The 9 Best Independent Contractor Payroll Software

These best independent contractor payroll software will help you automate your payroll processes so running payroll will be a breeze.

Paying contractors can be easy or complex, depending on what your overall team looks like. If you just have a handful of contractors on your team, it’s relatively simple. But if you have some independent contractors, some full-time employees, and people working in multiple counties/states/countries, running payroll becomes much more complex.

To reduce the complexity, you need to invest in independent contractor payroll software. These tools keep track of the status of all of your employees to ensure everyone’s paid properly and has the right deductions withheld from their paychecks, and they do it all automatically with no effort on your part at all.

The nine best independent contractor payroll software options below will help you automate your payroll processes so running payroll for a mixed team of worker types will be a breeze.

What is independent contractor payroll software?

Independent contractor payroll software is a tool that helps businesses pay freelancers and 1099 workers accurately and on time, handle tax form generation (like 1099-NEC), and keep records for compliance — all without withholding payroll taxes.

Benefits of using independent contractor payroll software

There are a few key benefits to using independent contractor payroll software:

- Time savings: Independent contractor payroll software automates payment processing, tax form generation (like 1099s), and reporting.

- Accuracy: It minimizes errors in contractor payments and tax filings with automatic calculations and validation tools.

- Compliance: Payroll software helps you stay compliant with labor laws and IRS requirements, especially around classification and tax documentation.

- Easy contractor management: These systems centralize contractor info, contracts, payment histories, payment information, and tax documents in one place.

- Faster payments: Most payroll solutions let you pay contractors through direct deposit and schedule when payments should be sent.

- Scalability: It makes it easy to manage growing teams of contractors across locations or projects.

There are other benefits to keep in mind as well. For example, some independent contractor payroll solutions come with time tracking and scheduling features to improve other aspects of workforce management.

Related: How to Set Up Direct Deposit for Employees

Key features to look for in independent contractor payroll software

Here are some of the bare minimum features that you should look when shopping for independent contractor payroll software:

- 1099 tax form management: Manually creating 1099s for your contractors at the end of the year takes an incredible amount of time, especially if you work with lots of contractors. Look for payroll software that does this for you automatically to save time and make sure you comply with IRS deadlines.

- Direct deposit: Sending contractors their payments via direct deposit is less expensive and time consuming than cutting paper checks or paying invoices one by one.

- Time tracking integration: If your contractors are paid by the hour, payroll software that includes time tracking — or at least integrates with time tracking software, will speed up the process of running payroll and make sure your payments are accurate.

- Contractor self-service portal: A self-service portal lets your contractors add and update their payment information and tax forms, view their pay history, and access documents without your help.

- Expense reimbursement tracking: If you reimburse your contractors for supplies, materials, or other expenses, look for payroll software that separates reimbursements from wages and adds them to payment runs when needed.

- Integrations with accounting software: You’ll likely want to find a system that integrates with your accounting software to keep your books accurate and up to date.

Finally, look for payroll software that has a good track record of customer support. Payroll — paying your team accurately and on time — is critical to any business, and you want to make sure any questions you have get addressed in a timely manner.

The 9 best independent contractor payroll software

The best independent contractor payroll software are Buddy Punch, QuickBooks Payroll, Square Payroll, OnPay, Gusto, Deel, Patriot Software, Roll by ADP, and Remote. Below, you’ll find our in-depth reviews of each of the tools, including who they’re best for, what unique features they offer, and how much they cost.

1. Buddy Punch

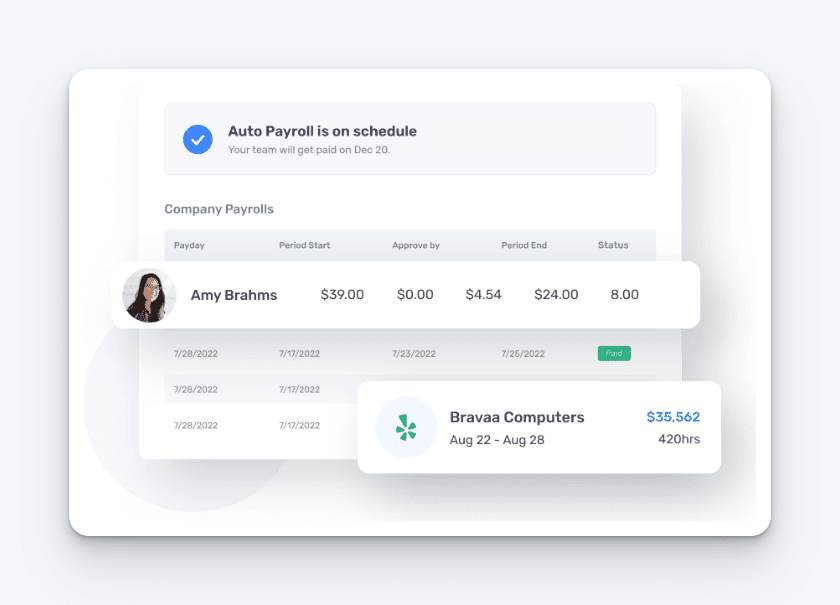

Buddy Punch is an all-in-one time tracking, employee scheduling, and payroll software that can be used to handle contractor payroll. The fact that it offers multiple workforce management features in a single tool makes it even more useful.

