How hard is it to do payroll?

Payroll is something that can sound easy; the company’s employees are entitled to compensation, and payroll is the process of paying what they’re owed. Unfortunately, the actual act of paying employee wages can grow into one of the more complex administrative tasks within an organization.

And that’s true whether there are five or fifty full-time employees within the company. Even one small error in recording the number of hours to be compensated can cause big problems if it’s left unresolved. Not only can they cause issues among employees, but there can also be legal repercussions.

There are two ways to handle payroll:

- Manually (on your own, or with the help of your payroll department)

- Digitally (through the use of software)

In this blog, we’re going to answer some of the common questions that business owners have about payroll, including how difficult it is, how beginners can make it easier for themselves, and more.

We’re also going to cover some of the differences between doing it manually versus making use of digital payroll solutions that can simplify the process.

By the end of this article, you should be more than equipped to handle all things payroll however you choose.

Note: If you’ve come here specifically looking for a tool to handle payroll, look no further than our very own Buddy Punch. Our built-in payroll processing feature replaces external payroll providers by allowing you to manage payroll from anywhere, at any time. With automatic payroll tax filings and payments, in-depth data, and more – this is one of the easiest ways to streamline the entire process. Click here to learn more.

How difficult is it to do payroll manually?

Payroll can be difficult to handle manually, especially in the early days of a small business. It takes time to acquire all the necessary pieces of information from employees, and all that data must be stored somewhere safe and secure yet within easy reach. Payroll management also involves calculating the employees’ pay — both gross and net — and withholding federal and state taxes.

Tax obligations can include:

- State Income Tax

- Social Security Tax

- State Unemployment Tax

- FUTA Taxes (Federal Unemployment Tax Act) and FICA Taxes (Federal Insurance Contributions Act)

- Medicare Taxes

- And more (depending on business size and location)

All of these tax payments compound to complicated the payroll process, not to mention that each new complication is a new opportunity for payroll errors to occur.

Step 1 of payroll is gathering all of your employee information, which you’ll only have to do once (other than when you hire new employees). Then you’ll have to repeatedly handle these other accounting duties each pay period to remain compliant with the Fair Labor Standards Act (FLSA).

Since you’d be doing all this manually, there’s also a risk of occasional problems related to inaccurate time sheets or inadequate time-tracking, which can make managing payroll more challenging. Even if you’re doing your best to make sure every payroll report is accurate, at some point human error is going to cause an issue.

How difficult is it to use software to do payroll?

Much easier than manual methods, on the whole. Because of the issues with manual payroll mentioned above, many business owners choose to use payroll software to drastically simplify the payroll process, as well as reduce the chance of human error making their record-keeping less accurate.

However, there are a wide variety of payroll options out there. Choosing one that works “best” is going to depend on what features are most important to you as you run payroll. A QuickBooks study says 39% of businesses globally spend 30% of their expenses on covering payroll (through using tools such as QuickBooks Online). That’s a large chunk of allocation, and it’s mostly because it’s necessary for any business that wants to expand. Why not make the process as easy as possible?

Most payroll software options will include the basics: organized payroll records, calculating overtime hours, easy exporting of employee paychecks, direct deposit forms or transfers to bank accounts, and more. Some might also come with instructions and a design that make it easy for a beginner to use.

But then you have to look at other functions you want. How easily can you transfer payroll information to and from their software? Is it easy to add new hires to the system? What sort of integrations are built-in to the software, and how much can it accomplish on its own?

In our opinion, you’ll want to find a payroll software that was built for longevity and business expansion, through the inclusion of powerful features such as employee time tracking and scheduling. All of these are features we made sure to include in our very own Buddy Punch.

Now, for business owners committed to handling employee paydays the manual way, let’s walk you through the process with a beginner’s guide.

How do I learn HR payroll?

The first step towards doing your own payroll is to learn all of your legal obligations, dictated by the Department of Labor (DOL). Regardless of the size or scale of your company, there will be state laws and federal laws that you need to follow when paying your employees, or else you risk legal trouble. Even those human errors we mentioned above can come back to haunt you if they impact an employee’s gross pay.

While many business owners use outsourcing to leave payroll in the hands of a third-party payroll specialist, it is something that can be handled in-house. Either you as the business owner or your human resources team (if you have one) can handle all your bookkeeping.

