How to Do Payroll Yourself in 9 Steps (+ A Better Method)

Many small business owners want to save money on payroll by doing it themselves but don’t know where to start.

In this article, we’ll go over a 9 step guide on how to do payroll yourself, covering:

- Gathering W-4 forms, plus your EIN

- Consulting employee timesheets

- Creating a payroll schedule

- Calculating base pay

- Calculating gross pay (overtime, PTO, and other bonuses)

- Calculating tax withholdings

- Planning for and make tax payments

- Paying your employees

- Filing payroll reports

But as we’ll see, doing payroll on your own isn’t always the best idea or the most cost effective one, even when compared to using payroll software or hiring an accountant. True, when you do payroll yourself, you can avoid payroll software fees or accountant fees, but there are two big trade offs to consider.

- The first is time, which becomes more of an issue the bigger your team is. When you realize how much your time (or the time of your managers) is worth, then you can quickly see how much manual payroll processes are actually costing your company. To do payroll right, you need to factor human resources, time sheets, expenses, and paid time off.

- The other trade off is human error and liability. Payroll needs to be done correctly, on time, and adhere to local and federal regulations. It’s not something you can easily “learn as you go.” Failing to properly calculate your workers’ compensation can cost both money and employee trust, and failing to file employee pay and taxes correctly could result in legal action.

To help you see what payroll process is best for you, we discuss the pros and cons of doing payroll yourself, detail how exactly you would do payroll on your own, then take a look at the benefits of using other methods, like payroll software.