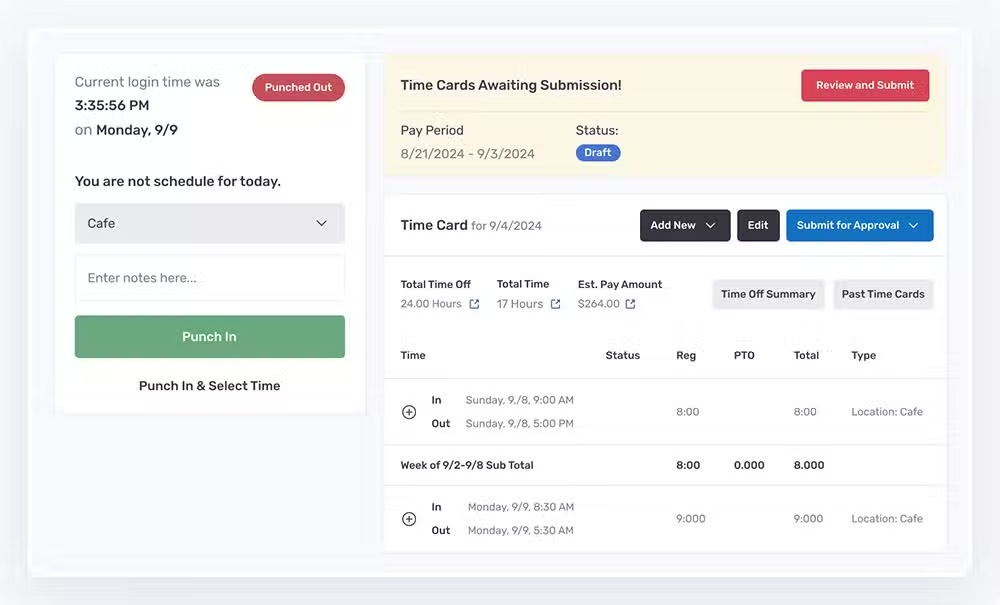

Because Buddy Punch is a web-based time clock app, it can be accessed on any device with an internet connection. This means you can connect to it through the web on desktop or can download the mobile apps available for iOS and Android smartphones and tablets. In other words, independent contractors manage time with Buddy Punch anytime, anywhere.

Buddy Punch has a particular focus on accessibility and simplicity. Upon logging in, contractors will see a simple screen where they can clock in or clock out, establish direct deposit information, and view pay stubs.

There isn’t an overabundance of features to confuse or overwhelm contractors, which makes both onboarding and daily usage a simple process.

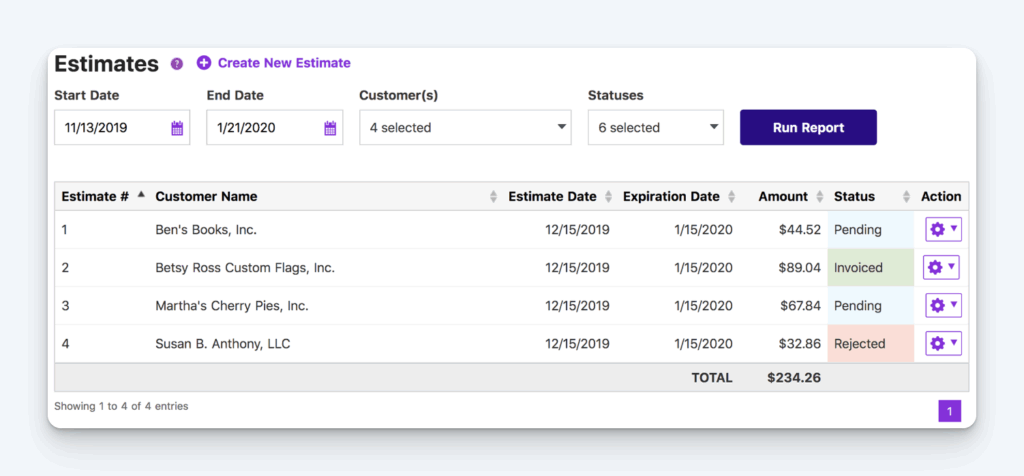

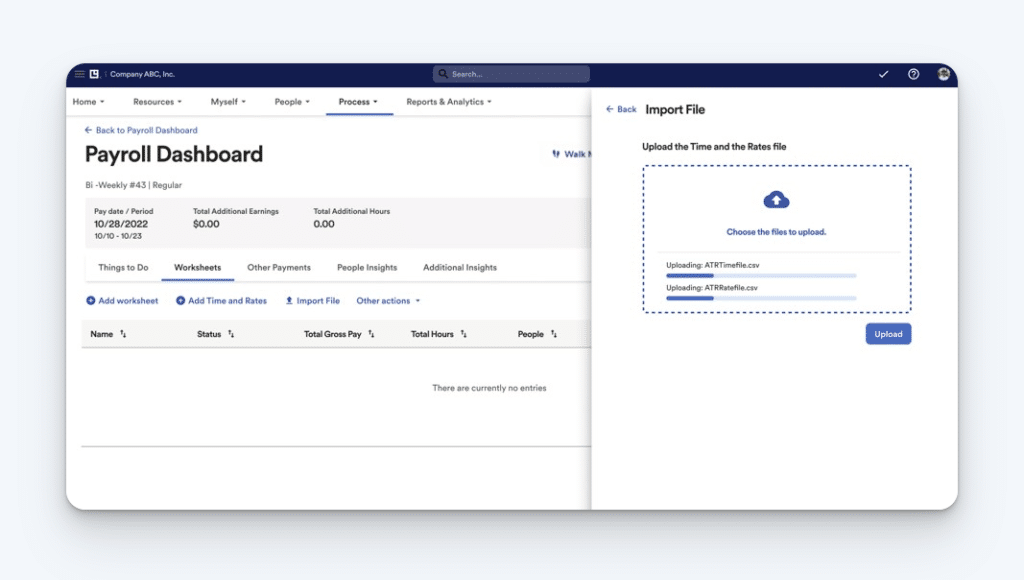

Buddy Punch also has an option for time to be imported into its payroll processor, pictured below. You can then view and fix any time tracking errors, such as correcting hours for someone who forgot to clock in or out. You can also use this opportunity to add additional earnings to a contractor’s pay, such as bonuses.

