What Are California Overtime Laws? Employer’s Guide

Understanding the California overtime laws is crucial for employers and employees to due to its significant impact on the workplace.

Here are the details of California laws for overtime 👇

| Aspect | Details |

| Regular Work Hours | California labor laws dictate that nonexempt employees, aged 18 or older, or minors aged 16 or 17 who are not required to attend school and are legally permitted to work, should not exceed 8 hours of work in a single day or 40 hours in a week without receiving overtime compensation. Overtime pay is set at 1.5 times the regular rate for any hours worked beyond 8 in a day or 40 in a week, with double time being applicable in specific circumstances. |

| Regular Rate of Pay | The regular rate of pay encompasses various forms of compensation, including hourly wages, salaries, piecework earnings, and commissions. It must always meet or exceed the applicable minimum wage. Calculation of the regular rate may involve hourly rates, monthly salaries, piece or commission rates, or a weighted average of multiple pay rates. |

| Exclusions from Regular Rate of Pay | Certain types of payments, such as gifts, expense reimbursements, and discretionary bonuses, are excluded from the regular rate of pay calculations. |

| Overtime for Salaried Employees | Salaried employees are entitled to receive overtime compensation unless exempted by specific laws or regulations. |

| Employer’s Right to Schedule Overtime | Employers generally possess the authority to schedule overtime hours and may take disciplinary action against employees who refuse scheduled overtime. |

| Payment for Overtime Hours | Overtime wages must be disbursed in the subsequent regular payroll period after they are earned, as mandated by California labor laws overtime. |

| Waiver of Overtime Compensation | Under California law, employees cannot waive their entitlement to overtime compensation, and any agreements attempting to do so are unenforceable. |

| Enforcement of Overtime Laws | Employees have the option to lodge wage claims with the Division of Labor Standards Enforcement (DLSE) or pursue legal action to recover any lost wages due to overtime violations. |

| Retaliation for Filing Wage Claims | In the event of employer retaliation against an employee for filing or threatening to file a wage claim, the affected employee can file a complaint of discrimination or retaliation with the Labor Commissioner’s Office or initiate legal proceedings to address the matter. |

Having an in-depth understanding of California overtime law help employers to avoid costly lawsuits and penalties.

Failure to comply with these laws can have significant financial consequences for businesses.

The top three key issues that understanding California overtime laws resolves for new employees and organizations include:

- Compliance: Understanding the law helps organizations comply with the state’s labor regulations, avoiding legal disputes and penalties.

- Fair Compensation: Employees are assured they will be paid fairly for any overtime work, promoting a positive work environment.

- Dispute Resolution: Clear knowledge of overtime laws enables organizations and employees to resolve disputes swiftly and fairly, maintaining healthy employer-employee relationships.

Try Buddy Punch For Free

| What is California Overtime Law? |

| California overtime law requires employers to pay eligible employees overtime for any hours worked beyond the 40-hour workweek. In California, overtime must be paid at 1.5 times the standard pay rate for all hours worked over eight on a weekday, over 40 in a workweek, and for the first 8 hours on the seventh day of work. Employees who work more than 12 hours on a weekday or more than 8 hours on the seventh day in a row must be paid twice their regular pay rate. |

Fair Labor Standards Act (FLSA) and the California Labor Code

In addition to the intricacies of California overtime law, employers and employees alike must familiarize themselves with employment laws as well.

This includes understanding the provisions of the Fair Labor Standards Act (FLSA) and the California Labor Code, which dictate regulations surrounding full-time employment, the number of hours constituting a standard workweek, and the regular hourly rate.

The FLSA, alongside California labor laws, sets the framework for hour laws, ensuring that employees are fairly compensated for their time and labor.

It mandates that overtime pay, typically at 1.5 times the regular hourly rate, be provided for any hours worked beyond the standard 40-hour workweek.

This encompasses scenarios where employees exceed eight hours in a single workday, 40 hours within a workweek, or the first eight hours on the seventh consecutive day of work.

Moreover, California labor law overtime stipulates that employees who work beyond 12 hours in a single workday or exceed eight hours on the seventh day of consecutive work must be compensated at twice their regular pay rate.

Employers and employees must be diligent in adhering to these regulations to ensure compliance and uphold the rights and protections afforded by employment law.

