What is a Tax Calculator Paycheck? Guide For Business Owners

A tax calculator paycheck helps you estimate your net pay after deductions, including federal and state income taxes, social security, and medicare contributions.

By inputting basic information such as your income, filing status, and deductions, you can quickly see how much you can expect to take home.

The top tax calculator paychecks you can opt for are as follows:

| IRS Tax Withholding Estimator: This tool helps estimate the appropriate amount of federal income tax that should be withheld from an employee’s paycheck. It requires input such as pay stubs from all jobs, additional income details, and the most recent tax return. TurboTax: TurboTax provides a range of tax calculators and resources. TaxCaster Tax Calculator: Offers estimates of potential tax refunds and provides insights into an employee’s financial standing. Tax Bracket Calculator: Calculates tax rates, aiding in financial decision-making. Forbes Income Tax Calculator: This tool helps estimate the federal and state taxes an employee might owe. AARP Tax Calculator: Specifically designed to estimate taxes for the year 2023. |

And if you want an all-in-one payroll tax calculator paycheck solution, here are the top five payroll software applications you can go for.

| Top 5 Pick 👇 | |

| Buddy Punch | Best Payroll System With Tax Calculator | Read The Full Review |

| FreshBooks | Best Accounting & Invoicing Software | Read The Full Review |

| Gusto | Best Payroll Solution With HR Features | Read The Full Review |

| Paycom | Best Comprehensive HR & Payroll Software | Read The Full Review |

| Quickbooks | Best Accounting Software Suite | Read The Full Review |

Try Buddy Punch For Free

| What Is a Tax Calculator? |

| A tax calculator is a powerful tool that helps individuals estimate the taxes they will owe or the refund they expect to receive based on their income and other financial information. These calculators consider gross pay, tax withholdings, deductions, and credits to determine the net income. |

Why Do You Need A Tax Calculator Paycheck?

A tax calculator for a paycheck is invaluable for several reasons, especially considering the complexities of the tax system and individual financial circumstances.

Let’s delve into how it aids in various aspects of financial management:

Estimating Take-Home Pay: A tax calculator provides employees with a clear picture of how much they will take home after deductions such as federal income tax withholding, FICA taxes, and any voluntary deductions like contributions to a retirement account or a Health Savings Account (HSA).

Tax Planning: Understanding the intricacies of tax laws can be daunting, but a paycheck tax calculator simplifies the process.

It enables individuals to plan their finances more efficiently by considering factors such as the standard deduction, credits for dependents, and the impact of filing status, whether it’s married filing jointly or head of household.

Budgeting: Armed with the knowledge of their net income after taxes, individuals can create realistic budgets that align with their financial goals and obligations.

They can account for recurring expenses, savings contributions, and even allocate funds towards specific goals like building an emergency fund or saving for a vacation.

Adjusting Withholding: The ability to adjust withholding allowances is crucial, especially with life changes such as getting married, having children, or taking on a second job.

A paycheck tax calculator empowers individuals to make informed decisions about their withholding status on the new W-4 form, ensuring they neither overpay nor underpay their taxes throughout the year.

Understanding Tax Implications: Whether it’s calculating the tax implications of an increase in hourly wage or comprehending how voluntary deductions impact the bottom line, a tax calculator provides clarity.

It considers year-to-date earnings, pay frequency, and any additional income streams to paint a comprehensive picture of tax liabilities for taxpayers.

How Does A Tax Calculator Work?

A tax calculator estimates the amount of taxes an individual owes based on income, deductions, credits, and other relevant financial information.

Here’s how it generally works:

Input Information: Users enter their filing status, income, deductions, credits, and other relevant financial information into the tax calculator.

Calculate Taxable Income: The calculator determines the user’s taxable income by subtracting deductions and credits from their total income.

Apply Tax Rates: The calculator uses the applicable tax rates for the user’s filing status and taxable income to calculate the amount of tax owed.

Factor in Credits and Payments: The calculator considers any tax credits the user is eligible for and subtracts them from the tax owed. It also finds any tax payments already made.

Calculate Refund or Balance Due: Based on the above calculations, the tax calculator determines whether the user will receive a tax refund or owe additional taxes.

Are Tax Calculators Accurate?

Tax calculators for paychecks can provide a reasonably accurate estimate of your net pay after taxes.