This is only scratching the surface of how Buddy Punch streamlines contractor payroll. Other features include:

- Automatic payroll calculations: Buddy Punch automatically calculates contractor payroll based on time worked as well as locations.

- Direct deposits: Contractors are sent a self-service login that can be used to input their direct deposit information securely. Alternatively, they can choose to be paid via check, which Buddy Punch also handles.

- Tax management: Buddy Punch handles electronic distribution of 1099 forms for contractors, as well as W-2 forms for your full-time employees.

- Customer support: An important part of choosing payroll software is knowing there’s a team on hand to help you with any critical wage, tax, or compliance questions. Thankfully, Buddy Punch is known for its responsive customer support, to the point where it’s a commonly mentioned as a highlight among users.

On popular software review site Capterra, Buddy Punch has a score of 4.8 out of 5 stars, with high ratings for both both ease-of-use and customer service, based on over 1,000 customer reviews.

Additional features

Buddy Punch’s usefulness doesn’t stop there. It also has a host of time tracking and employee scheduling features that make the gathering and optimization of contractor data easy for any business owner or administrator. These options include:

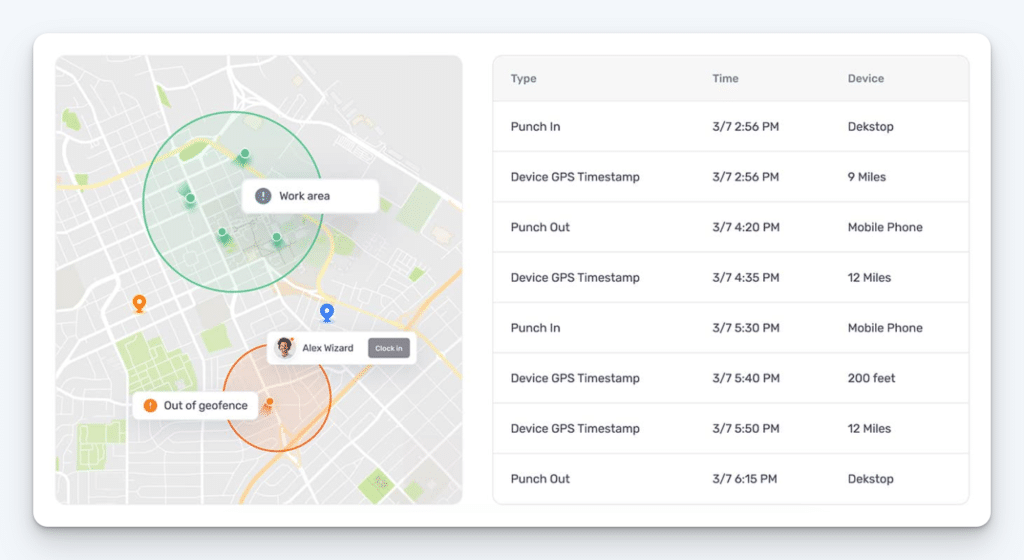

- Location management: Monitor the locations of remote contractors with Buddy Punch’s GPS tracking. Log locations when contractors clock in or clock out. Alternatively, monitor real-time GPS locations the entire time they’re on the clock. You can also create geofences that prevent punching while offsite.

- Employee scheduling: Drag-and-drop shifts to build work schedules. Everyone who’s scheduled receives notifications alerting them of their shifts. Additionally, you can allow team members to trade shifts and cover open shifts to reduce no-shows and improve engagement.

- Job costing time clock: Create different job codes for different projects. Employees and contractors can select job codes while clocking in, allowing you to monitor how much time is spent on each project, task, and job. Contractors can also switch between different codes throughout the day.

- Time theft reduction: Improve employee accountability and ensure no buddy punching or time theft is happening behind your back. Require contractors to take photos of themselves when clocking in/out. View these photos in on their timesheets to make sure the right person clocked in.

- Kiosk functionality: Convert any device into a stand where employees and contractors alike can clock in and clock out in an office or at a remote job site. Buddy Punch’s kiosk function allows users to clock in through personalized PIN codes or through QR code scanning.

- Customizable reporting: Buddy Punch’s time tracking reports give you a bird’s eye view of everything from daily hours to in/out activity and more. Export reports in Excel, CSV, or PDF formats.

Pricing

You can add Buddy Punch Payroll to any Buddy Punch plan for $6 per user per month, plus a $39 base fee. Buddy Punch Payroll comes with contractor 1099s and employee W-2s, direct deposit, employee self-onboarding, expert payroll support, and more.