A good point of reference for learning the basics of payroll is CPAs (certified public accountants). They’re not exactly payroll professionals as they have a different job, but there is enough overlap that they will be able to offer some useful advice on how you can take control of your payroll requirements yourself. You may also consider attending a payroll service course.

How do you start manually doing payroll?

Let’s start with what beginners must have to do payroll:

– An EIN (Employer Identification Number). Also known as an Employer Tax ID, which you can get from the IRS.

– State/Local IDs. This will depend on your business and your state.

– State Registration. Like the above, state registration will vary from state to state and will also determine how you’re meant to handle tax withholding.

– Employee information. Including their name, address, date of birth, compensation, and Form W-4.

Gathering all these details can be tedious for payroll administrators, but it’s required. Once you’ve accomplished this, you’ll find it much easier to handle payroll if you have the right system in place. This may take a little bit of work and fine-tuning, but once you’ve got your payroll process, you’ll find that you can pay your staff each month without having to experience headaches.

As well as learning how to calculate your employees’ earnings, think about when you’ll pay them. Having the right payroll schedule is about finding the balance between maintaining cash flow and ensuring your employees don’t go too long without their pay stub. Once a month or biweekly is standard.

How hard is it to do payroll?

The payroll process can be relatively straightforward overall but there are also many moving parts that can make it difficult. Even if you have a payroll system up and running, there can be a few things that make it more complicated.

Some managers also get tripped by the tax deductions aspect of payroll. For example, aspects of the Form 941, such as reporting money withheld from an employee’s pay for federal income tax, Medicare, Social Security, or wage garnishment. Some new employers also struggle with dealing the various payroll taxes, such as the Federal Insurance Contribution Act (FICA) or state or local taxes.

Besides knowledge gaps, there’s always the ongoing issue of losing track of an employee’s data, or poor time management leading to you having to pay an unexpected amount of overtime pay. This is when it becomes critical to make sure that your employees are doing their part and not padding their timesheets. Time tracking and payroll software like Buddy Punch can help ensure this.

In short, it is rarely the organization’s most enjoyable task, and doing it improperly can be a liability – but it doesn’t have to be hard.

Why is payroll so complicated?

What makes payroll so complicated is all the moving parts that get introduced from calculating gross pay all the way down to the net pay your employees actually receive. Hourly rates, accurate timekeeping, payroll deductions and taxes, state and federal laws – there are just a ton of logistics to keep in mind while you’re doing payroll.

Payroll isn’t just one task, but rather many tasks that must all be completed. And you have to complete all those tasks every single pay period.

Perhaps its due to this repetition, or just because of the numerous moving parts involved in payroll, that business owners so often turn to payroll software to streamline the process. We understand that feeling. After expanding our team to 20 employees at 3 different locations, we felt the need to find a software that could accommodate both our payroll and our time tracking needs. When we didn’t find it, we built our own, and Buddy Punch was born.

How do you do Payroll with Software?

While this answer will change from software to software, we want to highlight what we’ve built with Buddy Punch, and why over 10,000 business owners have turned to using it.

As we’ve outlined above, there are numerous snags when it comes to handling Payroll manually. That’s why many business owners turn to using automatic solutions like Buddy Punch.

Here are some of the features that come with Buddy Punch that make it a no-brainer option for simplifying the payroll process for business owners, administrators, and HR departments alike:

