Is Overtime Taxed? Overtime Tax Rules and 2026 Changes

Learn how overtime tax is calculated, dispel some common misconceptions, and discover what recent changes in 2026 mean for your business.

Overtime tax is a big source of frustration for employees and employers alike.

Workers pick up extra hours, expect a significant pay bump, and then feel disappointed when their paychecks are smaller than anticipated. Managers aren’t always sure how to explain it to their teams, and business owners often stress that payroll will become complex or noncompliant — especially as overtime rules change.

That’s what this guide is for. Below, I break down how overtime is taxed today, what updates impact overtime in 2026, and how to keep your payroll compliant and error-free.

The right software can help take the headache out of staying compliant with overtime tax rules. Buddy Punch makes it easy to accurately track employees’ hours, calculate overtime according to your rules, and export accurate data for smooth payroll processing. Sign up for a free trial to test it yourself.

Common overtime tax misconceptions

Let’s start by addressing common points of confusion around overtime tax.

Yes, overtime is taxed

Overtime is part of an employee’s wages, so it’s generally taxable — just like pay for regular hours.

If an employee owes federal income tax, overtime pay is typically subject to the usual withholding rules.

State and local income taxes may apply, too, depending on where the employee lives. Overtime wages are generally subject to Federal Insurance Contributions Act (FICA) taxes that fund Social Security and Medicare as well.

No, overtime isn’t taxed at a higher rate

Another widespread myth is that overtime hours have a special or higher tax rate. In most cases, that isn’t true. What makes overtime feel like it’s taxed more is higher withholding.

Withholding is what gets taken out of each paycheck as an estimate of what the employee will owe at the end of the year. When an employee earns more in a single pay period (because of overtime), the payroll system may withhold more tax from that paycheck. That’s because withholding formulas assume the higher earnings are the employee’s “new normal,” so they deduct more upfront.

Here’s what that can look like in practice:

- An employee earns $20/hour for a standard 40-hour workweek, totaling $800 per paycheck.

- They work five overtime hours at $30/hour, earning $150 extra.

- Withholding may increase because the total pay for the period ($950) is higher than usual ($800), not because the overtime hours are taxed at a higher rate.

As Hone John Tito, COO of KZG Group and Co-Founder of Game Host Bros, puts it, “The fact is the withholding calculation is simply too cautious.”

No, withholding isn’t the same as actual tax liability

The good news is that employees don’t automatically “lose” that money. Withholding is only an estimate, and the amount the employee actually owes in taxes is calculated when they file their return.

Jesse Singh, founder of Maadho, breaks it down:

“The IRS uses withholding tables that are designed around the idea that the employee will be working their regular hours all year round. So the withholding tables will calculate a higher amount of withholdings for all levels of federal and state tax withholdings, Social Security, and Medicare. Once the employee files their tax returns, they will see that there was an adjustment made for the year, and, therefore, the employee will owe the same amount of tax as they did in total taxable wages.”

That’s why an employee who worked overtime in December and had more withheld may receive a refund — or owe less than they expected — when they file, depending on their overall income and withholding for the year.

Yes, overtime and bonuses can be withheld differently

Many employees understand that bonuses can be withheld differently than regular pay, and it’s easy to assume overtime works the same way. But it doesn’t.

Bonuses are often treated as supplemental pay, which can be withheld using special methods. Meanwhile, overtime pay is typically treated as regular wages, combined with the rest of the paycheck, and run through standard withholding formulas.

The IRS allows employers to withhold taxes on supplemental wages in two ways:

- Flat rate method: A simple and predictable method, commonly 22% for federal income tax

- Aggregate method: A more dynamic option, where withholding is calculated based on total earnings per pay period

For example, a $500 bonus may have $110 being withheld under a flat 22% supplemental rate. But $500 in overtime pay may lead to a higher or lower amount being withheld, since that $500 is combined with regular pay and processed through standard withholding tables.

This explains why a bonus and overtime can show different take-home pay even though the extra pay is the same.

What’s changing in 2026

Payroll teams should be aware of the following updates that will impact overtime tax in 2026.