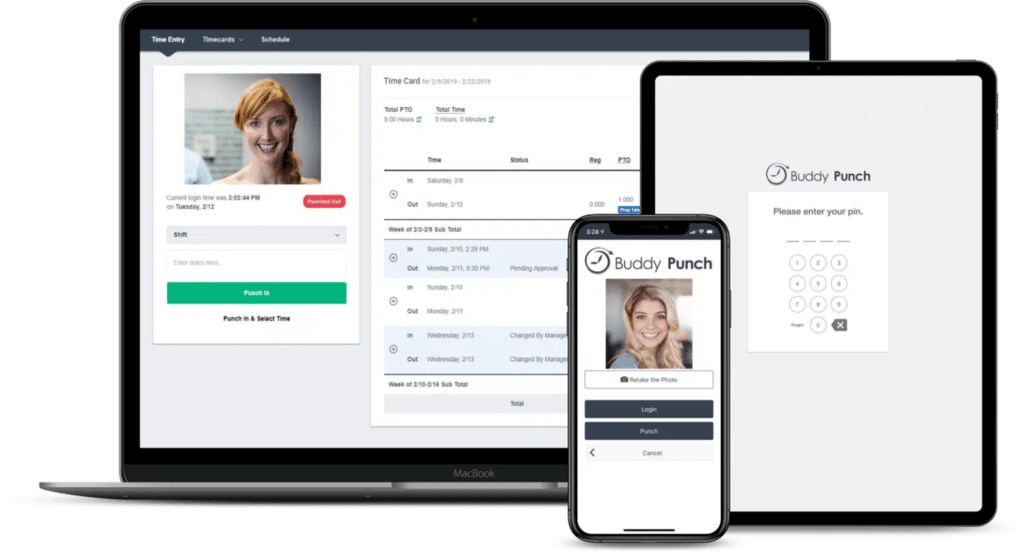

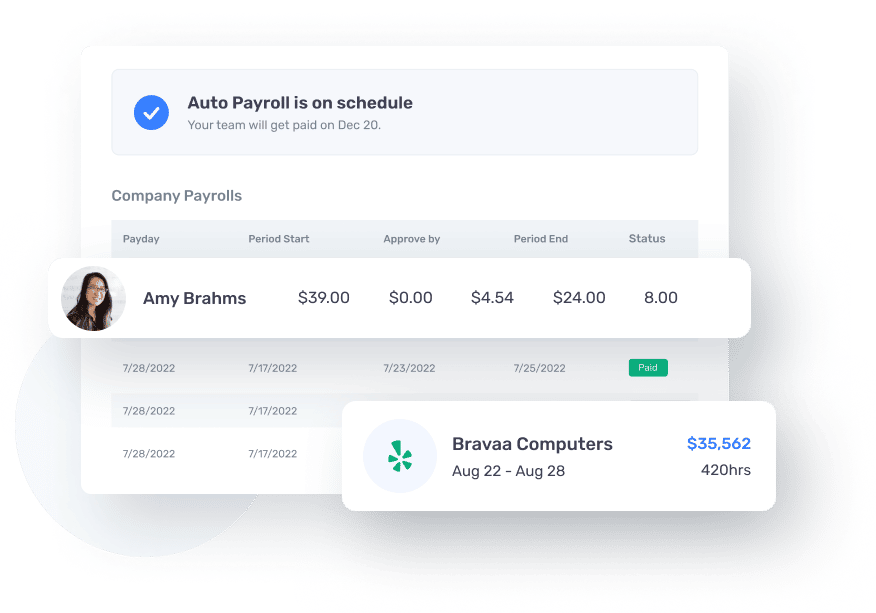

When it comes to using software, we take a look at our payroll solution Buddy Punch. Buddy Punch is a time clock, scheduling tool, and payroll provider.

Buddy Punch is a time clock, scheduling tool, and payroll provider, offering tools like:

- Automated payroll calculations account for hours worked, overtime, PTO, and other bonuses.

- Tax withholdings and tax forms are generated along with the payroll.

- Direct deposit can be set up via employees’ self-service portal.

- And more!

If you’d like to learn more about how Buddy Punch can help you with payroll, you can keep reading or you can visit our site for additional information.

Can I Do Payroll Myself? Things to Consider

Before we begin with our step by step guide to running payroll yourself, let’s take a closer look at the pros and cons of doing payroll yourself.

Pro: You’re Not Paying for Software or an Accountant

Doing payroll yourself can be a good move if you’re a small business owner who wants to keep funds earmarked for other expenses. As long as you keep good records, can do basic math, and are confident in navigating local, state, and federal tax laws, doing your own payroll can be a money-saver.

Con: Manual Payroll Processes Will Take More Time

One of the biggest trade offs of doing payroll yourself is time. Gathering necessary records, running calculations, and filing taxes is an often cumbersome process, particularly if it’s your first time running your own payroll. In many cases, the cost of time is greater than the expense of outsourcing payroll or using a software solution like Buddy Punch.

Con: Manual Processes Come with a Higher Risk of Human Error and Legal Liability

Whether you’re doing payroll on paper ledgers or via spreadsheet programs like Excel, one misplaced number can be quite costly. Having to redo an employee’s paycheck is enough of a hassle, but filing your taxes incorrectly can get you in trouble with entities like the IRS. Expert accountants are far less likely to make such mistakes, and payroll programs like Buddy Punch remove the element of human error, providing greater security and peace of mind.

How to Do Payroll Yourself in 9 Steps

The number of things you need to keep track of when doing business payroll yourself can make the whole process feel overwhelming. For some people, it helps to think of doing payroll as three distinct phases: rounding up necessary forms and information, actually calculating employee wages, and submitting payments and tax forms to the appropriate people.

Or you can just follow this step-by-step guide, which covers these nine steps:

- Gathering W-4 forms, plus your EIN

- Consulting employee timesheets

- Creating a payroll schedule

- Calculating base pay

- Calculating gross pay (overtime, PTO, and other bonuses)

- Calculating tax withholdings

- Planning for and make tax payments

- Paying your employees

- Filing payroll reports

Step 1: Gather W-4 Forms Plus Your EIN

Employees need to complete form W-4, a document that helps keep track of personal allowances. The more allowances workers have, the less taxes are taken out of their paycheck. If you’re missing any of your workers’ W-4s, you’ll need them to fill it out before you can process their payroll (and always make sure you give this form to new hires!). Note: freelancers and independent contractors will need a form W-9 instead.

