How Many Work Hours are in a Year?

If you’re the average salaried employee working 40 hours a week, the answer is that you have 2080 average work hours in a year. However, not only are there modifiers to consider (paid time off, federal holidays, preventing burnout), there’s also numerous health and productivity incentives that should make you eager to find a more accurate number.

In this article we’re going to provide a complete thorough look at all things related to work hours. Including:

- Average number of work hours for different work schedules

- Non-work hours

- How Holidays and PTO factor into the equation

- The benefits of tracking your working time

- One tool to drastically simplify all calculations.

By the end of this article, we hope you’ll understand the full scope of everything that goes into tracking your workweek.

What are the total work hours in a year?

Let’s look at that 2080 average work hour number we produced earlier. We got this figure by taking the number of hours worked per week for the average salary employee (40) and multiplying it by the number of weeks in a year (52). 40 x 52 = 2080 hours.

The problem with this number is that it ignores factors such as federal holidays that land during workweeks. In some cases, you may have to deal with leap year calculations, as a leap year means there’s a chance you have extra day of work in February (depending on when February 29th falls). That means you can add an additional full day of work ie. 2088 working hours in a leap year.

That said, since leap years only happen every 4 years and there aren’t that many holiday days off (which we’ll list off later), we find that the 2080 figure still works to give the average salaried worker an idea of how much they work in a year.

But it only applies if you’re working the standard 40-hours per week.

What are my total work hours per year then?

For those of you who work a different work schedule, we’ll provide a handy quick-look at common hour allotments:

- 10-hour work week: 520 working hours per year

- 15-hour work week: 780 working hours per year

- 20-hour work week: 1040 working hours per year

- 25-hour work week: 1300 working hours per year

- 30-hour work week: 1560 working hours per year

- 35-hour work week: 1820 working hours per year

- 40-hour work week: 2080 working hours per year

- 45-hour work week: 2340 working hours per year

- 50-hour work week: 2600 working hours per year

- 55-hour work week: 2860 working hours per year

- 60-hour work week: 3120 working hours per year

- 65-hour work week: 3380 working hours per year

- 70-hour work week: 3640 working hours per year

- 75-hour work week: 3900 working hours per year

- 80-hour work week: 4160 working hours per year

Once again, these annual work hours do not take into account holidays or paid time off, and you’ll have to add an extra day’s worth of hours if you’re trying to calculate this number during a leap year (so long as the extra day lands on a workday).

Also, it’s important to note that salaried employees are paid on a basis that already takes into account leap years. Your salary is based on 365.25 days per year, meaning there won’t be an extra day’s worth of pay awarded to you even if you do end up working another day.

For any of you with work hours falling outside or in-between the range we listed, you can easily calculate your total time worked per year by taking your weekly work hours (A) and multiplying that number by 52 (the number of weeks in a year). A x 52 = Your average number of hours worked each year.

How many non-work hours are there in a year?

If you’re worried that it sounds like you’re spending your whole life at work, fear not. You can easily see the amount of time you get to spend outside of work by calculating the total number of hours in any given year and then subtracting your total working hours per year (provided by us above or figured out through the formula).

There are 24 hours in a day, and 365 days in a calendar year. 24 x 365 = 8760 total hours. (For leap years, when we have 366 days in the year, the total number of hours in a year is 8784.)

So, for the standard work hours we’ve already described, the numbers look like:

- 10-hour work week: 8760 – 520 (10 hours per week x 52 weeks in a year) = 8240 non-working hours per year.

- 15-hour work week: 8760 – 780 (15 hours per week x 52 weeks in a year) = 7980 non-working hours per year.

- 20-hour work week: 8760 – 1040 (15 hours per week x 52 weeks in a year) = 8040 non-working hours per year.

- 25-hour work week: 8760 – 1300 (25 hours per week x 52 weeks in a year) = 7460 non-working hours per year.

- 30-hour work week: 8760 – 1560 (30 hours per week x 52 weeks in a year) = 7200 non-working hours per year.

- 35-hour work week: 8760 – 1820 (35 hours per week x 52 weeks in a year) = 6940 non-working hours per year.

