The Easiest Way to Calculate Employee Overtime

When it comes to running a successful business, there are a few things that remain true no matter how many employees you have or what industry you’re in.

One of these things is the importance of accurately calculating overtime pay. Even if you’re a small business, having a system that can help you to accurately keep track of hourly rates and overtime rates isn’t just a good idea, it’s vital.

The U.S. Department of Labor passed the Fair Labor Standards Act/FLSA rules to guarantee employee compensation at one-half times their regular rate of pay once they exceed 40 hours of work. Calculating that total pay doesn’t fall on your team members – its up to you as their employer to follow the overtime rules and make sure their weekly salary is accurate. The consequences for not tracking employees’ salaries are severe, and labor laws in states can sometimes vary from federal law. Overtime laws also dictate that you need to keep track of hours in each pay period when it comes to exemptions, double time, and differential pay. Either way, if you don’t keep overtime wages accurate, you could be looking at a visit from the DOL or facing lawsuits.

Whether you have an old-fashioned pen and paper system or a robust staff clock in system, the fact remains that it’s your responsibility to accurately pay your nonexempt employees for overtime work. Part of that comes from management of timekeeping overall, as losing track of straight time (regular hours at an employee’s regular rate) will directly feed into losing track of the number of overtime hours an employee worked.

According to the Bureau of Labor Statistics, the average American hourly worker works slightly more than four total hours of overtime per workweek, or, 208 hours per year. Estimating an average wage of $21 per hour time-and-a-half pay, this works out to $6,552 per employee each year. For companies with multiple employees, it’s easy to see how this can quickly add up. Then there are the health risks that are associated with working overtime; with one study showing a connection between people who work 55 or more hours per week and cardiovascular disease.

With this in mind, let’s look at a few important steps that you can do to accurately calculate employee overtime, while at the same time improving your overtime management system.

Ensuring Accuracy With Time Tracking Software

Although you’ll want to ensure that you’re paying your employees for time worked, you’ll also want to ensure that you’re not overpaying them.

With the best time card apps, you’ll likely get a feature for calculating time built into the software. For some this will directly be a time-and-a-half calculator, while others will simply allow you to input any hourly pay rate you want for salaried workers and show you the total wages owed for easy pay calculation. Beyond this, you can ensure you’re don’t accidentally pay employees for more than the total number of hours salaried employees actually worked by keeping track of their workday. Implementing this software for your workforce also makes work time more productive overall, as employees act more responsibly on the clock.

These time trackers work with remote teams or fluctuating workweeks, and some even have functions to juggle time off, collect GPS data, or require a QR code or webcam verification before hourly employees can clock in. Even if you’re only paying minimum wage, there’s no reason why you should have to worry about time theft and exaggerated hours.

If you’re looking to improve how you keep track of overtime while adhering to federal and state laws, our tool Buddy Punch might be right for you.

Buddy Punch’s Overtime Tracking Features

Let’s look at a few of the features it offers to business owners that want to exercise control over their overtime pay rates.

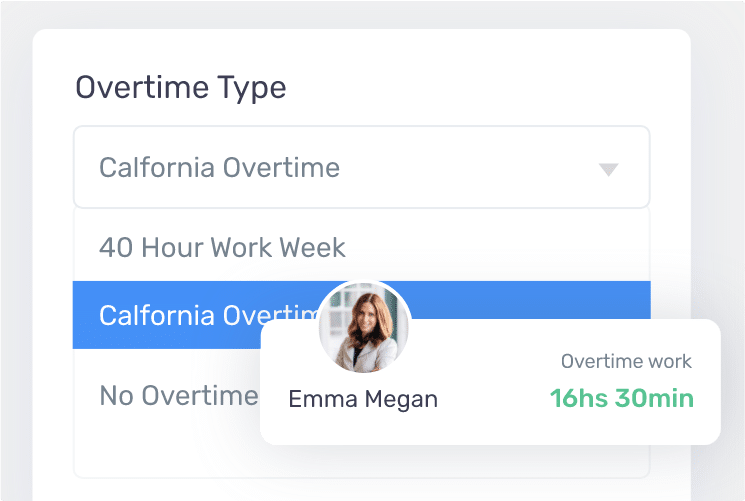

Overtime Calculations

Overtime Calculations lets you chose from more than a dozen different overtime types to determine how total overtime pay is calculated. You can even create custom types, and set your overtime compensation on a per-employee basis.

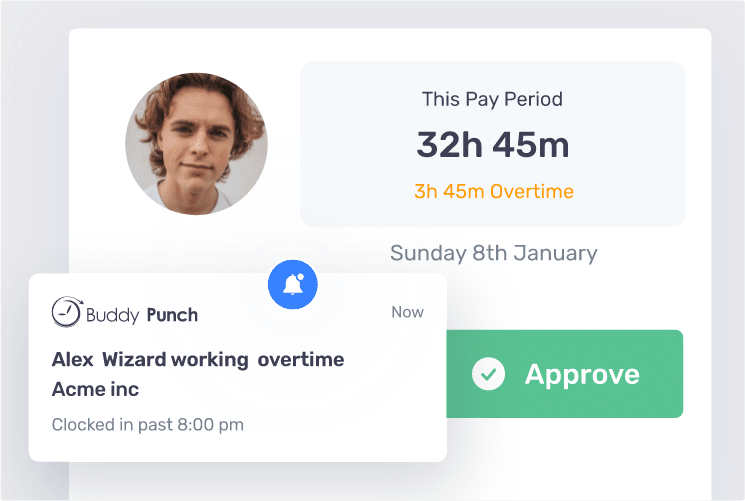

Overtime Alerts

Buddy Punch’s overtime alerts system will help you stay up to date on how much overtime hours your team members are accumulating. When an email notification is sent out, you’ll be informed of how many hours have been worked and if an employee is currently punched in or out.