You’ll also need to have a federal Employer Identification Number (EIN) ready. This is like an SSN (Social Security Number) for your business and is used by the Internal Revenue Service to identify a business entity. You may also need to get a state EIN number in order to file taxes in your state.

Keeping track of employee information manually can be tricky, which is why our software service Buddy Punch has a documents tab to keep all your tax paperwork in one place.

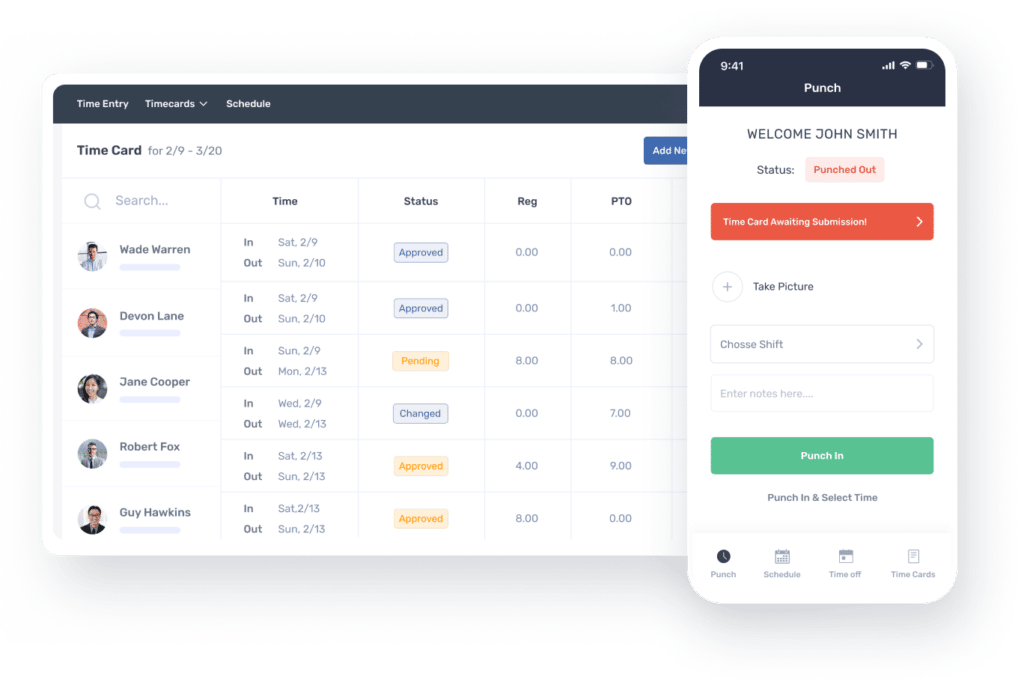

Step 2: Consult Employee Timesheets

To know how much to pay your employees, you need to know how many hours they’ve worked. This is true even for non-exempt salaried employees; you’ll need to consult their timesheets or time cards to determine whether they’re legally entitled to overtime pay.

You can use timesheet software to let your employees track their hours on a computer or app. Or you can try using physical timesheets, like a downloadable timesheet template.

One of the most frustrating parts of manually doing your own payroll is gathering up your team’s timesheets and time cards and inputting that data into your payroll system. You can save yourself time and headaches by using Buddy Punch’s time tracking tools.

Step 3: Create a Payroll Schedule

Before you can calculate payroll, you must decide how often you’ll pay your employees. Businesses commonly compensate their workers on a weekly, biweekly/semi-monthly, or monthly basis. When deciding your schedule, keep in mind you’ll need to run payroll on the same interval as the pay period. Also be sure to account for employee pay dates, tax filing deadlines, and tax payment due dates.

Bonus: How to Do Payroll for One (Salary or Owner’s Draw?)