Learn more about Buddy Punch

- Start a free trial — no credit card required

- View pricing

- Watch a video demo

- Take an interactive product tour

- Request a personalized demo

2. QuickBooks Payroll

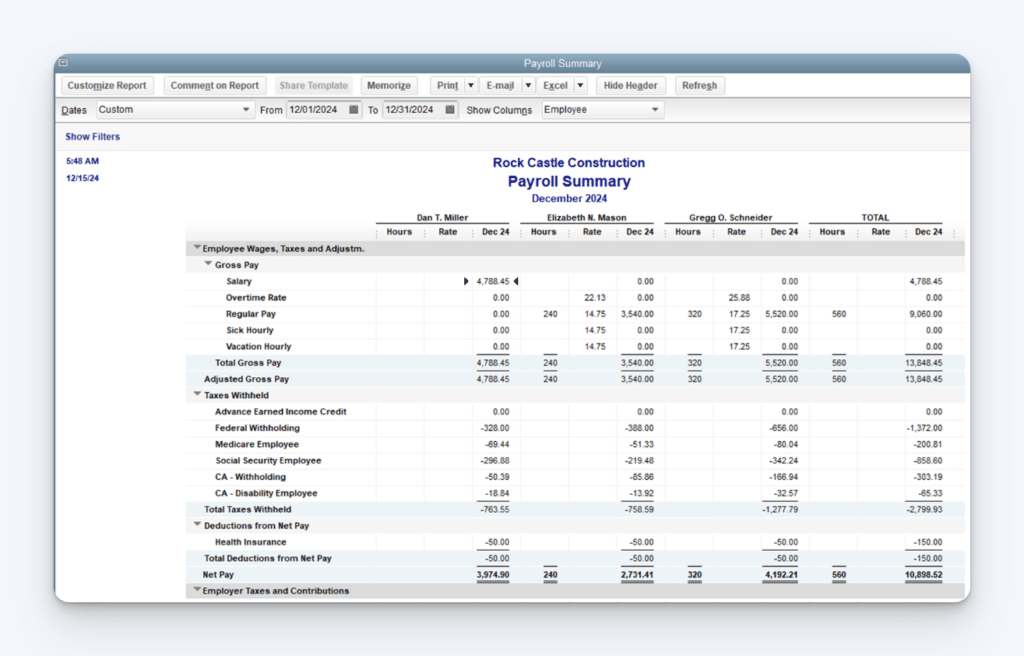

QuickBooks Payroll offers powerful accounting and bookkeeping tools to ensure you can streamline payroll, track time, manage HR, and offer your team benefits. Payroll is the primary function that QuickBooks was known for before they expanded their offerings. As of this post writing, QuickBooks Payroll has a rating of 4.4/5 stars on Capterra.

QuickBooks Payroll is an add-on for either QuickBooks Accounting, QuickBooks Online, or QuickBooks Desktop. This means their payroll functions can be accessed via the web, through the mobile apps available for iOS and android smartphones and tablets, or via a download application in the case of QuickBooks Desktop.

QuickBooks Payroll offers same-day direct deposit, allows team members to view their pay info and forms such as W-2s or 1099s, and provides a tax penalty protection of up to $25,000.

Key features

- Full-service payroll: QuickBooks Payroll will calculate, file, and pay payroll taxes for you.

- Auto payroll: Run auto payroll for salaried employees on direct deposit. You’ll still be able to review, approve, or edit payroll before payday. Make changes and add additional compensation easily, such as commission and bonuses.

- 1099 e-file: Create and e-file unlimited 1099-MISC and 1099-NEC forms. Additionally, QuickBooks payroll will automatically send electronic copies to your contractors.

- Direct deposit: Submit payroll up to 5 PM the day before payday. Funds are withdrawn the day employees get paid.

- Employee portal: Enable employees and contractors to access pay stubs, W-2s, 1099s, and other pay details. Employees and contractors can submit their pay preferences, personal details, and tax info.

- Income and expenses: Import transactions from your bank, credit cards, PayPal, Square, and more. Automatically sort transactions into tax categories. Create custom tags and organize them to monitor how you make and spend money.

- Project management: Get a bird’s eye view of all your projects. Track labor costs, payroll, and expenses through job costing. Check project profitability at a glance.

QuickBooks Payroll also offers 24/7 expert product support, automated onboarding, and inventory tracking.

Pricing

You can get QuickBooks Payroll’s full-service payroll, expert review, and 1099 contractor management for $9 per employee per month plus a $92 per month base fee.

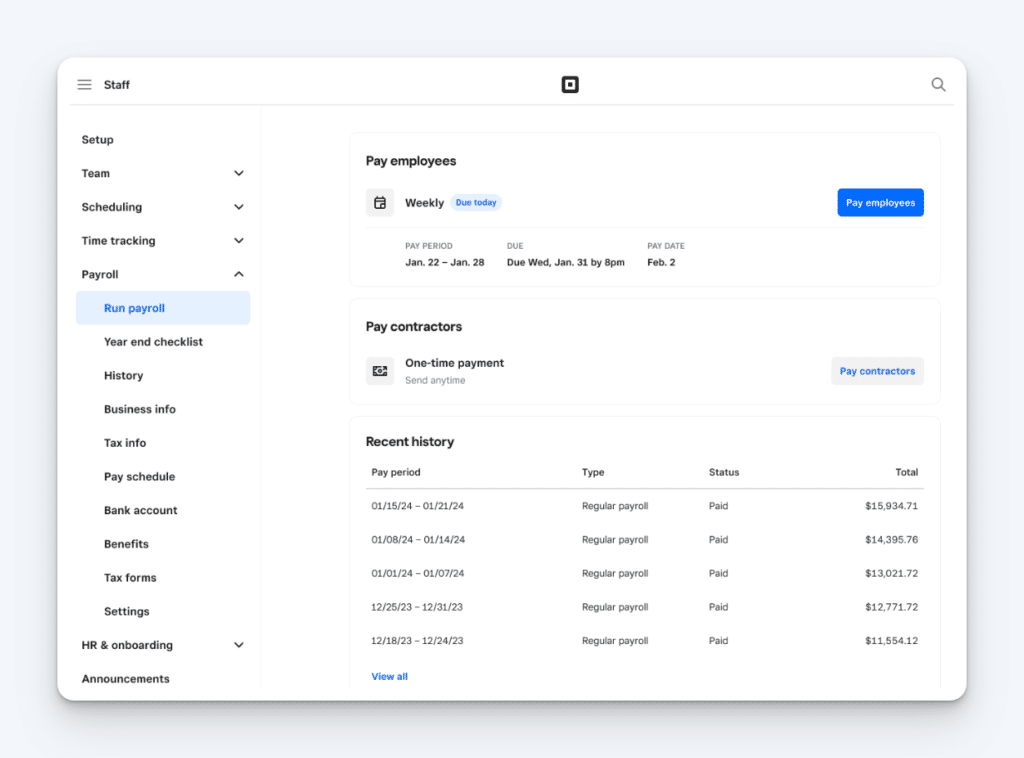

3. Square Payroll

Square Payroll is an offshoot of the square point-of-sale system app and allows business owners to manage team member payments regardless of if they’re using Square itself. As of this post’s writing, Square Payroll has a Capterra score of 4.7 out of 5 stars.