In addition to these features, Buddy Punch’s time tracking options ensure you’ll be accurate when it comes to keeping up with regular hourly rates for your employees. GPS Tracking, Job Codes (to keep up with completion of job duties), Geofencing, and more are powerful modern options that help you keep your employees accountable, in effect making sure they really earn those regular wages that sometimes get taken for granted.

In addition to strong overtime features, Buddy Punch has been noted to have a helpful and responsive customer support team – which is nice when you want to make sure someone is in your corner when it comes to dealing with employees. Just take a look at what one reviewer had to say about our service:

Whenever I have a question that I can’t find in the FAQ or a billing issue, they are super friendly and quick to respond. I even accidentally got charged for a full year subscription when I wanted to go monthly, and they refunded me immediately after contacting them. CSR is very helpful, and always quick to respond!

You can read reviews of Buddy Punch like this one (and many others) on software review site Capterra, where our software has a rating of 4.8/5 based on 836 reviews.

Upgrade Your Scheduling System

When it comes to overtime, it’s important to ensure that your team is picking up extra hours because there was a need for them, not because of scheduling errors. Ineffective scheduling or scheduling errors can result in overbooking, which will impact your bottom line. That said, making sure your scheduling is running smoothly can be a full-time job in and of itself.

Not having enough employees to ensure all the jobs are filled isn’t a good reason to make your employees work overtime. While occasionally, employees will get sick, quit, or otherwise leave a gap that requires some overtime, it shouldn’t be a regular and constant occurrence. By not hiring and having enough employees onboard to fill all the positions, other employees can quickly burn out. By overworking your team, you open the doors to more errors, mistakes, and even injury.

Improve Time Management

Poor time management can also create a perceived need for overtime hours. While sometimes, there is a real need for additional staff, often, what appears like a short-staffing situation could be an issue with your team being unclear on the extent of their duties, or otherwise lacking the time management skills to finish everything during the allotted hours. Ensuring that you, or your managers have a good grasp of time management is important. A good manager will be able to help your employees to manage their time better and will be able to ensure that work is done as efficiently as possible, reducing the need for unnecessary staff and eliminating employee lateness.

Tools and Training

Back before many modern labor regulations, Henry Ford found this his employees were most productive with a 40-hour workweek. Now that we’re more used to this scheduling as a society, it’s possible we’re taking for granted just how much can be accomplished in that time. If you’re going to be paying hourly wages, it would be optimal to train your employees to make the most of their straight time so overtime becomes less of a concern for your business overall.

You should also be sure to give your employees the tools and training required to complete their work in an appropriate time manner. Help them work towards being more efficient in their work.

Know the Various Overtime Types

Time and a half is the most standard overtime calculation you’ll come across, and you can get this gross pay total by taking employee’s regular pay rate per hour x 1.5. However, this isn’t the only possible calculation for additional hours to take into account.

Some companies actually choose to go over the standard one and a half pay rate, going as far as to offer a double pay (also known as double time). Companies usually do this to incentivize overtime hours.

Another common overtime rate is holiday pay. This is when you have an employee work despite a federal holiday. There’s no set standard pay for this rate besides it being more than an employee’s usual pay.

A more niche special case is shift differentials. These occur when nonexempt employees are paid a fixed hourly rate at undesirable times, setting them up for additional hourly pay (reminiscent of daily overtime hours). In this situation, employers have to take the blended rate, or weighted average, of all rates paid to calculate the overtime premium due.

As we mentioned above, sometimes software options (like Buddy Punch) allow you to automatically calculate overtime based on the overtime type if it’s standard, or to create a custom calculation rule if it’s not.

Savvy Business Owners Must Prepare for Overtime

Whether you choose the ease of using a software like Buddy Punch to manage overtime hours, or you decide to take a more time-consuming, hands-on approach to managing your team members and their time, business owners have to take charge of managing overtime hours. Taking initiative (and encouraging your team members to do the same) will help a lot in this regard. Meanwhile, those who want to ensure they’re in compliance with laws may want to use a digital solution to ensure that all time tracked is accurate down to the minute.

Try Buddy Punch Free

If you’ve decided you’d like to streamline overtime management through software, you can sign up for a 14-day free trial of Buddy Punch here. You can also book a one-on-one demo, or view a pre-recorded demo video to see Buddy Punch’s other employee management features (such as time tracking and employee scheduling).

You May Also Like:

- 13 Best Employee Time Tracking Software & Apps for Small Businesses in 2024

- Why You Should Pay Your Employees On Time

- How are PTO hours accumulated?

- 4 Vacation and Sick Time Tracking Spreadsheet Templates (And 1 Superior Alternative for Time Tracking Overall)

- State Overtime Rules & Premium Pay Laws (Every state from California to Utah)

- Buddy Punch Docs: How to Create a Custom Overtime Rule

- How to Manage Overtime More Efficiently