This guide is for informational purposes only and is not intended to be legal advice. Consult an employment attorney or your state’s labor division for more information.

Updated January 15, 2026

Put overtime tracking on autopilot with Buddy Punch. It tracks your employees hours, automatically identifies overtime hours based on your policies, and calculates total pay for you. It can even alert you when employees are nearing overtime so you can shift schedules and avoid unexpected labor costs. Learn more about our overtime tracking software or start your free trial today!

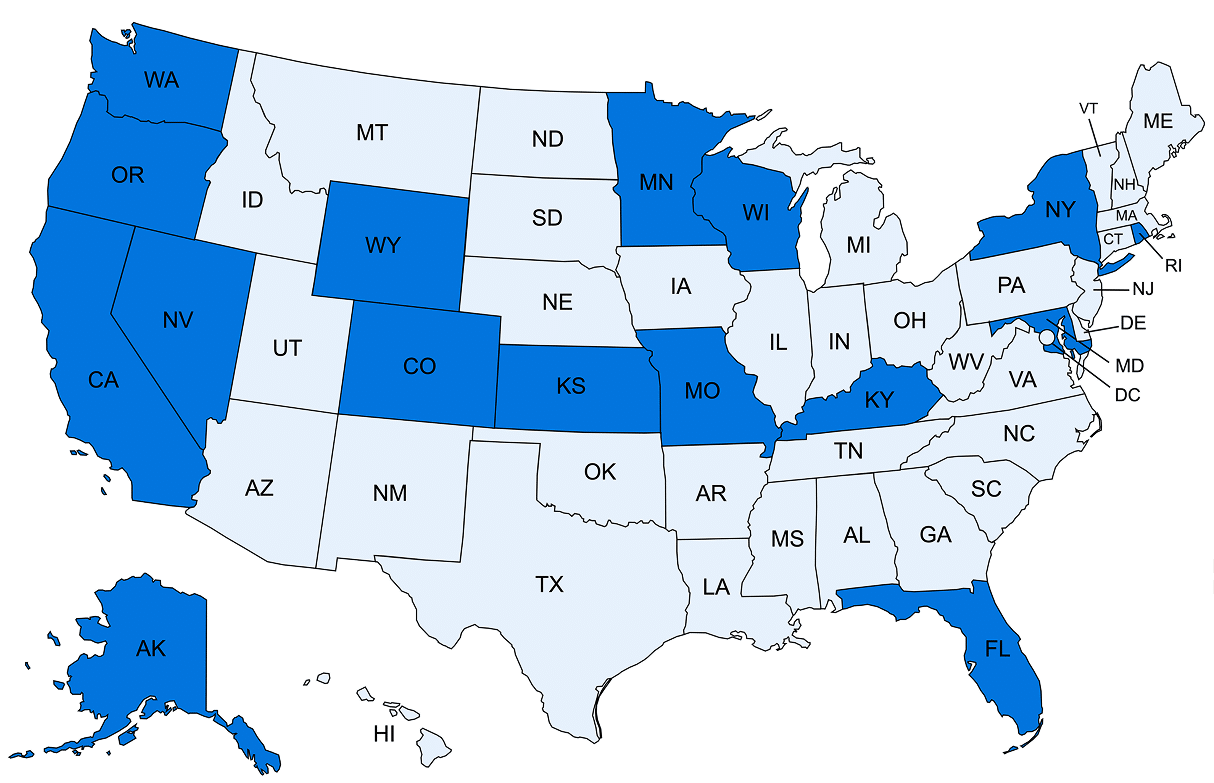

Overtime laws for each U.S. state

Alabama

Alabama follows federal FLSA guidelines for overtime. Non-exempt employees must earn at least 1.5 times their regular hourly rate for all hours worked beyond 40 in a single workweek. A workweek is defined as a fixed, recurring period of 168 hours (seven consecutive days).

Alaska

Alaska has both daily and weekly overtime requirements. Employees must be paid at least 1.5 times their regular hourly rate for all hours worked beyond eight in a single day or 40 in a single workweek.

However, some roles and types of businesses are exempt from these rules, such as businesses with fewer than four employees. Learn more about other exemptions by contacting the Alaska Department of Labor and Workforce Development, Labor Standards and Safety Division.

Arizona

Arizona follows federal FLSA guidelines for overtime. Non-exempt employees must earn at least 1.5 times their regular hourly rate for all hours worked beyond 40 in a single workweek. A workweek is defined as a fixed, recurring period of 168 hours (seven consecutive days).

Arkansas

Arkansas follows federal FLSA guidelines for overtime. Non-exempt employees must earn at least 1.5 times their regular hourly rate for all hours worked beyond 40 in a single workweek. A workweek is defined as a fixed, recurring period of 168 hours (seven consecutive days).