How Do California Labor Laws Differ From Federal Overtime Regulations?

The overtime restrictions in California are different from those in the federal government in a few significant ways.

While California required overtime pay for hours exceeding 8 in a workday and for the first 8 hours worked on the seventh consecutive day of work in a workweek, federal law requires overtime pay for hours worked beyond 40.

Furthermore, California mandates double pay for any hours worked past twelve in a workday and beyond eight on the seventh day in a row.

What is the 4 10 Rule in California?

In California, an alternate work schedule known as the “4 10 rule” is used, in which workers work four 10-hour days as opposed to five 8-hour days.

Employees follow this routine, putting in 10 hours a day, four days a week, and then taking three days off.

Even though the 4-10 rule can have advantages, such as longer weekends and shorter commutes, it’s crucial to comprehend how it impacts overtime compensation.

Who is Eligible for Overtime Pay in California State?

According to California’s labor rules, most employees are entitled to overtime compensation.

Non-exempt workers carry out non-managerial, non-executive, and non-administrative duties in exchange for hourly pay or salaries.

Exempt workers, who generally fall under specific categories outlined by California law, are not entitled to overtime compensation. They may be executive, administrative, or professional workers.

Types of Employees Covered by California Overtime Laws

Following are the types of employees covered by California laws for overtime.

1. Exempt Employees

California overtime laws do not cover exempt employees entitled to overtime pay.

To qualify as exempt, employees must meet specific criteria regarding their job duties and salary level.

2. Non-Exempt Employees

Non-exempt employees are covered by California overtime laws and are entitled to overtime pay for hours worked beyond the standard 8-hour workday.

These employees are typically paid hourly wages and perform non-managerial, non-executive, or non-administrative tasks.

What Exemptions Exist Under California Overtime Law?

California overtime law provides exemptions from overtime pay requirements for certain categories of employees.

These exemptions are based on the nature of the work performed and the employee’s salary level.

Some common exemptions under California law include:

- Executive Exemption: Employees primarily manage the business or a department, direct the work of other employees, and have the authority to hire or fire employees.

- Administrative Exemption: Employees whose primary duties involve office or non-manual work directly related to management policies or general business operations and require the exercise of discretion and independent judgment.

- Professional Exemption: Employees in learned or artistic professions whose work requires advanced knowledge in science, learning, or artistic creativity.

Here are some more details:

| Exemption | Description |

| Alternative Workweek Schedule | Employees subject to a validly adopted alternative workweek schedule may not receive overtime for regular schedules of up to 10 hours per workday within a 40-hour workweek. Overtime is required for hours beyond the established schedule, with different rates for various thresholds. |

| Healthcare Industry | Employees in the healthcare industry under Order 5 may work up to 12 hours per workday within a 40-hour workweek without overtime pay, with conditions. Other specific exemptions apply to employees working in hospitals or establishments primarily caring for the sick, aged, or mentally ill. |

| Ambulance Drivers and Attendants | Ambulance drivers and attendants scheduled for 24-hour shifts, with agreed-upon meal and sleeping periods, are exempt from daily overtime. |

| Ski Establishment Employees | Ski establishment employees may have a scheduled workweek of up to 48 hours, with overtime pay for hours exceeding 10 in a workday or 48 in a workweek. |

| Extra Players | Extra players are entitled to overtime pay for hours worked beyond specified thresholds in a workday. |

| Minors (Non-School Attendees) | Minors, except those required by law to attend school, receive overtime pay for all hours worked on the sixth consecutive workday. |

| Agricultural Workers | Agricultural workers are subject to phased-in overtime thresholds, reaching 8 hours per day and 40 hours per week by 2022 or 2025, with double time after 12 hours in a day. Additional provisions apply to specific roles like sheepherders and irrigators. |

| Live-In and Non-Live-In Employees | Live-in employees receive overtime for specific off-duty hours worked, while non-live-in household employees are exempt from overtime on the seventh consecutive workday if weekly hours do not exceed 30 and daily hours do not exceed six. |

How Are Overtime Hours Calculated In California For Daily and Weekly Overtime?

Following are the ways to calculate overtime hours.

1. Standard Workweek

The regular workweek, defined under California overtime legislation, is seven days in a row, beginning on the same calendar day every week.