There are two main ways to pay yourself as business owners: salary and owners draw.

If you opt for a salary, you withhold taxes from a paycheck you receive on the same basis as your salaried employees. This is a legal requirement for businesses that are structured as S-corporations, as C-corporations, or as limited liability companies (LLCs) taxed as a corporation.

You could also pay yourself under owner’s draw, in which you choose to receive money from your business’ profits on an as-needed basis rather than a set pay schedule. You can draw up to the amount you would put into the company, known as owner’s equity. Doing this means you wouldn’t have to pay payroll taxes upfront when you take a draw, but you’ll need to budget for your tax bill.

Step 4: Calculate Base Pay

For hourly employees, base pay is their wage rate times their hours. For example, if you pay on a biweekly schedule, your employees receive a pay rate of $20 per hour, and an employee worked 80 hours during those two weeks, that employee’s base pay is $1600.

If employees are salaried, their base pay is the portion of their salary due for the pay period in question. Once again, let’s assume a biweekly schedule. If an employee’s monthly salary is $24,000 a year (i.e. $2000 per month), then they’re entitled to $1000 for those two weeks of work.

Note: if your employees receive compensation in the form of tips, these are legally considered a portion of their base pay in the US. Therefore, you need to keep track of your employees’ tips.

In the case of hourly workers, accurate timesheets are essential to ensure your employees are paid correctly. Buddy Punch’s timesheets can be imported directly into its payroll menu, streamlining the process.

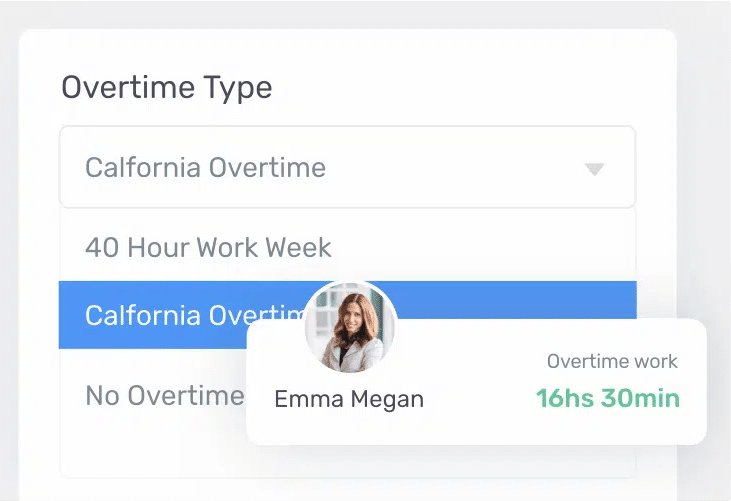

Step 5: Calculate Gross Pay (Overtime, PTO, and Other Bonuses)

Once you have employees’ base pay, you’ll need to incorporate additional earnings such as overtime, paid time off, and any other bonuses offered by your business. For overtime, you’ll need to consult state and federal laws in addition to your business policies; for a more complete guide, consult our article on how to calculate overtime. For paid time off, check your records for workers’ approved time off and calculate their bonuses according to your policies. Finally, add in any other bonuses you offer (e.g. hazard pay or loyalty bonuses) to find your employees’ gross pay.

When you use Buddy Punch, overtime and paid time off are factored into your team’s payroll automatically. You can also add additional earnings like bonuses or commissions before submitting payrolls.

Step 6: Calculate Tax Withholdings

For every employee, you need to calculate tax deductions, such as the social security tax, the FICA payroll tax, the federal income tax, and state income tax. Other pre-tax deductions include health insurance, flexible savings accounts, and money for retirement plans. If you need guidance on tax withholdings and tax rates, consult the IRS and your state and local revenue services. If any employee is subject to wage garnishments, you should also calculate these based on their gross pay.