California

Employees in California must be paid at least 1.5 times their regular hourly rate for all hours worked beyond eight (but less than 12) in a single workday or 40 in a single workweek. If an employee works more than 12 hours in a workday, they must be paid double their regular hourly rate for any hours in excess of 12.

Additionally, if an employee works seven consecutive days in a row, on their seventh day of work, they’re entitled to 1.5 times their normal hourly rate for the first eight hours of work that day, and double their regular hourly rate for any hours in excess of eight.

There are some exemptions to these overtime rules. Contact California’s Department of Industrial Relations for more information.

Colorado

Colorado has overtime laws that apply to the number of consecutive hours worked and the number of hours worked per week. A rate of at least 1.5 times an employee’s normal hourly rate must be paid when an employee works more than 12 consecutive hours during a shift (even if those hours are worked across multiple workdays) or more than 40 hours in a single workweek.

Connecticut

Connecticut follows federal FLSA guidelines for overtime. Non-exempt employees must earn at least 1.5 times their regular hourly rate for all hours worked beyond 40 in a single workweek. A workweek is defined as a fixed, recurring period of 168 hours (seven consecutive days).

Delaware

Delaware follows federal FLSA guidelines for overtime. Non-exempt employees must earn at least 1.5 times their regular hourly rate for all hours worked beyond 40 in a single workweek. A workweek is defined as a fixed, recurring period of 168 hours (seven consecutive days).

Florida

Most businesses in Florida must follow federal FLSA guidelines for overtime. Non-exempt employees must earn at least 1.5 times their regular hourly rate for all hours worked beyond 40 in a single workweek. A workweek is defined as a fixed, recurring period of 168 hours (seven consecutive days).

However, Florida does have a specific law for employees who perform manual labor. This law states that overtime must be paid to these workers when they exceed 10 hours of work in a day unless a written contract that requires a greater number of hours to be worked daily has been signed by the employee.

Georgia

Georgia follows federal FLSA guidelines for overtime. Non-exempt employees must earn at least 1.5 times their regular hourly rate for all hours worked beyond 40 in a single workweek. A workweek is defined as a fixed, recurring period of 168 hours (seven consecutive days).

Hawaii

Hawaii follows federal FLSA guidelines for overtime. Non-exempt employees must earn at least 1.5 times their regular hourly rate for all hours worked beyond 40 in a single workweek. A workweek is defined as a fixed, recurring period of 168 hours (seven consecutive days).

Idaho

Idaho follows federal FLSA guidelines for overtime. Non-exempt employees must earn at least 1.5 times their regular hourly rate for all hours worked beyond 40 in a single workweek. A workweek is defined as a fixed, recurring period of 168 hours (seven consecutive days).

Illinois

Illinois follows federal FLSA guidelines for overtime. Non-exempt employees must earn at least 1.5 times their regular hourly rate for all hours worked beyond 40 in a single workweek. A workweek is defined as a fixed, recurring period of 168 hours (seven consecutive days).

Indiana

Indiana follows federal FLSA guidelines for overtime. Non-exempt employees must earn at least 1.5 times their regular hourly rate for all hours worked beyond 40 in a single workweek. A workweek is defined as a fixed, recurring period of 168 hours (seven consecutive days).

Iowa

Iowa follows federal FLSA guidelines for overtime. Non-exempt employees must earn at least 1.5 times their regular hourly rate for all hours worked beyond 40 in a single workweek. A workweek is defined as a fixed, recurring period of 168 hours (seven consecutive days).

Kansas

Kansas state law requires overtime pay for all hours worked beyond 46 in a workweek. However, FLSA rules may supersede the state law for your business. Contact the federal Wage and Hour Division to find out if federal laws apply to your business.

Kentucky

Non-exempt employees in Kentucky must earn at least 1.5 times their regular hourly rate for all hours worked beyond 40 in a single workweek. Additionally, if an employee works seven consecutive days, they must be paid at least 1.5 times their regular hourly rate for all hours worked on the seventh day.

Some exceptions apply. Contact the Kentucky Education and Labor Cabinet, Division of Wages and Hours for more information on exceptions.

Louisiana

Louisiana follows federal FLSA guidelines for overtime. Non-exempt employees must earn at least 1.5 times their regular hourly rate for all hours worked beyond 40 in a single workweek. A workweek is defined as a fixed, recurring period of 168 hours (seven consecutive days).

Maine

Maine follows federal FLSA guidelines for overtime. Non-exempt employees must earn at least 1.5 times their regular hourly rate for all hours worked beyond 40 in a single workweek. A workweek is defined as a fixed, recurring period of 168 hours (seven consecutive days).