The first eight hours worked are also eligible for overtime compensation on the seventh day of a workweek.

2. Overtime Threshold

In California, most workers are eligible for overtime compensation for any hours worked above eight in a workday, forty in a workweek, and the first eight hours on the seventh day of a workweek in a row.

One exception is employees who meet the income level and work primarily in executive, administrative, or professional capacities.

3. Overtime Rate

Employees not excluded from California’s overtime laws are entitled to overtime pay equal to 1.5 times their regular pay rate for any hours worked over 8 in a workday.

Employees are entitled to twice their regular pay rate for hours worked beyond twelve in a workday and beyond eight on the seventh consecutive day of work.

4. Calculating Overtime Hours (Either Daily or Weekly)

The amount of overtime earned in California is determined by adding up all the hours worked in a workday and workweek. Employees who are not excluded from overtime pay are eligible to:

- Hours spent in a workday that exceed eight.

- Above 40 hours put in during a workweek.

- The first eight hours of a workweek’s seventh day of work.

Employers must precisely log and compute overtime hours to ensure compliance with California overtime rules and prevent possible legal concerns.

5. Total Overtime Pay

In California, the total overtime pay is determined by multiplying the number of overtime hours worked by the employee’s regular pay rate.

Employers must compute total overtime pay accurately to comply with California labor rules and stay out of trouble.

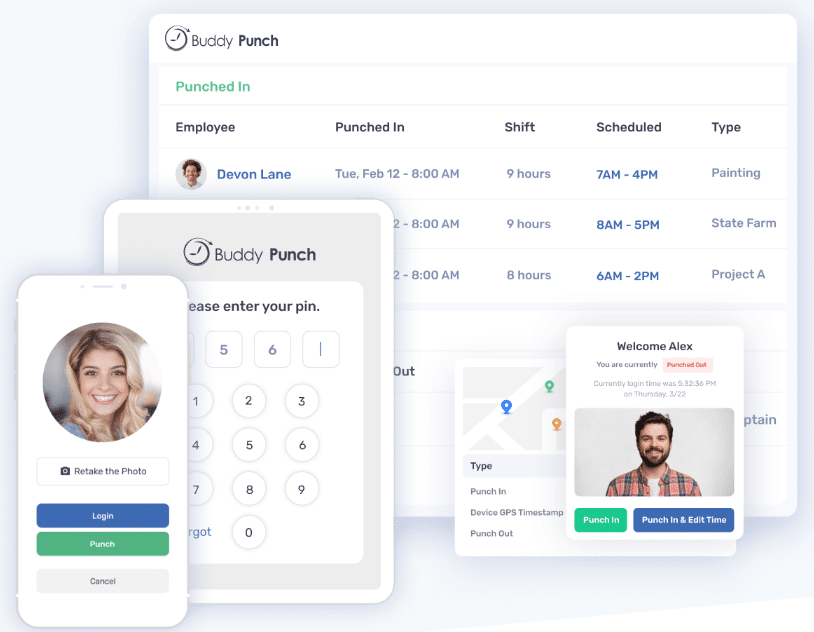

How Can You Use a Buddy Punch (Time Tracking Software) To Calculate Overtime?

Buddy Punch offers small businesses in California a streamlined approach to calculating overtime for their full-time and independent contractors.

By automating calculations based on California’s overtime laws, including meal breaks and wage rates, the software simplifies the process for employers.

It handles various types of overtime, ensuring accurate compensation for employees who work beyond standard hours.

1. Tracking Overtime Thresholds

One key feature of Buddy Punch is its ability to track hours worked beyond specific thresholds set by California labor laws, as outlined in state laws and wage orders.

For example, in California, any hours worked beyond eight in a single day are considered overtime for one-half times the regular rate for outside salespersons.

Similarly, hours worked beyond 40 in a week also qualify for overtime pay. Buddy Punch accurately tracks these hours and applies the appropriate overtime rates, helping small businesses remain compliant with state regulations.

2. Applying Overtime Rates

California law requires employers to pay overtime at a rate of 1.5 times the employee’s regular rate of pay for hours worked beyond standard thresholds.

Buddy Punch automatically applies these rates, ensuring that employees receive the correct compensation for their overtime hours.

