Calculating paid time off (PTO) can be difficult. It all depends on which accrual rate you decide to use (which should be outlined in your company’s policy to comply with federal and state laws).

The first step to tracking employee vacation time is to decide how many hours you want to allocate to full-time employees each year. Based on a 40-hour work week, you may want to give 40 hours (one week of vacation time), 80 hours (two weeks), or some other number in between. Based on the accrual method you choose, you can calculate how much time employees accrue each pay period.

Modern PTO tracking software can automatically calculate PTO accruals for you, saving you a ton of time and making sure your calculations are always accurate and up to date. However, if you prefer to calculate the data manually, we’ll cover everything you need to know to calculate vacation time.

Common PTO accrual methods

Below are some of the most common methods that employers use for vacation accruals, complete with explanations of how to calculate PTO based on each method.

Yearly

The simplest way to award vacation time is in a lump sum yearly. Choose a time when your employees accrue their allotted vacation time – usually at the beginning of the year or on the employee’s anniversary. At the beginning of the year, add their vacation time. As the employee takes time off, simply subtract it from the current total.

The main downside to this accrual rate is new employees have to wait a full calendar year before accruing any vacation time. If you do not want them to wait, one of the other accrual rates may work better for you.

Hourly

This accrual rate is ideal for part-time employees who work variable shifts. Their allocated time off is directly dependent on the number of hours they worked.

Calculation example:

For the sake of an example, we will use the most common 40 hour work week. To figure out how many hours your employee works in a year, multiply 40 work hours by 52 weeks (the number of weeks in a year). Then, subtract 40 hours off of the total for the time you’re awarding as PTO.

40 hours x 52 weeks = 2,080 hours

2080 hours – 40 hours (allocated PTO) = 2,040 hoursNow to get the accrual multiplier, divide the number of allocated vacation hours by the total hours per year as calculated above.

40 hours ÷ 2,040 yearly hours worked = .019 hoursThis means that for every hour your employee works, they will earn .019 hours of PTO.

Daily

The daily hourly rate is another accrual rate that is ideal for part-time employees. The only requirement is that the part-time employees work full eight-hour shifts. If the employees only work partial shifts or varying shifts, it may be better to choose a different accrual method.

Calculation example:

You will first need to multiply the number of work days in a week by 52 weeks to calculate how many work days you have per year (remember to subtract any paid holidays and the days off per year).

5 (days in a work week) x 52 (weeks in a year) = 260 work days a year

260 – 5 (allocated PTO) = 255 days

255 – 5 (paid holidays) = 250 work days per yearNow to get the accrual multiplier, divide the number of allocated vacation days by the total work days per year as calculated above.

5 ÷ 250 (Work days per year) = .02 daysThis means that for every day your employee works, they will earn 0.02 days of PTO.

Monthly, twice a month, or every two weeks

After the yearly accrual method, these are the more common, simpler accrual methods used to calculate PTO. Employees tend to be less confused because they will see the same amount on each paycheck.

Calculation example:

You would take the number of yearly allocated PTO hours and divide it by 12 for monthly pay, by 24 for twice-monthly pay, or 26 for bi-weekly pay.

40 (Allocated PTO) ÷ 12 = 3.33 hours accrued per pay period -OR-

40 (Allocated PTO) ÷ 24 = 1.67 hours accrued per pay period -OR-

40 (Allocated PTO) ÷ 26 = 1.54 hours accrued per pay periodWhichever method (or variation of methods) you choose to use to calculate PTO for your employees, write it down. Track it. Make it policy. It avoids confusion and accusations of favoritism.

How software softens the load

Now that we’ve covered the most common manual methods of calculating paid vacation time for hourly employees, it should be clear why some business owners choose to either use PTO tracker templates or implement software that automatically calculates and accrues vacation time for team members.

Beyond saving time, PTO tracking software offers a greater degree of accuracy and even transparency if they let employees view their paid time earned as they work (which can help motivate them to complete more work).

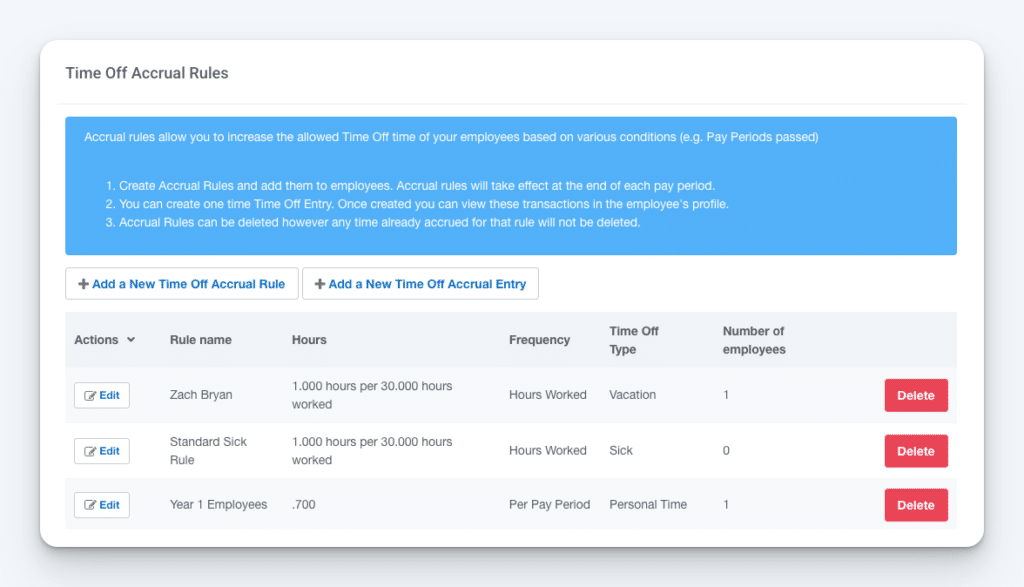

For example, our very own Buddy Punch comes with a full paid time off tracking suite. In addition to you being able to set up automatic calculation with our PTO accruals option, you can also enable your employees to view their earned PTO and make PTO requests that you can approve or deny.

Learn more about Buddy Punch

- Start a free trial — no credit card required

- View pricing

- Watch a video demo

- Take an interactive product tour

- Request a personalized demo

Planning for next year

While it’s normally difficult to make any drastic changes to your operations, it’s important to take time at the end of the year to consider what new innovations and techniques you can adopt going into the next year, including how you calculate and track PTO.