Maryland

Most businesses in Maryland must follow federal FLSA guidelines for overtime. Non-exempt employees must earn at least 1.5 times their regular hourly rate for all hours worked beyond 40 in a single workweek. A workweek is defined as a fixed, recurring period of 168 hours (seven consecutive days).

However, there is also a state law that requires agriculture employees to be paid overtime when working over 60 hours in a workweek even if those employees are exempt from FLSA overtime requirements. You can learn more by contacting the Maryland Department of Labor, Division of Labor and Industry, Employment Standards Unit.

Massachusetts

Massachusetts follows federal FLSA guidelines for overtime. Non-exempt employees must earn at least 1.5 times their regular hourly rate for all hours worked beyond 40 in a single workweek. A workweek is defined as a fixed, recurring period of 168 hours (seven consecutive days).

Michigan

Michigan follows federal FLSA guidelines for overtime. Non-exempt employees must earn at least 1.5 times their regular hourly rate for all hours worked beyond 40 in a single workweek. A workweek is defined as a fixed, recurring period of 168 hours (seven consecutive days).

Minnesota

Most businesses in Minnesota must follow federal FLSA guidelines for overtime. Non-exempt employees must earn at least 1.5 times their regular hourly rate for all hours worked beyond 40 in a single workweek. A workweek is defined as a fixed, recurring period of 168 hours (seven consecutive days).

However, Minnesota also has a state law that requires overtime to be paid to employees when working more than 48 hours in a workweek. This rule may apply to your business if the exemptions in the federal FLSA do not match Minnesota’s FLSA. Contact the Minnesota Department of Labor and Industry for more information.

Mississippi

Mississippi follows federal FLSA guidelines for overtime. Non-exempt employees must earn at least 1.5 times their regular hourly rate for all hours worked beyond 40 in a single workweek. A workweek is defined as a fixed, recurring period of 168 hours (seven consecutive days).

Missouri

Non-exempt employees in Missouri must earn at least 1.5 times their regular hourly rate for all hours worked beyond 40 in a single workweek. Additionally, employees of an amusement or recreation business may be owed 1.5 times their regular compensation for any hours worked in excess of 52 in any one-week period even if they’re exempt from overtime according to federal FLSA regulations.

Montana

Montana follows federal FLSA guidelines for overtime. Non-exempt employees must earn at least 1.5 times their regular hourly rate for all hours worked beyond 40 in a single workweek. A workweek is defined as a fixed, recurring period of 168 hours (seven consecutive days).

Nebraska

Nebraska follows federal FLSA guidelines for overtime. Non-exempt employees must earn at least 1.5 times their regular hourly rate for all hours worked beyond 40 in a single workweek. A workweek is defined as a fixed, recurring period of 168 hours (seven consecutive days).

Nevada

Non-exempt employees in Nevada must earn at least 1.5 times their regular hourly rate for all hours worked beyond 40 in a single workweek. Additionally, employees who earn less than $18 per hour must be paid 1.5 times their regular hourly rate when they work more than eight hours in a single workday.

New Hampshire

New Hampshire follows federal FLSA guidelines for overtime. Non-exempt employees must earn at least 1.5 times their regular hourly rate for all hours worked beyond 40 in a single workweek. A workweek is defined as a fixed, recurring period of 168 hours (seven consecutive days).

New Jersey

New Jersey follows federal FLSA guidelines for overtime. Non-exempt employees must earn at least 1.5 times their regular hourly rate for all hours worked beyond 40 in a single workweek. A workweek is defined as a fixed, recurring period of 168 hours (seven consecutive days).

New Mexico

New Mexico follows federal FLSA guidelines for overtime. Non-exempt employees must earn at least 1.5 times their regular hourly rate for all hours worked beyond 40 in a single workweek. A workweek is defined as a fixed, recurring period of 168 hours (seven consecutive days).

New York

Non-exempt employees in New York must earn at least 1.5 times their regular hourly rate for all hours worked beyond 40 in a single workweek. Additionally, residential workers (people who live in the home of their employer) must be paid at least 1.5 times their regular hourly rate for all hours worked beyond 44 in a single workweek, even if they’re exempt from federal FLSA overtime regulations.

North Carolina

North Carolina follows federal FLSA guidelines for overtime. Non-exempt employees must earn at least 1.5 times their regular hourly rate for all hours worked beyond 40 in a single workweek. A workweek is defined as a fixed, recurring period of 168 hours (seven consecutive days).

North Dakota

North Dakota follows federal FLSA guidelines for overtime. Non-exempt employees must earn at least 1.5 times their regular hourly rate for all hours worked beyond 40 in a single workweek. A workweek is defined as a fixed, recurring period of 168 hours (seven consecutive days).

Ohio

Ohio follows federal FLSA guidelines for overtime. Non-exempt employees must earn at least 1.5 times their regular hourly rate for all hours worked beyond 40 in a single workweek. A workweek is defined as a fixed, recurring period of 168 hours (seven consecutive days).