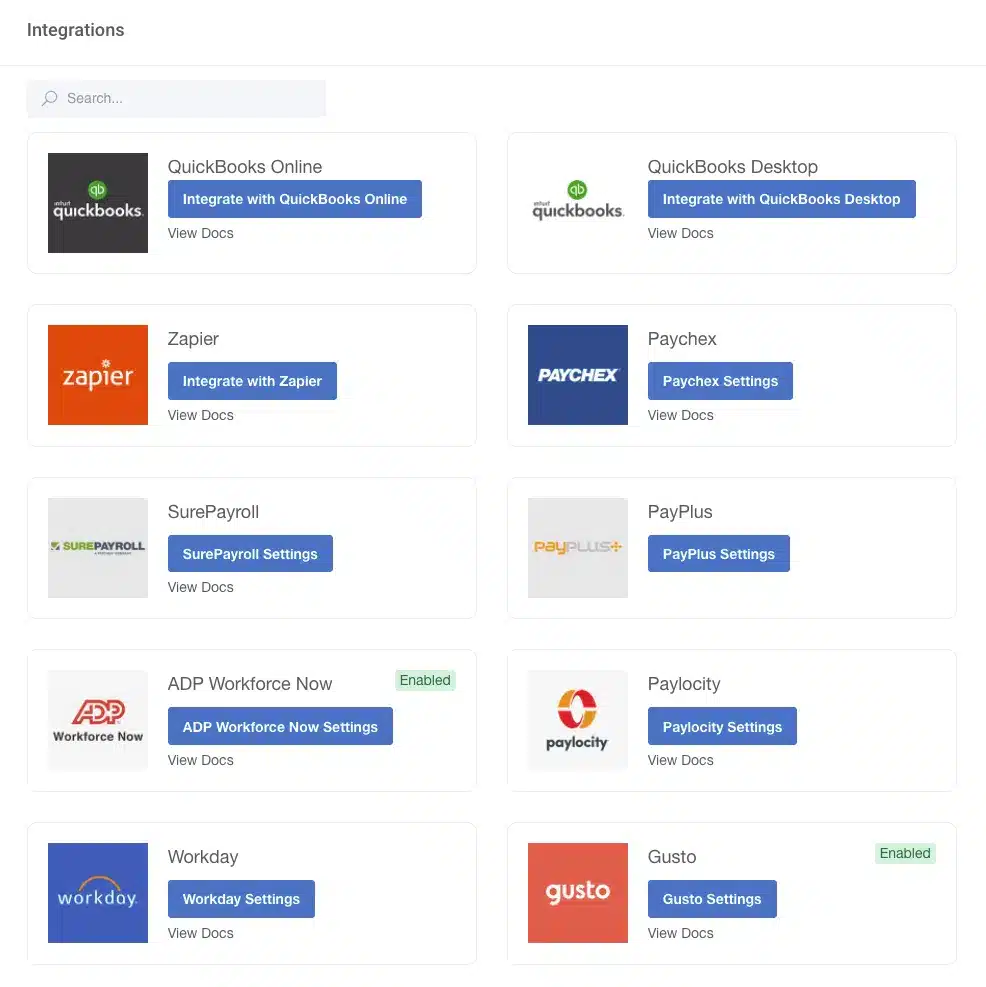

3. Integration with Payroll Systems

Another benefit of using Buddy Punch for overtime calculation is its seamless integration with existing payroll systems, ensuring adherence to wage orders.

This integration streamlines the payroll process by automatically transferring data from Buddy Punch to the payroll system.

This not only saves time but also minimizes the potential for errors in overtime calculations and ensures accurate payment to employees.