Square Payroll can run as an app on Apple or Android phones, enabling you to import time cards and send payments from anywhere at any time. You can also log into Square Payroll through the web.

Square Payroll allows you to pay W-2 employees and 1099 contractors hourly, salary, or custom amounts, has the ability to automatically pay your employees each pay period, and can streamline onboarding for new employees or contractors.

Key features

- Form management: Square Payroll generates and files W-2s and Form 1099-NECs for your team in January for the prior tax year.

- Employee scheduling: Create, manage, and publish schedules for yourself and your entire staff.

- Automatic filings: make use of automatic calculations, withholdings, and filings for federal estate payroll taxes on your behalf.

- New hire reporting: Square Payroll will automatically report new hires according to your state’s regulations if requested to do so during the onboarding process.

- Tips: Calculate direct tips automatically and import them into your payroll run.

- Instant deposit: Eligible team members that use cash can use the instant deposit feature through Cash App to receive their pay quicker than normal.

- Multiple tax jurisdiction support: For each state or tax jurisdiction in which you process payroll, Square Payroll will remit the tax payments and complete your tax filings on your behalf.

Square Payroll also offers insurance through their partner SimplyInsured, provides onboarding guidance, and has labor cost reporting.

Pricing

You can get Square Payroll’s full-service payroll, automated tax filings, and resources in one place for $35 per month plus $6 monthly fee per person. You can also get the contractor-only payroll for $6 per month per person.

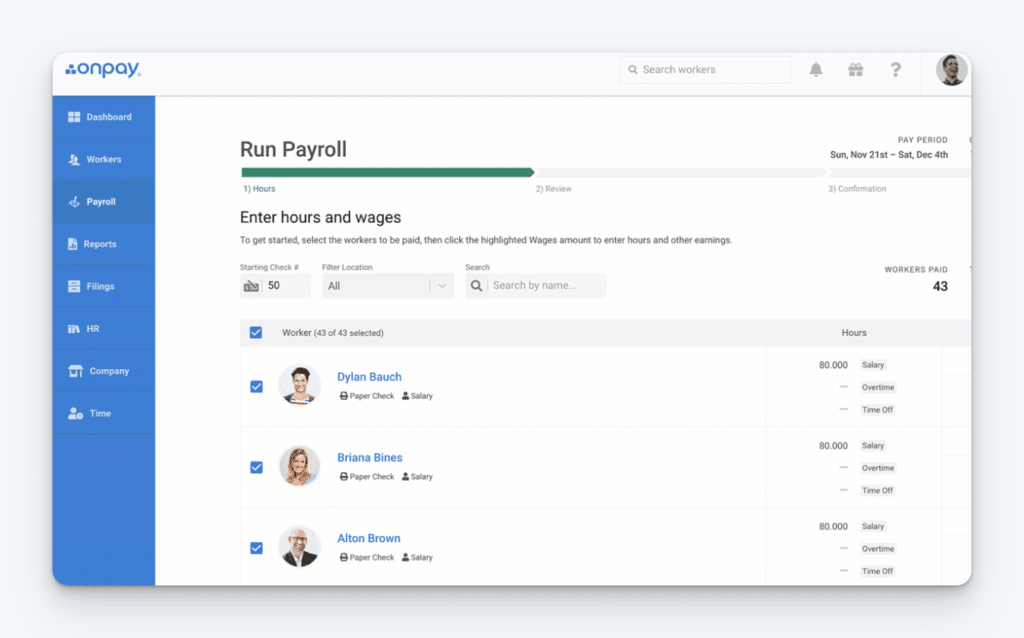

4. OnPay

OnPay is a HR, payroll, and benefits software that equips business owners to stay organized and stay compliant. As of this post’s writing, OnPay has a rating of 4.8 out of five stars on Capterra.

Users can access OnPay via the web or as an app for Android and Apple.

OnPay lets you run payroll and a breeze from any device, syncs many accounting software options, and has automated taxes to ease the difficulty of managing federal, state, and local regulations.

Key features

- Direct deposit: Ditch paper checks and switch to direct deposit for payroll. Review and approve each pay run and OnPay handles the rest at no extra cost. Avoid errors and optimize your time.

- Payroll reporting: View and customize payroll reports right in the app based on date ranges, columns, or your chosen filters. Custom views can be saved for easy access by finance teams, HR departments, accountants, or anyone else.

- Self-onboarding: invite contractors to onboard themselves to save time and data entry. Contractors can download their own 1099s at the end of the year.

- Org chart: Make use of visual org charts to keep your team connected. Create a clear picture of your workforce and employee hierarchy based on department, location, or team.

- PTO management: Use everything you need to approve, manage, and track your team vacation and leave days with just a few clicks. Build and assign custom accrual policies, automate calculation of PTO balances, and sync time off directly with payroll.

- Worker’s comp: Secure payroll to make it easy to ensure your team is taking care of and that you remain in compliance.

- Documentation: Invite employees and contractors to onboard themselves and require E signatures on their paperwork. OnPay stores offer letters as well as W-4 and 1099s.