These calculators use current tax laws and rates to make calculations, so any changes to tax laws or your financial situation can affect the estimate’s accuracy.

Can I Use A Tax Calculator For State Taxes?

Yes, you can use a tax calculator for state and federal taxes. Many tax calculators allow you to input your state of residence and other relevant details to estimate your state tax liability.

State tax calculations typically consider factors such as your income, filing status, and any state-specific deductions or credits you may qualify for.

How Often Should I Use A Tax Calculator?

The frequency with which you should use a tax calculator for your paycheck depends on your individual circumstances.

Generally, it’s a good idea to use a tax calculator whenever changes to your financial situation could affect your tax liability.

This includes changes such as a raise or promotion, starting a new job, getting married or divorced, having a child, buying a home, or any other significant financial event.

Why is It Important To Have Accurate Paychecks?

Accurate paychecks ensure that employees receive the correct compensation for their work, including any overtime, bonuses, or benefits they are entitled to.

It also helps employees budget and plan their finances effectively, knowing exactly how much they will receive on payday.

How To Calculate Taxes From Paycheck?

Following are the ways to calculate your paycheck:

1. Gather Information

To calculate your paycheck accurately, gather essential information such as your gross pay, pre-tax deductions, and post-tax deductions.

You’ll also need to know your filing status and the number of allowances you claim on your W-4 form.

2. Calculate Gross Pay

Calculating your gross pay is the first step in determining your net income after deductions, which includes taxes and other withholdings.

To calculate your gross pay, start with your total earnings before deductions.

If you’re paid hourly, multiply your hourly rate by the hours worked in the pay period.

| Formula | Description |

| For hourly employees: | Gross Pay = Hourly Rate × Hours Worked |

| For salaried employees: | Gross Pay = Annual Salary / Number of Pay Periods in a Year |

3. Fill Additional Pay

In calculating your paycheck, you must include any additional pay you may receive, such as bonuses, commissions, or overtime.

These earnings are taxed differently from your regular income and can impact your overall tax liability.

4. Deduct Pre-Tax Deductions

Deducting pre-tax deductions accurately ensures you’re not overpaying taxes and can help maximize your take-home pay.

These deductions are subtracted from your gross pay before taxes are calculated, reducing your taxable income.

| Formula | Description |

| Deduct Pre-Tax Deductions | Adjusted Gross Pay = Gross Pay – Pre-Tax Deductions |

5. Calculate Taxes

Calculating taxes accurately ensures that the correct amount is withheld from your paycheck, avoiding any surprises come tax time.

The types of taxes include federal income tax, state income tax (if applicable), social security tax, and medicare tax.

6. Subtract Post-Tax Deductions

Unlike pre-tax deductions, subtracted before taxes are calculated, post-tax deductions are subtracted after taxes have been withheld.

Standard post-tax deductions include health insurance premiums, union dues, and voluntary contributions to charities or savings accounts.

| Formula | Description |

| Subtract Post-Tax Deductions | Net Income = Adjusted Gross Pay – Post-Tax Deductions |

7. Calculate Net Pay

Net pay, also known as take-home pay, is the money you receive after all deductions have been taken out.

To calculate your net pay, subtract all deductions from your gross income. The resulting amount is your net pay, the actual amount you will receive in your paycheck.

| Formula | Description |

| Calculate Net Pay | Net Pay = Adjusted Gross Pay – Total Taxes – Post-Tax Deductions |

Best Software Options To Calculate Paycheck Tax

Following are the best software options to calculate your paycheck tax.

1. Buddy Punch

Buddy Punch is a versatile payroll solution used by businesses of all sizes and across various industries.

It offers time tracking, scheduling, and automated payroll processing features.

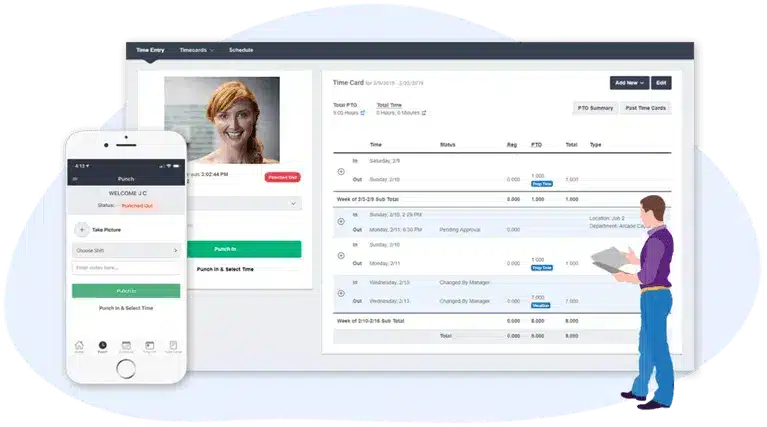

With Buddy Punch, employees can clock in and out using a mobile app, eliminating the need for manual time tracking and reducing errors.