Buddy Punch handles all tax withholdings for you and your team, including local, state, and federal taxes. Your employees can log into their self-service portal and see relevant tax paperwork, including end of the year tax forms (1099s/W-2s).

Step 7: Plan For and Make Tax Payments

Once you’ve calculated federal, state, and local tax withholdings (e.g. social security tax, FUTA [federal unemployment tax], Medicare taxes, and remit taxes), you need to ensure the money goes to the appropriate agency. Depending on the tax, you may either send the money immediately or set it aside, only withdrawing the tax deposits from your bank account closer to the payment deadline. Consult the guidelines of the corresponding agency for more detailed instructions on how to handle tax payments.

Buddy Punch handles all tax withholdings for you and your team, including local, state, and federal taxes. Your employees can log into their self-service portal and see relevant tax paperwork, including end of the year tax forms (1099s/W-2s).

Step 8: Pay Your Employees

When you pay employees, consider what payment methods you can offer, and if you offer more than one, be sure to send their compensation by their preferred method. Examples include direct deposit, checks, or wire transfers. In addition, you should send them documentation of their payments that they’ll need for their tax returns.

Buddy Punch allows employees to use their self-service portal to opt in to automatic direct deposits whenever payrolls are processed.

Step 9: File Payroll Reports

Once you’ve filed or set aside withholdings and paid your employees, you’ll need to file payroll reports with the Internal Revenue Service (IRS) and the Social Security Administration (SSA). Both for logistical reasons and to protect yourself from audits by these entities, retain all payroll records and proof of your filing status for at least three years.

Other Ways to Do Payroll

Because DIY payroll can be complex and time-consuming, there are plenty of alternatives to doing payroll yourself. One is to use payroll software such as Buddy Punch to streamline and automate the process. Another is to employ an expert accountant to process your payrolls. Finally, many businesses outsource these calculations to payroll services. We’ll begin with our own payroll solution Buddy Punch.

Payroll Software: Buddy Punch

Buddy Punch is a cloud-based all-in-one platform for payroll, time tracking, and scheduling. Here’s how it works.

When workers start their shifts, they can log into Buddy Punch via designated kiosks or their own devices. Not only is their time recorded via easily accessible online timesheets, it also automatically tracks and calculates overtime and PTO. All this information gets directly imported into payroll, allowing for accurate and efficient calculation of wages and tax withholdings.

Once you approve the payroll, Buddy Punch automatically generates the proper tax forms and releases payments to employees who have signed up for direct deposit. And if you’d rather use a payroll service, Buddy Punch can integrate with leading accounting software, preventing the hassle of scrounging up physical timesheets and records.

Time Tracking

Buddy Punch is compatible with Windows, Mac, Android, and Apple devices, allowing workers to clock in and out from their own devices. This provides a convenient way for you to track and keep records of your employees’ hours.

Buddy Punch also includes helpful accountability features like:

- Photos on Punch. When enabled, employees must take pictures of themselves when they clock in, combatting buddy punching via facial verification.

- Geofencing. Employees can only log in when they’re at their work site, preventing them from logging in before they arrive at work.

- IP Address Locking. Enabling this feature means employees can only log in from their workplace’s Wi-Fi.