OnPay also lets you automatically deduct garnishments, streamlines access through single sign-on, and allows you to set up multiple pay schedules for your company.

Pricing

OnPay does not offer any variable pricing plans, so the software always costs $40 per month as a base fee plus $6 per person per month.

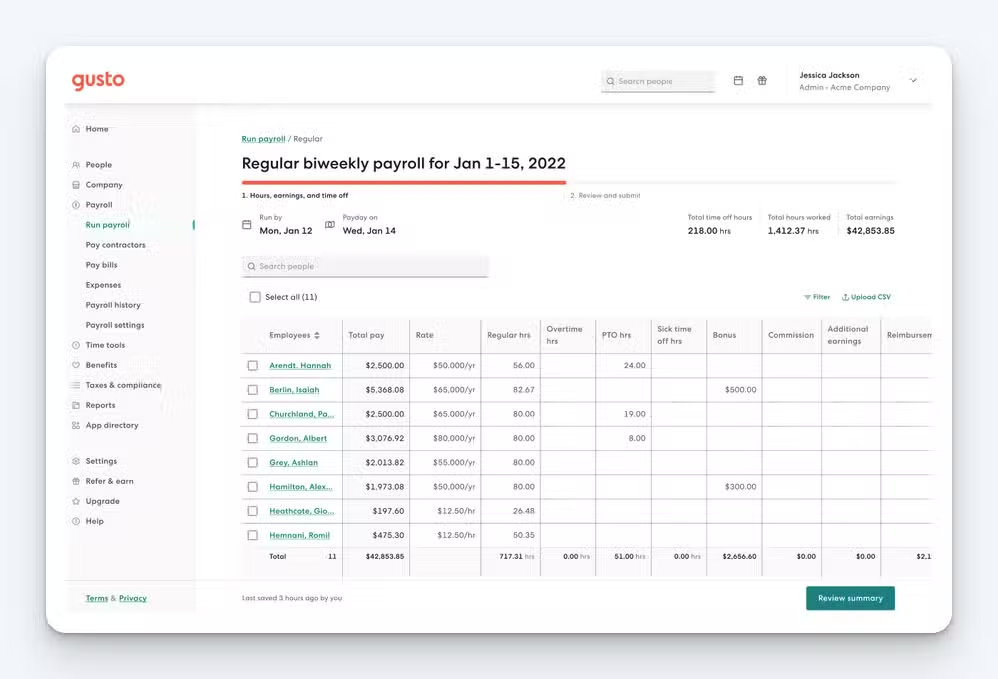

5. Gusto

Gusto is a payroll, HR, and benefits software designed for small and medium-size businesses alike to better manage their workforce. As of this post writing, Gusto has a Capterra rating of 4.6/5 stars.

Gusto can be accessed through the web or downloaded for use on smartphones and tablets (it functions on both Apple and Android devices).

This tool lets you sync your team’s hours automatically, review summaries of information such as contractors, expenses, and payroll history, and store forms and signatures.

Key features

- Form management: Store and organize your employee I-9s and W-2s in addition to contractor 1099s.

- Tax registration aid: Make use of resources to register in all the states your employees live and work to ensure continued compliance.

- In-depth tracking: Track lunches, breaks, and even geolocations. Particularly useful in the case of hourly workers when you want to make sure you’re staying in compliance.

- Onboarding: Easily hire, manage, and pay teams – even using local currencies in the case of managing a global workforce.

- Customer support: Get expedited support from Gusto’s team to help with tax compliance and usage of software.

- Self-service: Once hired, employees can enter their information into Gusto. This includes contractors entering their 1099s or employees entering their W-2s and pay stubs. Users can even change jobs.

- Benefits management: Manage all your benefits in one place, from health insurance to dental and vision to broker integration and more. Use Gusto to help craft the right plan for your team and budget.

Gusto also lets you create and place surveys to gauge happiness and areas of concern, bill pay to save time and money, and create job posts for popular job boards such as LinkedIn and Indeed.

Pricing

You can get Gusto’s full-service payroll, dedicated customer success manager, and advanced analytics and custom reporting for $135 per month plus $16.50 per person per month.

Related: If Gusto feels like it’s close to what you’re looking for but not perfect, find a better fit in our list of the best Gusto alternatives.