The software also integrates with popular payroll systems, streamlining the payroll process and ensuring accuracy.

1. Automated Payroll System

Integrated with its time tracker, the software handles payroll tax filings and payments and provides expert support, making payroll processing a breeze.

The software’s intuitive dashboard allows for easy review of employee work hours and seamless time data syncing.

Buddy Punch’s payroll software offers the convenience of managing payroll anytime, anywhere as it offers apps on both mobile devices (iOS or Android), tablets, and desktop devices (Windows or Mac).

The software allows for accessible payroll tax filings and payments and expert support.

2. Fully Integrated Time Tracker

Buddy Punch offers a fully integrated time tracker that streamlines payroll processes.

The software provides real-time insights into employee hours, allowing for efficient scheduling and budgeting.

3. Automatic Payroll Tax Filings And Payments

With automatic payroll tax filings and payments, businesses can focus on other aspects of payroll management, knowing that their tax obligations are being handled efficiently.

The feature helps companies to stay compliant with tax regulations and avoid penalties.

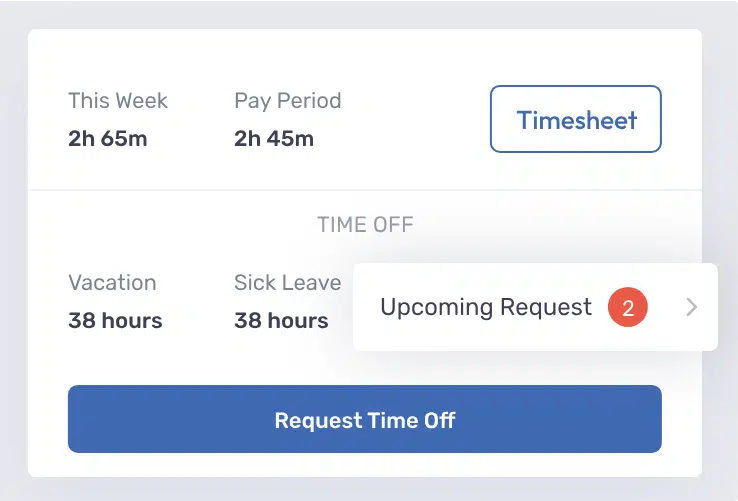

4. Payroll Dashboard For Reviewing Work Hours and Time Off

Payroll dashboard for reviewing work hours and time off feature provides a centralized platform for employers to track and manage employees’ work hours, including overtime and breaks.

5. Automated Requests For Payroll

Buddy Punch offers automated requests for payroll, streamlining the process for employees and employers.

The requests are automatically processed and integrated into the payroll system, reducing the manual effort required by payroll administrators.

6. Expense Tracking, Including Various Types Of Expenses

The expense tracking feature helps you manage your finances effectively and ensures compliance with tax laws.

You can track various expenses, including bonuses, commissions, and reimbursements, all in one place.

7. Payroll Tax Filings In The US

Automated payroll tax filings in the US feature ensures that your tax filings are accurate and compliant with the latest legislation, saving you time and reducing the risk of errors.

8. Multi-State Tax Registration

Multi-state tax registration functionality is essential for businesses operating in multiple states, ensuring compliance with varying tax laws and regulations.

9. Full Payroll Compliance With Local Legislation

Full payroll compliance with local legislation is precious for small businesses that may need dedicated HR or payroll departments to stay updated on changing regulations.

10. Automated Payroll Payments

Automated payroll payments can help you save time and reduce the risk of errors associated with manual payroll processing.

You can set up automatic payments for your employees, including direct deposits and other payment methods.

11. Printable Checks

With the printable checks feature, you can quickly generate and print checks for your employees, simplifying the payment process.

The feature is handy for businesses that prefer paper checks or need to provide physical checks to their employees.