Temporary overtime deduction (2025–2028)

The overtime premium deduction introduced in 2025 will continue this year through 2028. It allows eligible employees to take a deduction for “qualified overtime compensation” when they file their federal tax returns.

Here’s what to know about the deduction:

- It generally applies only to the portion of overtime that exceeds the employee’s regular pay rate, known as the overtime premium. For example, if an employee is paid “time and a half” (1.5), the changes apply just to the extra “half” (0.5).

- It usually applies to overtime required by the Fair Labor Standards Act (FLSA).

- Its annual deduction limit is $12,500 for single filers and $25,000 for married people filing jointly.

- It starts phasing out at $150,000 annual income for single filers and $300,000 annual income for joint filers.

- It can be used whether someone itemizes deductions or not.

Importantly, this deduction usually reduces tax owed when filing, but it does not automatically reduce what’s taken out of each paycheck. If an employee expects a lot of overtime, they may want to adjust their Form W-4 so their withholding better matches what they expect to owe.

For even more information, read the full list of One Big Beautiful Bill Act (OBBBA) provisions and the overtime deduction fact sheet from January 2026.

Updated W-2 reporting

In January 2026, the IRS released a revised Form W-2 that includes a field to report total qualified overtime compensation: Box 12, code TT. That means employers need a reliable way to track qualified overtime premium separately, so they can total and report it correctly.

This change affects 2026 pay, which will be reported on W-2s issued in January 2027.

Permanent tax rate brackets

The federal income tax system uses seven marginal tax rates: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. These were meant to expire after 2025 under the Tax Cuts and Jobs Act (TCJA), but the OBBBA made them permanent, so they’ll apply in 2026.

A practical tax example

Imagine an employee works:

- 40 regular hours at $25/hour = $1,000

- Eight overtime hours at 1.5 times their standard wage ($37.50/hour) = $300

That puts gross pay at $1,300 for the week.

How to Calculate Overtime Pay: A Guide for Beginners

Overtime premium

Since the employee is paid time and a half for overtime, the portion that may qualify for deduction is just the extra 0.5 above the regular rate:

$37.50 − $25 = $12.50 premium per overtime hour

$12.50 × 8 hours = $100 premium total

So $100 is the overtime premium the employee may be able to deduct from their income tax if they’re eligible.

Withholding and take-home pay

Payroll will usually withhold taxes based on the full $1,300 paycheck. The overtime deduction doesn’t automatically reduce withholding unless the employee updates their Form W-4.

Using simple assumptions, withholding might look like this:

- $156.00 federal withholding (12% of $1,300)

- $65.00 state income tax (if applicable; assuming 5%)

- $99.45 FICA (7.65% of $1,300; this applies to all wages)

That’s $320.45 total withheld. So the employee’s take-home pay for the week is $979.55 ($1,300 − $320.45).

Deduction at filing

When the employee files their tax return, they may be able to deduct the $100 overtime premium from their taxable federal income. If their federal tax rate is 12%, the deduction could reduce their tax bill by $12 ($100 × 12%).

Why accurate time tracking matters more for overtime in 2026

Overtime taxes depend on correct overtime calculations. And correct calculations start with accurate time records.

If hours or overtime are tracked inconsistently, you can end up with payroll errors, reporting and withholding issues, and frustration from employees who are confused about their paychecks.

In 2026, this matters even more because employers may need to separately track and report qualified overtime compensation. With the other new rules as well, audits may be more common, making accuracy doubly important.

As Jason Vaught, Director of Content and Marketing at SmashBrand, explains:

“[In] 2026, employers need to immediately update their payroll systems to separately track qualified overtime compensation to meet new federal reporting requirements. Time tracking needs to be done accurately by employers because the deduction only applies to the FLSA-mandated premium portion of the overtime pay. Employers also need to have audit-capable payroll records to isolate the premium portion for every employee so that they can report that amount [on] the 2026 Form W-2.”