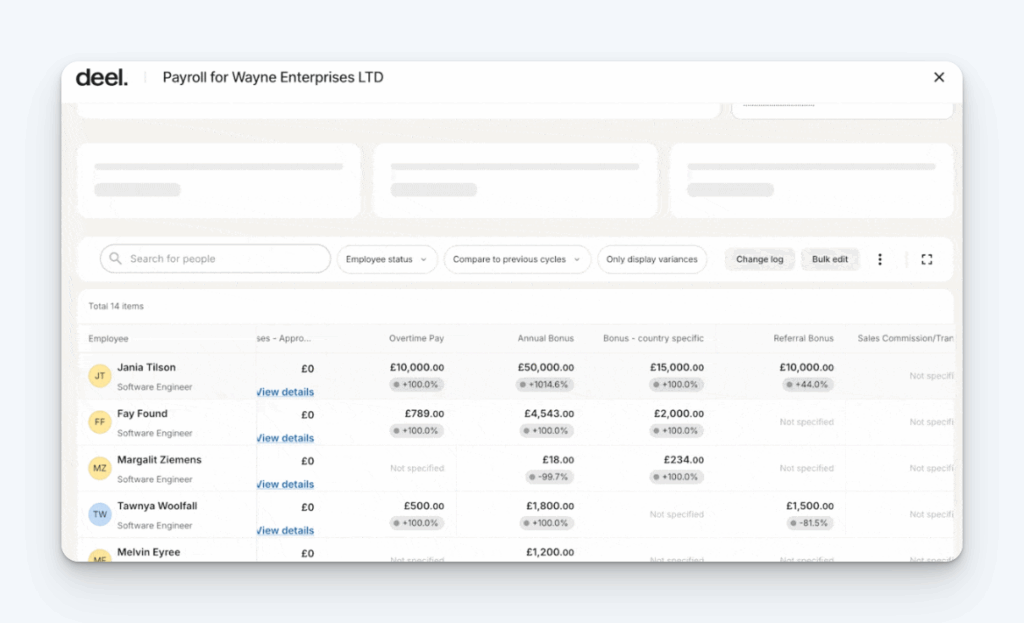

6. Deel

Deel helps manage global software companies, providing unmatched speed, flexibility, and compliance. As of this post’s writing, it has a rating of 4.8/5 on Capterra.

Deel can be accessed via the web and can be downloaded as a mobile app on the Apple app store and Google play store for mobile devices. All of Deel’s payroll features function right on your phone.

Deel allows you to hire worldwide without opening legal entities, streamlines HR for global teams, and can pay all types of workers anywhere with consolidated payroll in full compliance.

Key features

- Employer of record: Hire employees globally with the EOR (Employer of Record) service. Everything is handled in-house to prevent a fragmented team experience.

- Global payroll: Receive assistance with monitoring and flagging the latest payroll regulatory changes across the globe.

- Customer support: Receive reliably fast, 24/7 customer support from local payroll experts positioned around the world.

- Bulk payments: Review and approve workforce salaries in just one system. Add bonuses or last-minute expenses within seconds.

- Global reporting: Get valuable insights by instantly analyzing the US and international payroll operations through one consolidated view complete with standardized reporting and dashboards.

- Compliance leaders: Outsource the handling of compliance to Deel. This includes state registration, tax filings, calculations, and payments – at the local, state, and federal levels.

- Integrations: Deel integrates with 80+ powerful tools to reduce manual tasks and streamline workflows.

Deel also lets you customize reports to fit your needs, provides automated contracts generation, and facilitates business scaling by allowing you to partner with international expansion experts.

Pricing

You can use Deel to automate localized contract generation, manage tax documents, and get verification of compliance checks for $49 per contractor per month.

7. Patriot Software

Patriot Software is a user-friendly payroll software that simplifies payday and compliance. Patriot Software has a Capterra score of 4.8/5 at this post’s writing.

Patriot Software is available via the web and is responsive, meaning that it will adapt to any screen whether it be phone, tablet, or desktop computer. There is also a mobile app available for employees and contractors, which allows them to monitor time cards and pay data for smartphones and tablets.

Patriot Software lets you plug in employee hours or automatically import them, has unlimited payroll runs for all pay frequencies, and provides year-end payroll tax filings at no additional cost.

Key features

- Unlimited payroll runs: Pay your employees as often as you want.

- Multiple pay rates: Add up to five pay rates for each hourly employee or contractor. You can differentiate pay rates for employees by adding a description to each rate.

- User self-service: Employees and contractors have secure access to the pay stubs, pay history, time off balances, and forms.

- Payroll reporting: Create and export payroll reports based on date, location, department or more – even payroll tax liabilities. Filter based on the data you need to get a complete overview of your business.

- Location management: Assign primary work locations to employees and contractors, such as remote job sites or working from home. Proper payroll taxes will be automatically applied based on team member locations.

- Workers’ Comp: Automatically pay your workers’ comp insurance premium with each payroll. This is achieved through their partner NEXT Insurance.

- Customization: Use Patriot Software’s standard hours and money types or add your own. Add your own employee deductions and company-paid contributions.

Patriot software also lets you change pay rates on the fly, can add unlimited users and contractors with permissions, and has optional HR software to further manage your workforce.

Pricing

You can get Patriot Software’s direct deposit, federal tax filings, guaranteed reliability, and robust payroll reports for $18.50 per month, plus $2.50 per user.

8. Roll by ADP

Roll by ADP is a chat-based payroll and makes use of GenAI technology to power small business payroll management and even HR assistance. It has a score of 4.8/5 on G2.

Roll by ADP is available through the web or as an app for iOS and android mobile devices.

Roll by ADP allows you to run payroll in under a minute, has an intelligent AI assistant, and can send payroll alerts.

Key features

- Payroll and taxes: Handle your payroll in just a few taps. Role by ADP takes over tax filing on your behalf.

- Intelligent assistance: Get enhanced AI generated insights into your business. Make use of personalized payroll advice.

- Raises and bonuses: Make payroll updates on the go, instantly. From one-time bonuses to automated garnishments, Roll takes care of it for you.

- Employee self-service: Allow employees and contractors to manage their own profiles. Send invite links for easy onboarding. Workers and contractors oversee payday alerts so they always know when they’re about to receive cash.

- Direct deposit: Run payroll and remain confident that workers will receive their funds within 24 business hours. Roll also has the capacity to perform same-day deposits for compressed schedules.

- QuickBooks integration: Roll by ADP integrates directly with QuickBooks Online to help streamline your workforce management.

- Customer service: Roll provides 24/7 live customer service with knowledgeable agents.

Roll by ADP also has AI-driven error checks, provides unlimited live chat support, and allows for new hire reporting.

Pricing

You can get Roll by ADP’s W-2 and 1099 support, direct deposit, and GenAI chat functionality for $39 per month plus $5 per user per month.