- 40-hour work week: 8760 – 2080 (40 hours per week x 52 weeks in a year) = 6680 non-working hours per year.

- 45-hour work week: 8760 – 2340 (45 hours per week x 52 weeks in a year) = 6420 non-working hours per year.

- 50-hour work week: 8760 – 2600 (50 hours per week x 52 weeks in a year) = 6160 non-working hours per year.

- 55-hour work week: 8760 – 2860 (55 hours per week x 52 weeks in a year) = 5900 non-working hours per year.

- 60-hour work week: 8760 – 3120 (60 hours per week x 52 weeks in a year) = 5640 non-working hours per year.

- 65-hour work week: 8760 – 3380 (65 hours per week x 52 weeks in a year) = 5380 non-working hours per year.

- 70-hour work week: 8760 – 3640 (70 hours per week x 52 weeks in a year) = 5120 non-working hours per year.

- 75-hour work week: 8760 – 3900 (75 hours per week x 52 weeks in a year) = 4860 non-working hours per year.

- 80-hour work week: 8760 – 4160 (80 hours per week x 52 weeks in a year) = 4600 non-working hours per year.

How do I get more accurate numbers for my hours worked per year?

As we’ve hinted at a few times here, to figure out your accurate work hours per year you’ll have to take into account paid holidays as well as any PTO taken off.

Let’s look at taking into account public holidays first. There are 11 federal vacation days across the United States:

- New Years Day

- Martin Luther King Jr Day

- George Washington’s Birthday

- Memorial Day

- Juneteenth

- Independence Day

- Labor Day

- Columbus Day

- Veterans Day

- Thanksgiving Day

- Christmas Day

Additionally, Inauguration Day counts as a 12th day off, but only for federal employees that work within the Washington, DC area. For everyone else, we can find the true amount of time we work by subtracting 11 vacation days’ worth of time from the total time expected to work (so long as no PTO is being used).

11 x 8-hour work days = 88 hours. That means in a standard year for a full-time employee, the number of hours you’ll work is not 2080, but rather 1992 hours. Once again, this is only true so long as you avoid taking any PTO.

Not all work schedules will be affected by vacation days in the same manner. If you’re not working on a typical 40-hour a week schedule and want to see how holiday hours impacted the total time you worked in a given year, you’ll need to find the number of days you were given off for holidays, then multiply that by the number of hours you would have worked on those days. Once you get this sum, you can subtract it from the total number of hours you would have worked that year maximum to get your true “hours I worked” value.

Lastly, we can add PTO hours taken into this equation using similar logic. Here’s the complete formula for solving how many hours you work per week (pay attention to parentheses and brackets):

Expected Hours of Work Per Year = (Your Working Hours Per Week x 52) – [(Holidays + Days of PTO) x Number of Working Hours Per Day]

Next, let’s walk you through this equation.

An in-depth look at time management.

So far, everything we’ve shown you is using estimates and expected values. But we also understand that you might want an even more precise understanding of how your time is spent, perhaps to re-evaluate your work-life balance, or to understand just what you’re getting out of your annual salary. So let’s breakdown the equation we provided above to demonstrate how hourly employees can calculate their work hours down to the second.

Step 1. Start tracking your hours over an average week.

There are two ways to go about this. Either you can begin by tracking your hours manually using spreadsheets or timesheets, while making sure to account for PTO and vacation days. Or, you can take the much easier option and use time tracking software.