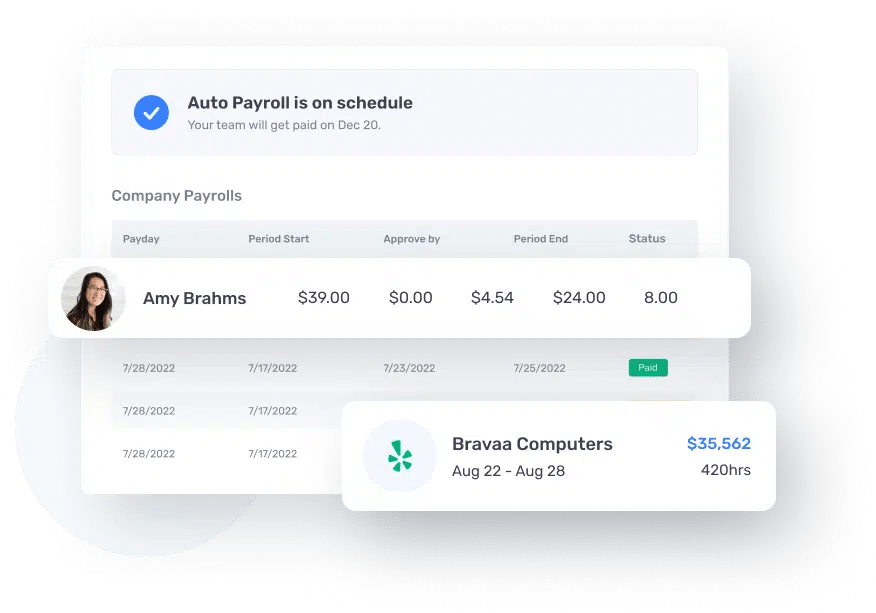

Access: Buddy Punch’s built-in payroll system allows you to access all of your payroll data from anywhere at any time, whether you’re on Desktop or Mobile devices.

Streamlining: Even though Buddy Punch includes options for payroll integrations with some common payroll software (such as QuickBooks, ADP, PayChex, and more), using our built-in system allows you to reduce costs and increase efficiency by handling all of your needs in one place.

Speed: Thanks to automation, Buddy Punch allows you to quickly import employees, freelancers, and independent contractors into our payroll system. From there, you can review their work time in our dashboard, sync everything up, and send off your team’s pay.

In addition to these three core features, Buddy Punch’s payroll allows you to set up a self-service option for team members. Employees can enter their own details and access their pay stubs, W2s, or 1099 forms.

Other highlights of Buddy Punch’s Payroll include:

- Payroll Tax Filings

- Responsive Customer Support

- Direct Deposit

- Automated Payroll Payments

- and more.

Click here to read more about the functions and benefits you get with Buddy Punch’s Built-in Payroll.

It’s also important to note that Buddy Punch has much more than just payroll processing functions included. Our software also comes with robust time tracking features and employee scheduling options, all to fully empower business owners to manage everything that happens in their workforce. You can even generate detailed reports to export as Excel spreadsheets or PDFs.

Considering all this, it’s no surprise that Buddy Punch has a rating of 4.8/5 stars on software review site Capterra, based on 823 reviews.

Here’s what one of those users had to say about our software:

“My staff loves that the software works seamlessly and I love the easy payroll reporting process. BEST of all, when I have a question, Buddy Punch really LISTENS and always walks me through the answer or offers to help themselves.”

Conclusion

As we’ve seen, payroll is something that can be difficult and challenging for beginners, but it’s not something that necessarily has to be like this. If you want to stick to manual methods, you’ll want to first break down each aspect of payroll into its necessary parts, and make your way through one at a time. It can be time-consuming, but accuracy is incredibly important to make sure you’re avoiding compliance issues.

Alternatively, if you’re looking to streamline the process, you’ll want to take a look at adding a software like Buddy Punch to your organization.

Try Buddy Punch for Free

We’re proud of what we built at Buddy Punch, and over 10,000 business owners have adopted it for their workforce management. It includes features we ourselves would have loved, having struggled to track time for 20 employees across three locations.

Transform how you process payroll, track time, schedule your employees. Click here to learn more and try it for free (14-day free trial).

You May Also Like…

- Payroll Compliance in the United States (Small Business Owner Guide)

- 6 Best Payroll Software for Small Businesses

- 5 Best Payroll Software with Direct Deposit

- Buddy Punch Docs: Payroll Integrations

- Human Resources Job Titles and Salaries

- What is Paid Time Off? (Policies, Pros and Cons, Maximizing Employee Engagement, etc.)

- Why Do Small Business Owners Not Take Much Time Off?

- Payroll Time Clock Systems (5 Options)

- Federal & State Minimum Wage Laws in the U.S.A.

- Buddy Punch Docs: Overview of Federal Employment Taxes Withholding

- 6 Best Timesheet Apps & Software [In-Depth Breakdown]

- State Overtime Rules & Premium Pay Laws