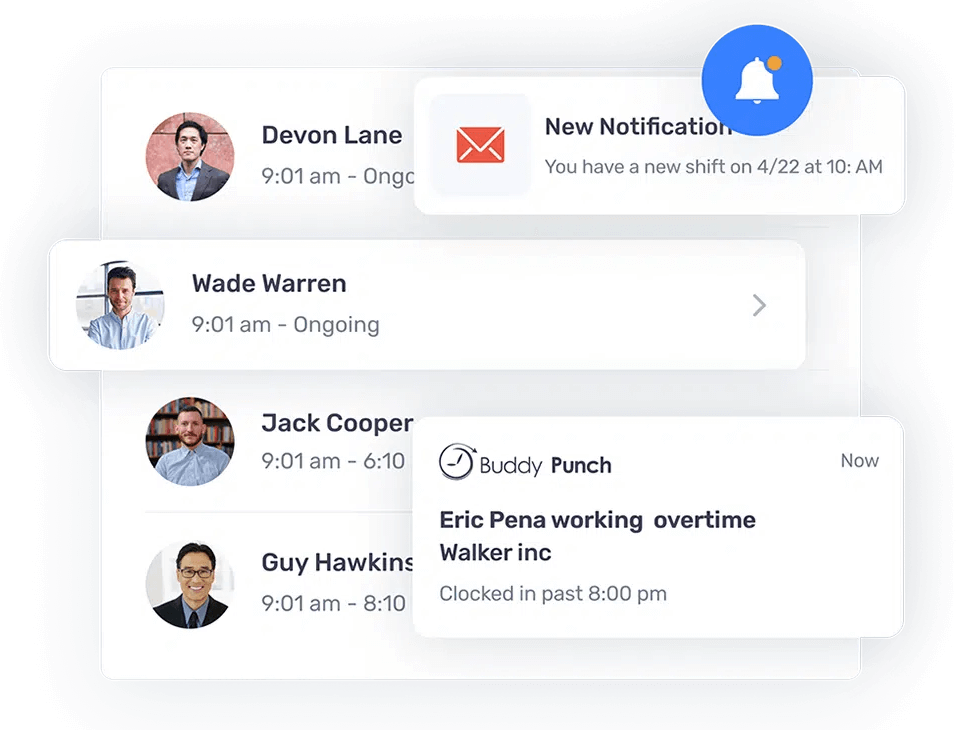

- Push Notifications alerting workers to their schedules.

- Automatic Breaks, which also reduce human error because employees don’t have to remember to clock in and out.

In addition to these and many other timekeeping tools, Buddy Punch is particularly useful for payroll because of its ability to track overtime and PTO.

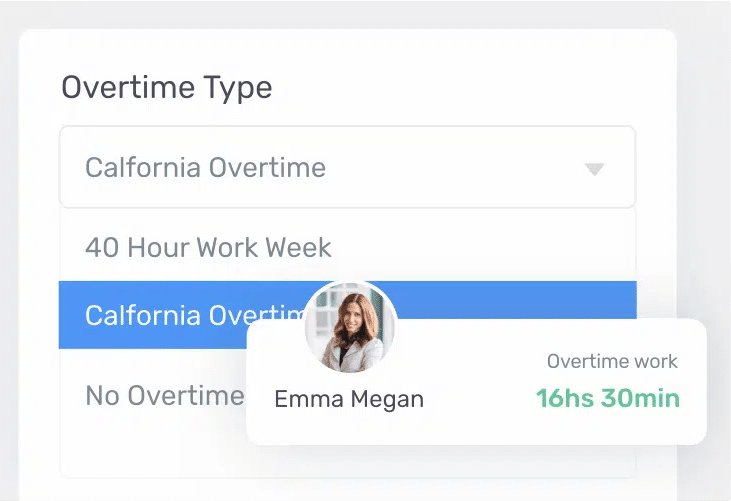

Overtime Tracking and Calculation

Because Buddy Punch tracks workers’ hours, it can also track when they go over their allotted time. If you enable overtime alerts, they and their managers will be notified when they’re approaching overtime, allowing you to adjust their schedules accordingly.

Sometimes overtime is unavoidable, and Buddy Punch tracks that too. During setup, you can select which type of overtime pay your business uses.

Buddy Punch will automatically track overtime and calculate it based on your selected method when you run payroll.