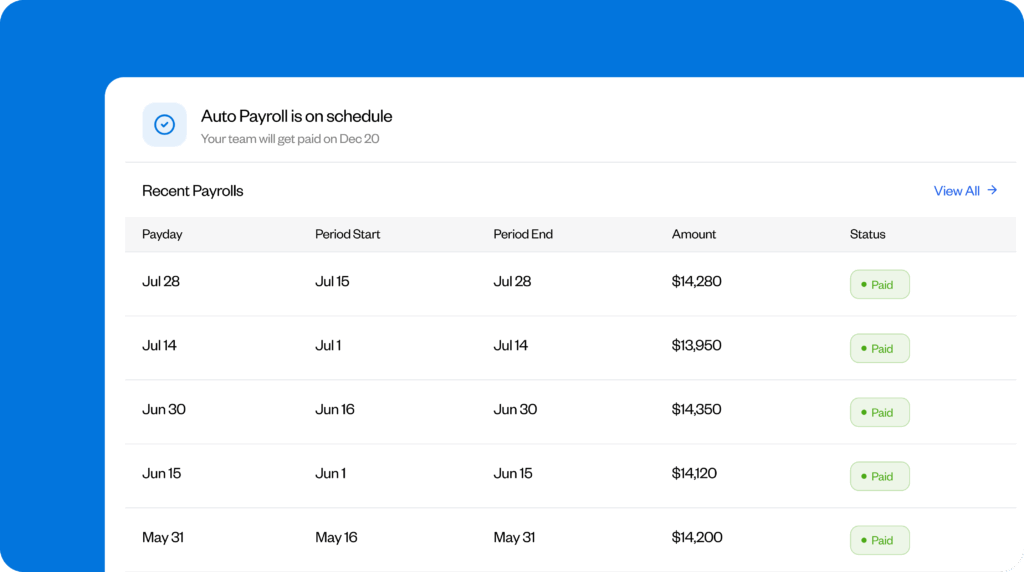

This is where a platform like Buddy Punch can help. Buddy Punch enables you to consistently track employees’ time, including overtime hours, apply overtime rules automatically, and export payroll-ready time data. That way, it’s easier to calculate the totals you need at the end of the year and answer questions when they come up.

To help you prepare for 2026 reporting, here’s a quick checklist:

- Confirm your payroll software is set up correctly, with the right configurations for today’s overtime rules.

- Be sure your time tracking accurately and consistently captures all hours worked, and that it can separately track overtime premiums.

- Encourage employees to update their Form W-4 if they anticipate working a lot of overtime (or, as a best practice, ask everyone to do this as a matter of course).

- Review W-2 Box 12/Code TT reporting, which is where you’ll report the overtime premiums.

- Check before finalizing payroll to catch any retroactive pay adjustments and avoid questions about unexpected withholding.

FAQs

Below, you’ll find answers to some common questions that employers and their employees have about overtime taxes rules.

Do I have to pay taxes on overtime?

In general, overtime is taxed the same as regular wages. However, due to a new law, overtime premiums (the extra “half” of “time and a half”) are deductible on an employee’s tax return (from 2025 to 2028). Employers still withhold federal income tax, however, unless an employee updates their Form W-4 accordingly.

Are tax rates changing for 2026?

Federal tax brackets and withholding rates themselves didn’t change in 2026. However, there have been updates to income thresholds that determine how much income falls into each bracket. Generally, these have shifted the brackets higher so that you can earn more before paying a higher tax rate. New withholding tables have also been released that account for new deductions, such as qualified overtime and tips.

How do you calculate overtime pay?

Typical overtime pay is 1.5 times the employee’s regular rate (though it may be higher based on your state’s overtime laws), paid for all hours over the threshold (for example, 40 hours per week). If an employee earns $25 per hour, their overtime rate is $37.50 for all hours above 40.

Final thoughts on overtime tax

Overtime taxes don’t have to be confusing for your business or your employees. When you track time consistently, apply overtime rules correctly, and maintain clean payroll records, it becomes much easier to calculate overtime pay, explain paychecks, and stay on top of reporting.

Tools like Buddy Punch can help by tracking time accurately and calculating overtime automatically so your payroll runs smoothly and disputes are less likely.

Contributors

- Hone John Tito, KZG Group, COO & Game Host Bros, Co-Founder

- Jesse Singh, Maadho

- Jason Vaught, SmashBrand, Director of Content & Marketing