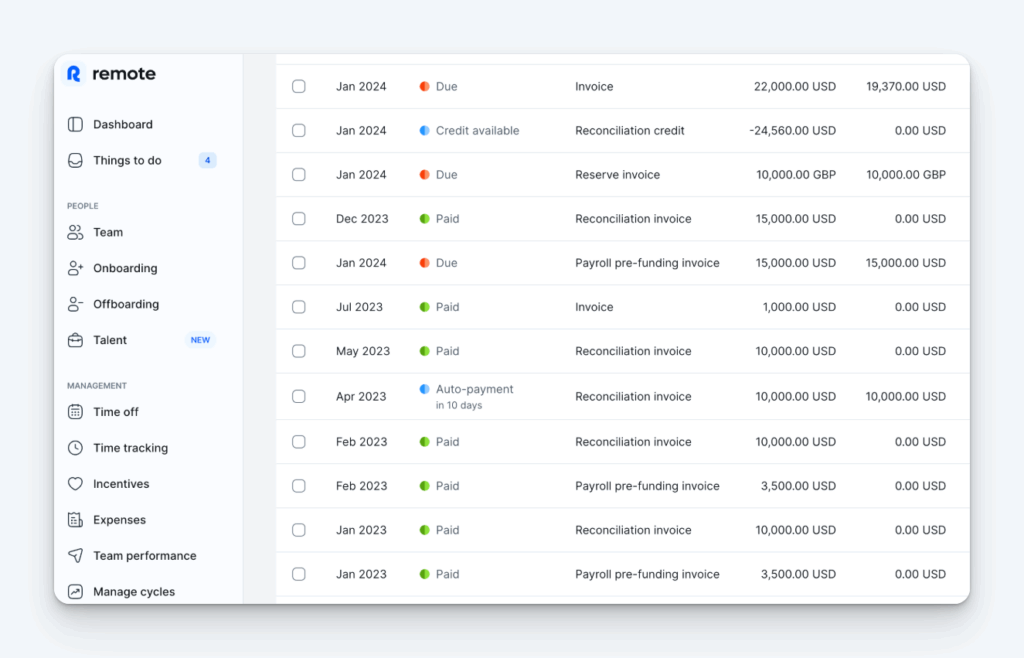

9. Remote

Remote is a global HR and payroll platform that helps business owners navigate employment with ease. It has a rating of 4.4/5 on Capterra as of this post’s writing.

Remote can be accessed via the web or you can download the remote mobile app for Android and iOS. The mobile app is mostly intended for employees and contractors to be able to manage time off, expense tracking, and their pay slips.

Remote lets you pay anyone, anywhere, keeps you in compliance with any tax laws even across international borders, and allows you to consolidate multiple third-party apps into one browser tab.

Key features

- Integrated payroll processing: Cut down on data duplication and extra overhead. Consolidate your payroll process all into Remote’s platform.

- Planned payroll runs: View the next payroll run for each country. Include reminders for any required actions or approvals to ensure payroll goes smoothly.

- Remote watchtower: Make proactive decisions on HR and employment law changes worldwide. Get expert insights to navigate nuances when it comes to tax compliance with ease.

- Customer support: Make use of Remote’s global expertise to facilitate the growth of your business. Eliminate the need for local offices providing tax support.

- Payroll reporting: See your predicted and actual payroll costs for each country to help you plan cash flow.

- Tax compliance: Automatically calculate and disperse tax payments to relevant authorities, ensuring compliance with local regulations. Avoid penalties and fines and have payments arrive on time.

- Simplified accounting: Access a complete audit trail of all payroll transactions for enhanced transparency and accountability. Keep accounting analysis and public detailed reports of salary and tax payments.

Remote also lets you protect payroll funds with comprehensive verification processes, provides worldwide payroll payment coverage, and allows you to integrate other tools via API connection.

Pricing

Remote offers a contractor specific management plan where you can get the ability to create, edit, and sign tailored contracts, coverage up to $100,000 per contractor for penalties, and transparent payments for $99 per contractor per month.

Choosing the best independent contractor payroll software for your company

Each of these nine independent contractor payroll software options have some of the same main tools: direct depositing, allowing contractors to access their 1099 forms, and reports. However, a closer look at each tool reveals nuances in how well a business owner can use them — from user interface to the degree of flexibility you have when it comes to customizing each option.

This is why it can be difficult to find the best contractor payroll software option without getting hands-on. Thankfully, making use of a free trial allows you to do exactly this. By trying out each tool, you’ll get a better feel for how they function than any feature list could inform you.

While experimenting during a trial, we encourage you to keep these questions in mind in order to remain as objective as possible:

- Do you need all the tool’s features? Consider the fact that both employees and contractors will be making use of the software you choose. Does it offer too many options? Would it be overwhelming and frustrating? You don’t want to risk users having difficulty navigating the tool. When it comes to features, more is not necessarily better.

- How easy is a tool for contractors to use? Can you send invite links to contractors for them to sign up? Are their 1099 forms easily accessible? You want to make sure there’s nothing impeding a contractor’s usage of the tool.

- Does the tool meet your specific business needs? Are you looking for an option that can run payroll automatically week after week? Are you looking for combined payroll and timekeeping software? Make sure you choose software you can tailor to your management style.

- Does the tool fit your budget? Pricing plans for software are notoriously tricky. Make sure you understand the difference between annual and monthly pricing and how each tool divides up their payroll features on their plans.

- How responsive is customer support? Whether you encounter a bug with the software or have a question about tax compliance, it’s vital that the tool you choose has a reliable and responsive customer support team. You can test this prior to purchasing a tool by simply reaching out to the team with a question and see how quickly and thoroughly they respond.

The best tactic a business owner can take is to narrow down their top picks of contractor payroll software and then use the free trial to determine which one is ultimately best. This is how you’ll find contractor payroll software that you, your team, and any contractors you partner with can rely on for years to come.