Buddy Punch’s Online Reviews

As of the writing date, Buddy Punch has 4.8 out of 5 stars and 940 reviews on Capterra.

Below, we’ll list just a few reviews that speak to Buddy Punch’s ease of use and great customer support service. (Click here to explore the full list of reviews.)

“We needed a new solution for timekeeping and Buddy Punch came through! Onboarding and integration was so easy. Once I figured out all the setting options, it’s really easy to customize to exactly what you need. Employees love using it because it’s so straight forward to use.”

Click here to read the full review

“BuddyPunch has been very helpful and I am glad my organization made the switch from our previous tracker to BuddyPunch. As mentioned earlier, the ease of use of BuddyPunch is what separates it from a lot of competitors.”

Click here to read the full review

“Easy to clock in from anywhere and still manage how much time you’ve worked in a day. Easily tells you when you’ve gone past 8hrs, and also great for seeing when your team members are clocked in or out.”

Click here to read the full review

Try Buddy Punch for Free

Ready to give Buddy Punch a try?

For free trial, no credit card required.

If you feel that Buddy Punch might be the right fit for your business, sign up for a 14 day free trial (no credit card needed). You can also book a one-on-one demo, or view a pre-recorded demo video.

2. FreshBooks

FreshBooks is an accounting software designed for small businesses and self-employed professionals to manage their finances efficiently.

FreshBooks does offer some payroll features, such as time tracking and the ability to pay contractors, but it’s not as robust as dedicated payroll solutions like Buddy Punch.

FreshBooks helps with basic tax calculations and provides reports for tax purposes, but it may not handle complex payroll tax requirements as comprehensively as other software.

Key Features,

- Invoicing

- Expense Tracking

- Time Tracking

- Project Management

- Estimates

- Financial Reporting

- Online Payments

- Mobile App

- Client Portal

- Integration with other tools

Freshbooks has a rating of 4.5 stars out of 5 on Capterra.

It has 4375 reviews on Capterra.

“Overall I am very happy with FreshBooks. Invoices are quickly generated and paid, and hourly tracking has gone from a burden to an easy process directly integrated into our day to day tasks.”

Click here to read the full review.

3. Gusto

Gusto is a cloud-based platform that offers a variety of HR and payroll services for small and medium-sized businesses.

Gusto offers comprehensive payroll features, including automatic payroll processing, tax filing, benefits administration, and compliance assistance.

Gusto handles all payroll tax calculations, filings, and payments, helping to ensure compliance with federal, state, and local tax regulations.

Key Features,

- Employee Onboarding

- Payroll Processing

- Benefits Administration

- Time Tracking

- Compliance Assistance

- Employee Self-Service

- Reporting and Analytics

- Integrations with other HR tools

- Tax Compliance

- Mobile App Access

Gusto has a rating of 4.7 stars out of 5 on Capterra.

It has 3849 reviews on Capterra.

“Useful tool and the management quality is productive and i like the management of payment operations and collaboration through different projects.”

Click here to read the full review.

4. Paycom

Paycom is a cloud-based human capital management (HCM) system that provides businesses with a suite of tools to manage various aspects of their workforce.

Paycom’s integrated approach allows businesses to consolidate their HR functions into one platform, reducing the need for multiple systems and improving overall efficiency.

Key features,

- Payroll processing

- Time and attendance tracking

- HR management

- Benefits administration

- Talent acquisition

- Employee self-service

- Compliance management

- Reporting and analytics

- Mobile app

- Learning management system (LMS)

Paycom has a rating of 4.4 stars out of 5 on Capterra.

It has 858 reviews on Capterra.

“Overall we are very happy with the product. It was easy to get set up and I find myself looking to use more and more of the fields and options because the reporting is really great! It has been a pretty quick learning curve because the interface is pretty user friendly.”

Click here to read the full review.

5. Quickbooks Paycheck Calculator

QuickBooks Payroll provides a user-friendly interface for managing payroll tasks, including calculating wages, withholding taxes, and issuing payments to employees.

It offers integration with QuickBooks accounting software, allowing for seamless financial management.

Key Features,

- Payroll Processing

- Automatic Payroll Tax Calculations

- Direct Deposit

- Employee Self-Service Portal

- Payroll Reporting

- Workers’ Compensation Tracking

- Time Tracking Integration

- Employee Benefits Management

- Mobile App

- Compliance Assistance

Quickbooka has a rating of 4.5 stars out of 5 on Capterra.