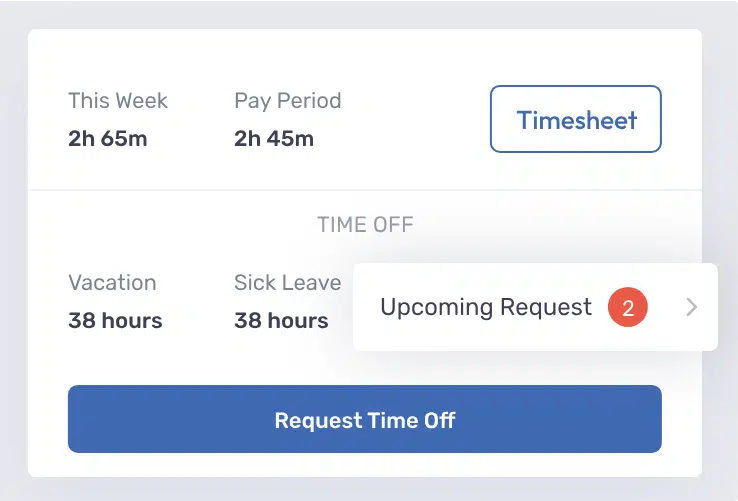

PTO

Within Buddy Punch, you can set up different types of PTO and set custom rules for the rates at which different employees accrue PTO. Buddy Punch automatically calculates PTO accrued based on their hours worked.

When employees want to cash in their PTO, they can do so via their self-service portal, and you’ll receive an alert along with their request.

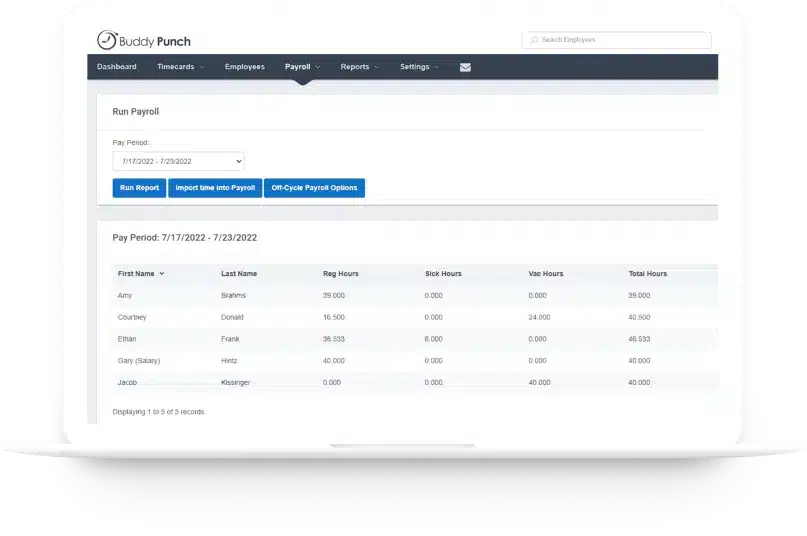

Import Hours Directly Into Payroll

When it’s time to do payroll, you can select employees and import their timesheets directly into the payroll menu. Buddy Punch will calculate their net pay based on their hours and hourly rate.

After that, all you have to do is review and accept the results.

Track Additional Expenses

In addition to employees’ usual pay, you can use Buddy Punch to track additional expenses.

For example, there’s built-in functionality for Group Life Term, reimbursements, non-hourly regular pay, paycheck tips, bonuses, commissions, cash tips, and severance pay.

