates. A time clock app like Buddy Punch makes this easy; it records hours without rounding, ensuring employees aren’t accidentally pushed into overtime over the course of a week.

Here’s what weekly pay would look like for an employee who receives $20 an hour for regular hours and $30 an hour for overtime hours:

| Base pay: 40 hours | $800 |

| Overtime: 10 hours | $300 |

| Total, pre-tax | $1,100 |

| Withholding tax | –$132 |

| FICA | –$84.15 |

| State tax | –$55 |

| Take-home pay | $828.85 |

The more consistently you document this in advance, the more accurate your data will be and the lower your risk of errors.

Overtime tracking software like Buddy Punch automatically logs what counts as overtime and what doesn’t. And with Buddy Punch Payroll, calculations, deposits, and tax filings are handled automatically. Or you can send the data to your payroll software, such as QuickBooks, in seconds.

Shift differentials

Shift differentials are extra pay rates for employees working less desirable hours, like weekends or nights. When employees are paid hourly, and their schedules vary each week, calculating total hours — including shift differentials — along with benefits and taxes can quickly become a headache.

This is because shift differentials are taxed the same as regular wages, but because they increase gross pay, they can affect the amount of tax that needs to be withheld in a pay period. Without adequate time tracking, even calculating total hours worked can lead to long email chains, disputes, or payroll errors.

For instance, if an employee worked 10 hours in week one, 20 in week two, and 15 in week three, their earnings and tax withholding will vary each week. The larger a shift-based team grows, the longer these calculations take as payday rolls around.

Buddy Punch’s time tracking software comes in handy here as well. It logs exactly how many hours an employee has worked each week, including any differential rates. Employees can receive notifications to remind them to punch in or out, ensuring this information is tracked in real time, improving its accuracy.

Hazard pay

Hazard pay incentivizes employees to work in hazardous conditions, such as where they’re at risk of injury or sickness. It’s common in fields such as healthcare, manufacturing, or construction.

Hazard pay is usually a percentage of someone’s salary, or an additional flat rate on top, taxed at the same rate as their normal wages. If an employee encounters dangerous conditions while also working overtime, they qualify for both hazard pay and overtime.

Without clear policies, an employee who works part of a shift in a normal setting and the other half in a high-risk environment may not understand which hours qualify as hazardous. When payroll teams calculate hazard pay during overtime, hours may be counted twice, or the wrong multipliers may be applied.

As before, the answer is to use time tracking software to accurately record the hours an employee works in hazardous conditions, ensuring your payroll run proceeds without a hitch.

Back pay (aka retro pay)

Back pay, or retro pay, is money owed to employees for previous periods to account for raises, corrections, or settlements. As this means an employee receives more money than they would in an average month, it may cause confusion when they receive their paycheck. They might not understand what the extra money is for, or why they’re getting taxed more.

Back pay is taxed in the year it’s paid to the employee, not the year it was earned. Calculating it at the worker’s normal rate may push them into a new tax bracket, so many employers apply the flat 22% federal withholding rate instead.

For example, if taxed at the flat rate, retro pay could look something like this:

| Back pay | $100 |

| Withholding tax –22% | –$22 |

| FICA: Social Security at 6.2% and Medicare at 1.45% | –$7.65 |

| Total tax | –$29.75 |

| Take-home pay | $70.35 |

State taxes will vary, so calculating this will depend on where the employee did the work.

Again, a platform like Buddy Punch makes this process smoother and less stressful. The software gives you an accurate record of your employees’ previous hours and pay rates. So when it comes time to calculate any back pay owed, Buddy Punch automatically applies the correct rates and taxes and generates payroll data so payments can be processed quickly. You can also refer to this data if your employee has any questions about retro pay.

Why do documentation and time tracking matter for supplemental pay?

Without accurate documentation and time tracking, supplemental pay can lead to complications working out tax rates and multipliers, or even how much you need to pay an employee. The resulting errors are time-consuming and costly for payroll teams to put right.

Employees could also assume something has gone wrong when they see the contents of their payslip, which can affect trust and morale.

Robert Schwachenwald, owner of Bizzy Bee Plumbing Inc, explains that disputes start when employees aren’t told things in advance:

“For example, a technician expects that just because they did overtime, their paycheck will look so much bigger, but they don’t understand how withholding works.”

The solution is simple: Explain how taxes and supplemental pay are calculated, and clearly categorize each type of pay consistently. It doesn’t have to be a complicated system, just one that everyone understands. For example, you could have separate lines or columns for each pay type, or display gross pay for each category.

Adding supplemental pay to regular wages can also affect retirement contributions (if based on gross pay) and eligibility for certain benefits. Clearly laying out how taxes, retirement contributions, and benefits are impacted by what you pay an employee reduces their stress and saves you time on disputes. Some companies do this by including an educational note in the payslip alongside deductions.

And ultimately, clear time tracking and recording of hours gives you accurate information to put into your payroll software, too. As it’s correct at the source, their tax rates, benefits, and retirement contributions are calculated more quickly and with fewer errors — regardless of how many different types of pay an employee receives.

Supplemental Pay FAQs

Below, you’ll find some answers to questions employers often have about supplemental pay.

What is a supplementary payment?

A supplementary payment is any pay that an employee receives that isn’t part of their base salary or hourly wages. This could include bonuses, commission, or severance pay.

How do you calculate total supplementary income?

To calculate supplemental income, add all of the pay outside of an employee’s base pay. Ensure you’re precise about time, scope, and purpose.

For example, if you have an employee who received commission and a one-off referral bonus during the month, you’d add the totals together to calculate their total supplementary income for that month.

What counts as supplemental pay vs. regular wages?

Regular wages refer to an employee’s base pay, whether that’s paid at an hourly rate or as a salary. Supplemental pay is income outside of base pay, such as commissions or referral bonuses.

Clear, consistent documentation for supplemental pay accuracy

Supplemental pay doesn’t have to be confusing or risky. Clearly and consistently documenting things like overtime protects you and your employees in the short and long term.

And using software like Buddy Punch for time tracking ensures you have accurate data from the start, reducing the risk of time theft, disputes, or errors.

Employees can log how many hours they’ve worked, and managers can approve those hours, giving you clear records in case of audits or disputes. Once you’ve got the data, you can export it to payroll solutions like QuickBooks, or use Buddy Punch Payroll to make sure your employees receive their supplemental pay correctly — without any unpleasant surprises.

Contributors

- Anna Kalkman, SmallBusinessMgr.com, Small Business Owner & Consultant

- Kasey Devine, Entraviam, Founder & CEO

- Robert Schwachenwald, Bizzy Bee Plumbing Inc, Owner