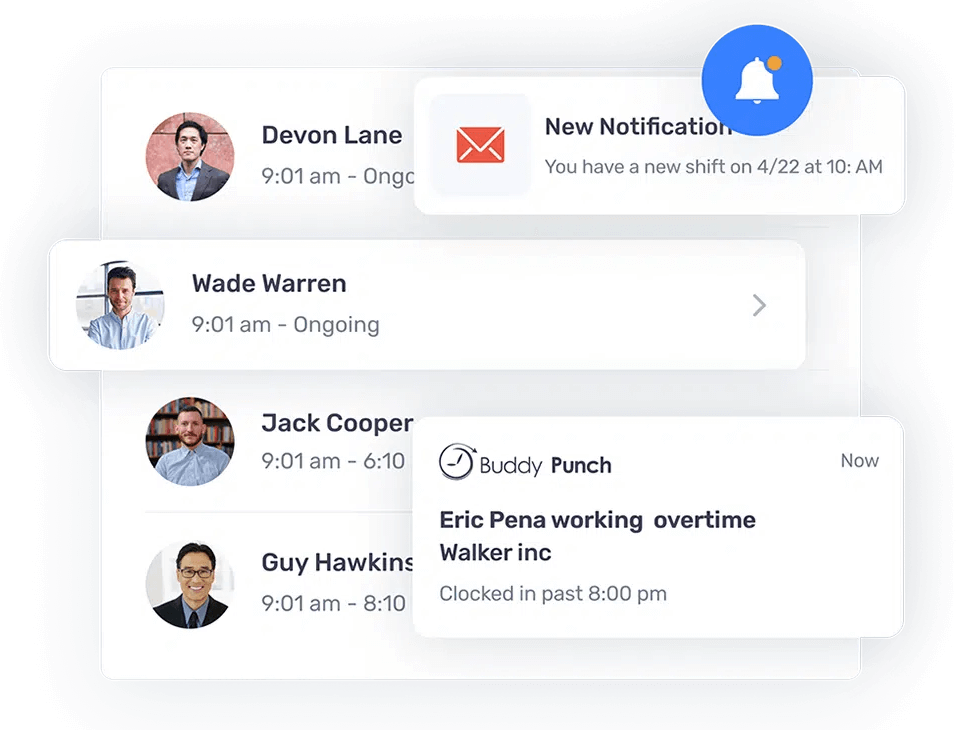

4. Adherence to Labor Laws

Buddy Punch helps small businesses in California stay compliant with labor laws and regulations, including wage orders and state laws concerning independent contractors.

The software is regularly updated to reflect any changes in California’s overtime laws, ensuring that employers are always aware of their legal obligations.

By providing accurate and compliant overtime calculations, Buddy Punch helps foster a fair and transparent working environment, building trust between employers and employees.

5. Efficient Payroll Processing

In addition to ensuring compliance with labor laws, Buddy Punch also streamlines payroll processing for small businesses.

By automating overtime calculations and integrating seamlessly with payroll systems, the software reduces the time and effort required to process payroll.

This allows small businesses to focus on other aspects of their operations while ensuring that employees are accurately compensated for their work.

Buddy Punch’s Online Reviews

As of now, Buddy Punch has a total of 946 reviews on Capterra and holds a strong rating of 4.8 out of 5 stars.

Here’s what some of the customers had to say about Buddy Punch,

“We needed a new solution for timekeeping and Buddy Punch came through! Onboarding and integration was so easy. Once I figured out all the setting options, it’s really easy to customize to exactly what you need. Employees love using it because it’s so straight forward to use.”

Click here to read the full review

“BuddyPunch has been very helpful and I am glad my organization made the switch from our previous tracker to BuddyPunch. As mentioned earlier, the ease of use of BuddyPunch is what separates it from a lot of competitors.”

Click here to read the full review

“Easy to clock in from anywhere and still manage how much time you’ve worked in a day. Easily tells you when you’ve gone past 8hrs, and also great for seeing when your team members are clocked in or out.”

Click here to read the full review

Try Buddy Punch for Free

Ready to give Buddy Punch a try?

For free trial, no credit card required.

If you feel that Buddy Punch might be the right fit for your business, sign up for a 14 day free trial (no credit card needed). You can also book a one-on-one demo, or view a pre-recorded demo video.

What Are The Penalties For Violating California Overtime Laws?

Employers who violate California’s overtime laws risk facing severe penalties.

Employers who underpay their workers for overtime may be forced to reimburse them for all unpaid earnings, including overtime and any double-time pay due.

California’s Division of Labor Standards Enforcement (DLSE) may also impose penalties on companies.

These sanctions may consist of:

- Civil Penalties: Employers may be forced to pay civil penalties for every violation of a California labor regulation. The fines for each infraction can vary from hundreds to thousands of dollars.

- Liquidated Damages: Liquidated damages are extra damages that an employer may be forced to pay in addition to the amount of overdue wages owing to an employee.