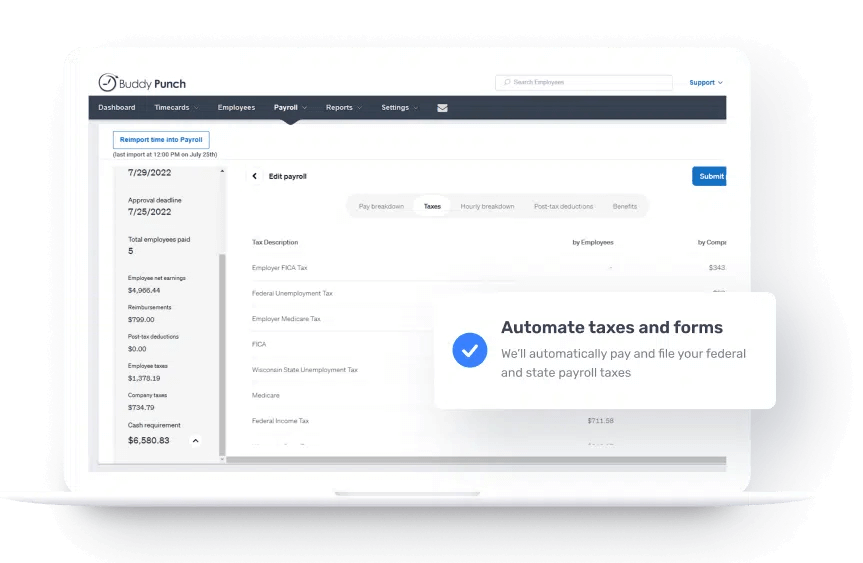

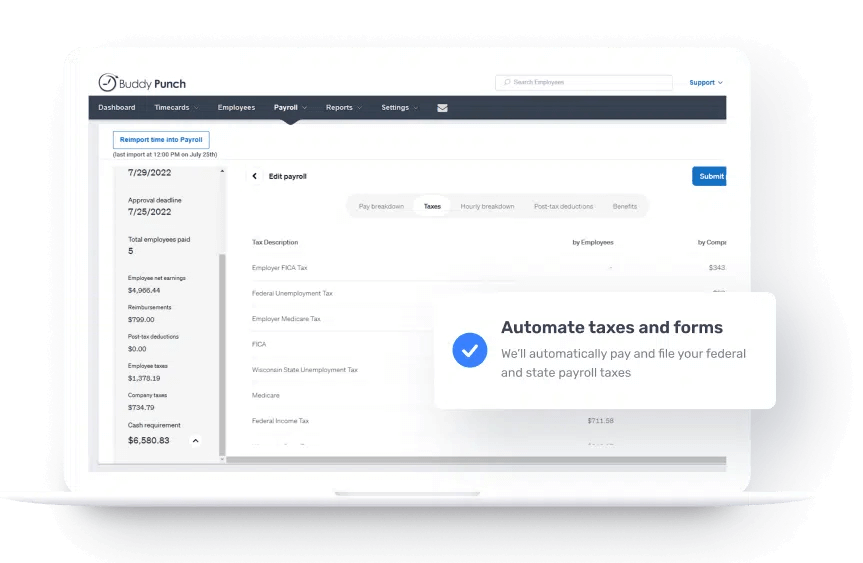

Automate Taxes

Buddy Punch automatically pays and files local, state, and federal employment taxes when you use it to run payroll.

You can review your tax forms within Buddy Punch, and employees receive their forms via their self-service portal.

Pay Your Employees via Direct Deposit or Check

Within their self-service portal, employees can select their preferred payment method.

If they choose direct deposit, Buddy Punch will automatically send their gross wages to their bank account once payroll is approved.

Accountant

If you’d rather not run payroll yourself, one option is to hire an in-house accountant. These experts typically have plenty of experience with these calculations, reducing the risk of errors or legal issues. The downside is that small businesses may not have enough work to justify investing in an on-staff accountant.

Payroll Service

Many small businesses choose to outsource their payroll to a payroll service because they don’t want to deal with the hassle and number of hours spent processing payroll themselves. As with hiring an accountant, the expertise of an online payroll company ensures that your payroll deductions and employees’ paychecks will be taken care of quickly and accurately. The downside, as discussed previously, is that these services are not free.

If you do choose a payroll service, rather than finagle physical time cards or print out spreadsheets, Buddy Punch allows you to export hours to leading accounting software.

Current integrations include Zapier, QuickBooks, ADP, Gusto, Paychex, Paylocity, and more!

To learn more about pricing and how Buddy Punch can help you with payroll, visit our site, register for a free trial, or request a demo today!