Oklahoma

Oklahoma follows federal FLSA guidelines for overtime. Non-exempt employees must earn at least 1.5 times their regular hourly rate for all hours worked beyond 40 in a single workweek. A workweek is defined as a fixed, recurring period of 168 hours (seven consecutive days).

Oregon

Non-exempt employees in Oregon must earn at least 1.5 times their regular hourly rate for all hours worked beyond 40 in a single workweek. Additionally, there are some state-specific overtime rules for certain types of workers in agriculture and manufacturing that may require overtime to be paid even if the employee is exempt from federal FLSA requirements. Contact the Oregon Bureau of Labor and Industries for more information.

Pennsylvania

Pennsylvania follows federal FLSA guidelines for overtime. Non-exempt employees must earn at least 1.5 times their regular hourly rate for all hours worked beyond 40 in a single workweek. A workweek is defined as a fixed, recurring period of 168 hours (seven consecutive days).

Rhode Island

Non-exempt employees in Rhode Island must earn at least 1.5 times their regular hourly rate for all hours worked beyond 40 in a single workweek. Additionally, retail employees must be paid 1.5 times their regular hourly rate for any hours worked on either a Sunday or a holiday.

South Carolina

South Carolina follows federal FLSA guidelines for overtime. Non-exempt employees must earn at least 1.5 times their regular hourly rate for all hours worked beyond 40 in a single workweek. A workweek is defined as a fixed, recurring period of 168 hours (seven consecutive days).

South Dakota

South Dakota follows federal FLSA guidelines for overtime. Non-exempt employees must earn at least 1.5 times their regular hourly rate for all hours worked beyond 40 in a single workweek. A workweek is defined as a fixed, recurring period of 168 hours (seven consecutive days).

Tennessee

Tennessee follows federal FLSA guidelines for overtime. Non-exempt employees must earn at least 1.5 times their regular hourly rate for all hours worked beyond 40 in a single workweek. A workweek is defined as a fixed, recurring period of 168 hours (seven consecutive days).

Texas

Texas follows federal FLSA guidelines for overtime. Non-exempt employees must earn at least 1.5 times their regular hourly rate for all hours worked beyond 40 in a single workweek. A workweek is defined as a fixed, recurring period of 168 hours (seven consecutive days).

Utah

Utah follows federal FLSA guidelines for overtime. Non-exempt employees must earn at least 1.5 times their regular hourly rate for all hours worked beyond 40 in a single workweek. A workweek is defined as a fixed, recurring period of 168 hours (seven consecutive days).

Vermont

Vermont follows federal FLSA guidelines for overtime. Non-exempt employees must earn at least 1.5 times their regular hourly rate for all hours worked beyond 40 in a single workweek. A workweek is defined as a fixed, recurring period of 168 hours (seven consecutive days).

Virginia

Virginia follows federal FLSA guidelines for overtime. Non-exempt employees must earn at least 1.5 times their regular hourly rate for all hours worked beyond 40 in a single workweek. A workweek is defined as a fixed, recurring period of 168 hours (seven consecutive days).

Washington

Non-exempt employees in Washington must earn at least 1.5 times their regular hourly rate for all hours worked beyond 40 in a single workweek. Additionally, some agriculture employees must be paid 1.5 times their regular hourly rate when working more than 40 hours in a workweek even if they’re exempt from federal FLSA regulations. Contact the Washington State Department of Labor and Industries for more information.

West Virginia

West Virginia follows federal FLSA guidelines for overtime. Non-exempt employees must earn at least 1.5 times their regular hourly rate for all hours worked beyond 40 in a single workweek. A workweek is defined as a fixed, recurring period of 168 hours (seven consecutive days).

Wisconsin

For adult employees (aged 18+) Wisconsin follows federal FLSA guidelines for overtime. Non-exempt employees must earn at least 1.5 times their regular hourly rate for all hours worked beyond 40 in a single workweek. A workweek is defined as a fixed, recurring period of 168 hours (seven consecutive days).

For minor employees (aged 16-17), additional rules apply. Minors must be paid 1.5 times their regular hourly rate for all hours worked beyond 10 in a single day.

Wyoming

Most businesses in Wyoming must follow federal FLSA guidelines for overtime. Non-exempt employees must earn at least 1.5 times their regular hourly rate for all hours worked beyond 40 in a single workweek. A workweek is defined as a fixed, recurring period of 168 hours (seven consecutive days).

However, Wyoming does have a specific law for laborers working on public works projects for the state. This law states that overtime must be paid to these workers when they exceed eight hours of work in a day. However, an employee can agree to work more than eight hours in a day without receiving overtime pay provided they still receive overtime pay when working more than 40 hours in a week.