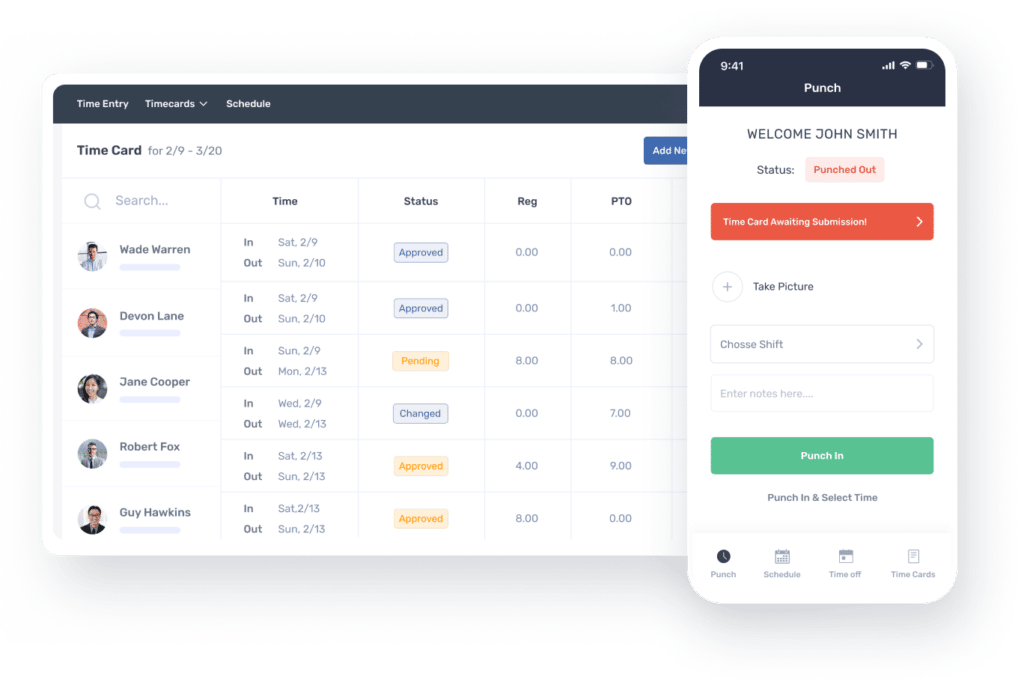

Time Tracking tools, such as our very own Buddy Punch, will automatically calculate your hours as you work. Additionally, they can be used to automatically take into account your PTO and vacation days. As such, they’ll be able to provide an accurate look of what your work year is going to look like later down the line.

Step 2. Multiply that weekly average by the # of weeks you work in a year.

For example, if you calculated that you work 30 hours in an average, uninterrupted week (no special circumstances like sick leave or a holiday interrupting things) then you can take that number and multiply it by the number of hours you work in a year. If you work every week without end, that’s 52. So your number would be 30 x 52 = 1560.

Not every American works 52 straight weeks. If you’re dealing with part-time employees for a seasonal job, you’ll need to swap out 52 for whatever number is accurate for you. For the sake of simplicity, we’ll continue using a standard 52-week work year for our examples.

Step 3. Take into account any holidays that fall on your workweek throughout the year.

The federal holidays offered to all U.S. employees include:

- New Years Day

- Martin Luther King Jr Day

- George Washington’s Birthday

- Memorial Day

- Juneteenth

- Independence Day

- Labor Day

- Columbus Day

- Veterans Day

- Thanksgiving Day

- Christmas Day

But you might want to check with your employer to see if you have other paid vacation time offerings according to your state or business. For example, some businesses allow their employees to have Christmas Eve off as well. Others offer a long grace period around certain holidays (Thanksgiving for example).

In any case, you’ll want to figure out how many days you’ll be given off over the year.

Step 4: Take into account PTO days.

Sick days, vacation days, jury duty and more, there are a ton of different paid time off types to consider. Even though the Fair Labor Standards Act (FLSA) doesn’t require employers to offer PTO at all, many do to stay competitive in the job market and attract highly skilled employees. As such, the amount of PTO you have access to will vary depending on the accrual systems your employer has in place.

So, figure out how much PTO you’re offered, then look at how much PTO you actually took off, and add those days to the holiday days.

Once you have the added value of your holiday days and PTO days, you want to multiply that by the number of hours you work a day. So, using the example above of an employee working 30 hours per week, that person is going to work 6 hours per day.

Their holiday day count should be added to their PTO day count, then multiplied by 6 to see how many hours they missed total.

Step 5: Complete The final Calculations

Following all the steps above, you’ll end up with our initially provided formula and be able to see the precise number of hours you work per year.

(Your Working Hours Per Week x 52) – [(Holidays + Days of PTO) x Number of Working Hours Per Day] = Precise Hours of Work Per Year.

Really puts into perspective how you’re earning that annual income.