It has 848 reviews on Capterra.

“A reliable and accurate service providing pretty much everything the small business needs to generate a payroll and to remit taxes and tax filings in a timely basis. Good customer service. When new state taxes were introduced, it was sometimes difficult to get the calculation of taxes due correct and, in my case, QuickBooks was never able to successfully remit the Washington Family & Medical Leave tax.”

Click here to read the full review.

How To Calculate Hourly Paycheck?

Calculating an hourly paycheck involves a few key steps to ensure accuracy:

Determine the Gross Pay: Multiply the number of hours worked in a pay period by the hourly rate.

Calculate Overtime: If the employee worked more than 40 hours a week and is eligible for overtime, calculate the overtime pay.

Deduct Taxes and Other Withholdings: Subtract federal, state, and local income taxes, as well as any other withholdings such as Social Security and Medicare taxes.

Calculate Net Pay: Subtract any additional deductions from the gross pay to get the net income, which is the amount the employee will receive in their paycheck.

Verify Calculations: Double-check all calculations to ensure accuracy.

How To Calculate Salary Paycheck?

Calculating a salary paycheck involves several steps:

Determine Gross Salary: Start by determining the employee’s gross salary, the money earned before any deductions.

Calculate Withholding Taxes: Determine the amount of federal income tax, state income tax, and any other applicable local taxes based on the employee’s W-4 form.

Subtract Pre-tax Deductions: Subtract any pre-tax deductions from the gross salary, such as retirement contributions or health insurance premiums.

Calculate Social Security and Medicare Taxes: The Social Security and Medicare taxes are based on the gross salary and current tax rates.

Subtract Post-tax Deductions: Subtract any post-tax deductions, such as union dues or charitable contributions, from the net salary after tax deductions.

Calculate Net Pay: Subtract the total tax deductions, pre-tax deductions, and post-tax deductions from the gross salary to calculate the net pay, the amount the employee will receive in their paycheck.

Ready to start a free trial?

No credit card required, all features included.

Frequently Asked Questions (FAQs)

What is a Form W-4, and why is it important for calculating paycheck taxes?

A Form W-4 is an IRS document that employees fill out to inform their employers of their tax withholding preferences, including the number of dependents and any additional withholding they desire.

It’s crucial for employers as it guides them in calculating the correct amount of federal income tax to withhold from each paycheck.

How does the number of dependents affect my paycheck tax calculation?

The number of dependents you claim on your Form W-4 directly impacts the amount of federal income tax withheld from your paycheck.

Claiming more dependents typically reduces the amount withheld, resulting in a higher net paycheck, while claiming fewer dependents leads to more taxes withheld.

What are FICA taxes, and why are they deducted from my paycheck?

FICA taxes, which stand for Federal Insurance Contributions Act taxes, include Social Security and Medicare taxes.

These deductions are mandatory and go toward funding these social insurance programs, providing benefits to retirees, disabled individuals, and Medicare recipients.

How can I calculate additional withholding on my paycheck?

If you anticipate owing more taxes at the end of the year or want to ensure a refund, you can request additional withholding on your Form W-4.

This extra amount is deducted from each paycheck and goes toward covering your tax bill.

What’s the difference between a bi-weekly and semi-monthly paycheck, and how does it affect taxes?

A bi-weekly paycheck occurs every two weeks, resulting in 26 pay periods per year, while a semi-monthly paycheck is issued twice a month, totaling 24 pay periods annually.

The frequency affects tax calculations, as bi-weekly paychecks may have slightly different withholding amounts due to more pay periods.

Conclusion,

In conclusion, a tax calculator for your paycheck can be a valuable tool for employees and employers alike.

Utilizing a reliable payroll calculator facilitates precise estimations of deductions, including FICA taxes and federal income tax withholding, based on factors such as dependents claimed and pay frequency.

Moreover, it empowers individuals to gauge their net income accurately, aiding in budgeting and planning.

For businesses, incorporating an hourly paycheck calculator streamlines payroll processing, ensuring accurate disbursements into employees’ bank accounts.

By factoring in dollar amounts for additional withholding or contributions to retirement accounts or FSAs, these tools enhance financial transparency and efficiency, enabling both parties to navigate tax obligations confidently.