- Attorney’s Fees and Costs: California labor laws may impose obligations on employers who violating California overtime laws can result in significant penalties for employers.

- Attorney’s Fees and Costs: If an employer violates California labor regulations, they may also be liable for the employee’s legal fees and other costs incurred in pursuing a claim for unpaid wages.

- Criminal Penalties: Employers knowingly breaking California labor regulations may be subject to fines and jail time in certain situations.

How Do California’s Overtime Laws Impact Small Businesses?

California’s overtime regulations can have a big effect on small enterprises, especially regarding compliance and labor expenditures.

When an eligible employee works more than eight hours in a workday, small firms must pay overtime at 1.5 times their regular pay rate.

This need may result in higher labor expenditures for small enterprises, particularly if staff members routinely work extra hours.

How Do California’s Overtime Laws Apply To Different Industries?

In California, overtime laws apply universally across industries, encompassing both blue and white collar sectors.

Whether you’re in manufacturing, hospitality, healthcare, or an office-based enterprise, the California Department of Industrial Relations mandates adherence to these regulations.

Hourly employees are entitled to overtime pay for hours worked beyond the standard 40-hour workweek, as stipulated by the Industrial Welfare Commission (IWC). This includes provisions for rest breaks, ensuring employees aren’t overworked or undercompensated for their time.

Employers must also be vigilant regarding piece-rate compensation, ensuring it complies with legal standards to avoid potential legal disputes.

Furthermore, California’s minimum wage requirements and protections for weekly salaried employees extend to all industries, safeguarding workers’ rights across the board.

Whether seeking legal advice or navigating the complexities of unpaid overtime, employers must prioritize compliance with these regulations to uphold fair labor practices and avoid legal repercussions.

How Do California’s Overtime Laws Affect Remote Workers Or Employees Working From Home?

The same overtime regulations that apply to employees working in physical locations also apply to remote workers and workers from home.

Employers are responsible for ensuring remote employees precisely track their hours and receive overtime compensation as needed.

There may be fines and legal repercussions for remote workers who violate California’s overtime regulations.

What Should I Do If My Employer Refuses To Pay Me Overtime?

You can do a few things in California if your employer won’t pay you overtime.

You should first address the issue with your company or the HR department to fix it internally.

You can file a wage claim with the California Division of Labor Standards Enforcement (DLSE) if your employer refuses to pay.

The DLSE will review your application and might even arrange a hearing to determine whether you are entitled to overtime pay.

Frequently Asked Questions (FAQs)

Can you terminate a California employee for refusing to work overtime?

In California, employers generally cannot terminate an employee for refusing to work overtime.

However, there may be exceptions depending on the specific circumstances and the terms outlined in the employment contract or collective bargaining agreement.

It’s essential for employers to adhere to California labor laws and any applicable regulations regarding termination and overtime.

It’s important to note that an employee’s refusal to work overtime might impact their annual salary, as overtime hours could contribute to their total hours worked in a year.

Employers should provide clear communication about expectations regarding regular hours and hours of overtime.

Can an employer force a California employee to take comp time pay instead of overtime pay?

No, in California, employers cannot force employees to take compensatory (comp) time instead of overtime pay.

California labor laws require that non-exempt employees be paid overtime wages for any hours worked beyond the standard workweek or workday limits.

Comp time is not a legally acceptable substitute for overtime pay in California.

It’s crucial for employers to accurately calculate overtime wages, including any nondiscretionary bonus that may affect the weekly salary of an employee.

If a California employee works unauthorized overtime, is the employer obligated to pay for it?

Yes, if a California employee works unauthorized overtime, the employer is generally obligated to pay for it.

According to California labor laws, non-exempt employees are entitled to overtime pay for all hours worked beyond the standard workweek or workday limits, regardless of whether the overtime was authorized by the employer.

Employers are responsible for accurately tracking and compensating employees for all hours worked, including any overtime hours.

It’s imperative for employers to include a disclaimer in their policies regarding unauthorized overtime and the consequences it may have on an employee’s total hours worked and weekly salary.

Conclusion,

California’s overtime regulations are intended to safeguard employees and guarantee that they receive just compensation for their labor.

These rules cover all professions and worker categories, including remote and home-based workers.

Employers and employees must know California’s overtime requirements to guarantee equitable treatment and adherence to state labor laws.