Why Calculating Your Work Hours Matters

There are a couple of pressing reasons that we encourage all employees to make sure they’re tracking their work hours:

- If you’re working more or longer hours than you expect, you may be making less money than you deserve. Hourly pay is dependent on a steady, positive correlation between hours worked and money earned. If you’re working 30 hours per week and your hourly rate is $25 per hour, you get paid $750 per week. So, if you run the numbers and find out you’re actually effectively working 31 hours per week, all of a sudden your hourly rate isn’t really $25 per hour, it’s $24.19. That means every week you’re losing $0.81, every month you’re losing $3.20, and every year you’re robbed of $38.40 – over a week’s worth of your time and effort.

- In times of instability, work hours are often reduced before wages are. Instead of being asked to take a pay cut, you’re far more likely to be asked to cut down hours depending on what’s happening at your workplace (scheduling issues, economic instability, freak occurrences such as severe weather or even a pandemic.) Understanding how much money you’re losing in these moments can be critical to ensure these absences won’t lead to financial ruin. Instead, you’ll be able to make adjustments in your budgeting, work-life balance, and expectations to maintain your well-being.

- Employers and Employees both benefit from calculating work hours. If you find out you’re working more than you expected and getting paid less than you should, it’s probably not a malicious effort on an employers part. Employers are held to several standards by federal law as far as tracking and paying employees for time (such as the laws around overtime hours). Everyone from top to bottom benefits when work hours are accurately tracked and compensated for.

Make Calculating Your Work Time Easier

Now that we’ve completely broken down how to get your work hours calculated, one thing should be obvious: this is why people use time tracking software to make the entire process easy.

Time Tracking Tools come with many built in features that drastically simplify everything we’ve mentioned:

- Tracking hours worked throughout the week becomes automatic thanks to digital time tracking options. With Buddy Punch, clocking in as simple as a single button press.

- Many of these tools provide pay estimates and calculations. For example, Buddy Punch can provide an employee pay rate overview for managers and administrators.

- In the case of overtime hours and pay, Buddy Punch has two options: the Notifications feature for the purposes of warning an employee when they’re approaching overtime, and the Overtime Calculations feature to quickly view how much regular, overtime, or double overtime has been worked (and how much pay is due).

- Managing time off requests: you can create custom paid time off times and also benefit from self-service options for PTO. Employers are notified when requests are sent so they’ll never go unnoticed.

- In some cases, you can even count of these tools to handle the scheduling and payment of employees as well. Buddy Punch has scheduling features in addition to a built-in payroll option to guarantee timely payment of accurate paychecks.

In the case of a tool like Buddy Punch especially, there are plenty of other features to enjoy beyond time tracking. Other functions you have to get a handle on work hours include:

- GPS tracking

- Geofence time tracking

- Kiosk functionality

- Employee scheduling

- Break time tracker

- and much more

Buddy Punch functions on any device with an internet connection, including Windows and Mac Desktops, iOS or Android smartphones, and tablets. Have full access to your work hours anywhere – including from home.

If you ever have a question while handling our software, you can connect to our 24/7 customer support via the Buddy Punch Help Desk. Additionally, our Help Doc Center contains many articles that answer FAQs and ease your use of our software.

For Savvy Employees and Employers, Calculating Work Hours is Just a Matter of Time

As we’ve broken down in this post, there are so many benefits to calculating your work time – from making sure you’re being paid properly to simply being in a position to evaluate your work time vs your free time. This is why employees and employers alike should engage in the practice.

However, some people find it intimidating. Even with us breaking down work hours into charts and formulas, the fact there isn’t an easy answer to “how many work hours there are in a year” (or at least, not with pristine accuracy) can scare some away.

Which is where time tracking software comes to save the day. With a tool like our Buddy Punch, time tracking, scheduling, and even payroll become drastically simplified processes that anyone can do, putting the power of work hour calculation & accurate payments into everyone’s hands.

Try Buddy Punch Free

If you’re interested in using Buddy Punch to track work hours throughout the year, you can sign up for a 14-day free trial here. You can also view a demo video here or request a one-on-one walkthrough here.